Global chemical industry mergers and acquisitions (M&A) are on the upswing, with signs of increased activity, according to Peter Young, president of US-based investment bank Young & Partners.

"There are clear signs of a revival in the M&A market, with a thawing of credit, stabilization of economies around the world, increasing buyer confidence, more realistic price expectations by sellers, a higher confidence in earnings and cash flow forecasts, and high cash balances," says Young in an interview with ICIS.

"We expect the M&A market to improve substantially in 2010 over 2009. Only a drop into another economic recession or a major hit to the financial system will prevent this improvement in M&A," he adds.

"There are clear signs of a revival in the M&A market"Peter Young, president, Young & Partners |

|---|

The largest and only deal over $1bn in size in Q1 was Japan-based Mitsubishi Chemical's $2.52bn acquisition of Mitsubishi Rayon, which closed in March.

More significantly, the number of completed deals over $25m in size rose to 15 in Q1 - a major increase over activity in 2009. In 2009, there were four deals completed in Q1, seven in Q2, eight in Q3 and seven in Q4.

And the backlog of announced deals yet to close totaled 12 transactions with a value of $19bn at the end of March, versus five deals with a value of $6.3bn at the end of 2009, according to Young & Partners.

"The M&A market is coming back significantly," says Chris Cerimele, director and head of chemicals at global investment bank Houlihan Lokey. "The capital markets are also active, with the high-yield financing market open and equity market healthy."

"Strategic buyers are seeking ways to accelerate growth"Frank Mitsch, analyst, BB&T Capital Markets |

|---|

"However, there are clear signs of an increase in financial buyer transactions as debt financing availability continues to improve," says Young. "The financing market is improving, but still not that robust. Financial buyer activity will ease its way up."

In March, US private equity firm Bain Capital agreed to buy compatriot Dow Chemical's Styron business for $1.63bn.

Styron includes Dow's polycarbonate (PC), acrylonitrile butadiene styrene (ABS)/styrene acrylonitrile (SAN) resins, polystyrene (PS) and styrene monomer operations, as well as the company's stake in the Americas Styrenics joint venture (JV) with US major Chevron Phillips Chemical.

"The M&A market is coming back significantly"Chris Cerimele, director, Houlihan Lokey |

|---|

PENT-UP DEMAND

Many strategic buyers stayed on the sidelines in 2009 as the recession played out. But now, pent-up demand from cash-rich companies is poised to drive deals.

"Strategic buyers, armed with balance sheets flush with cash, are seeking ways to accelerate growth beyond their organic means," says Frank Mitsch, analyst at BB&T Capital Markets, also US. "With many players on the sidelines in 2009, we believe there is notable pent-up demand that is just waiting to be executed on in 2010."

"Proactive companies in the chemical sector that are willing to invest up-front time preparing for deals so that they can move quickly as opportunities become available will be able to effectively utilize M&A as a growth tool to reposition themselves," says Saverio Fato, global chemical leader for international consultancy PricewaterhouseCoopers.

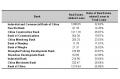

The amount of cash on balance sheets of 15 US chemical companies under coverage by BB&T (excluding giants Dow and DuPont) reached a decade-high of $8.3bn in 2009 - 60% above 2008 levels.

"Big money is back," says Mitsch. "[US specialty chemical company] Solutia showed the most dramatic increase in cash levels, helped in part by the sale of [the nylon business]. [US compounder] PolyOne quintupled its cash balance, primarily through capital improvements, while Westlake [Chemical] and Huntsman [both US] nearly tripled their cash, reflecting commodity swings and legal settlements, respectively."

At the end of Q1, DuPont had $4.5bn in cash and marketable securities. It also had debt of $11bn, which is more-than manageable for the Standard & Poor's A-rated company. DuPont remains one of the best positioned chemical firms to make acquisitions.

Dow Chemical is still relatively leveraged following its $19bn acquisition of US specialty chemical company Rohm and Haas in April 2009. At the end of Q1, it had $2.9bn in cash and $23.2bn in debt.

With consolidation a key driver of M&A activity, firms in the fragmented markets of coatings and adhesives - such as US-based Valspar, RPM International and H.B. Fuller - could appear on radar screens of buyers, he notes.

In addition, companies emerging from bankruptcy, such as US-based Chemtura, W.R. Grace, Solutia, Tronox and Netherlands-based LyondellBasell Industries could be potential targets, along with companies with focused portfolios such as Arch Chemicals and Nalco (both global water treatment firms), the analyst adds.

Leveraged buyouts (LBOs), which disappeared in 2009, could also be making a comeback. "As earnings have elevated from the abysmal 2008 to early 2009 levels, private equity firms are increasingly able to justify valuation multiples," says Mitsch.

The analyst's top LBO candidate is US-based phosphates company Innophos. A buyout could be feasible at about twice the company's current price of less than $30 per share based on various cash flow metrics, he says. Other LBO candidates include PolyOne, says the analyst.

ON THE SELLING BLOCK

More chemical assets are hitting the selling block as companies view the M&A market as returning to healthy levels of activity with more robust valuations.

"Valuations may have hit trough levels in the fourth quarter of 2009," says Young.

Cerimele is seeing more sell-side pitches. "Companies are feeling like this is a good time to explore asset sales as the days of lowball offers and bargain basement deals are coming to an end," he says. "Plus, buyers are looking for deals more actively - both strategics and private equity firms."

In April, Eastman Chemical, announced it was "reviewing strategic options, including a potential divestiture" for its poyethylene terephthalate (PET) business. The US chemical firm has retained global bank Merrill Lynch as its financial adviser.

Potential buyers are private equity firms, notes a US banker source. "There isn't a long list of strategic buyers looking to buy a PET business." Eastman explored strategic options for its PET business in 1997, including a sale, and unsuccessfully planned to split it off as a separate publicly traded firm in 2001.

Swiss specialty chemical company Cognis is also reportedly in sales talks with Germany's BASF, and US-based Lubrizol, among others, notes Mitsch. In April, German media reported BASF was preparing a 3bn ($3.7bn) takeover bid for Cognis.

While the chemical M&A recovery is in full swing, a couple of "wild cards" could take the global economy and the M&A market off track, according to Young.

"Major defaults in commercial real estate and certain sovereign nations such as Greece and Dubai are likely," he says. "Plus, a key concern, even in the context of a global recovery, relates to how economies and financial systems handle the withdrawal of numerous stimulative and financial support programs."