SSF likely to accelerate overseas investments, eyeing private equities

BEIJING: The Social Security Fund (SSF), the nation's largest pension fund, is planning aggressive investments in overseas markets, including private equities, Dai Xianglong, chairman of the National Council for Social Security Fund, said on Monday.

"The SSF is keen on expanding its overseas footprint through its investments in stocks, bonds as well as new avenues like private equities," said the chairman.

Dai Xianglong, chairman of the National Council for Social Security Fund, said the fund's assets will touch 2 trillion yuan by 2015. [Jiang Xin / for China Daily]

The fund can invest as much as 20 percent of its total assets abroad, Dai said.

The fund's holding of overseas assets including stocks and bonds were just 6.54 percent of its total portfolio at the end of last year.

Dai said the fund's role would be that of a financial investor and it does not intend to seek control of the investee companies.

The chairman, however, refused to reveal the investment timetable but said the fund was in talks with overseas asset managers on several programs for unlisted companies and private equity funds.

The pension fund will also come out with rules governing its overseas investments after it gains some experience abroad, Dai said.

"There is enough room to improve our overseas investments," said Dai. The fund's next few moves will help diversify the nation's huge foreign exchange holdings of $2.4 trillion, he said.

"The appreciation of the yuan will be gradual and will not affect the overseas investments by SSF if the returns are high enough," said Dai.

The US dollar remains the world's main reserve currency and the American economy is recovering, even though repairs to the financial system will take a "long time", said Dai, adding that he doesn't see Europe's sovereign debt crisis worsening either.

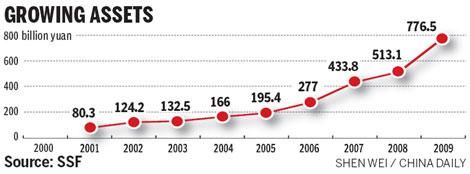

The pension fund's assets are set to increase to 2 trillion yuan in 2015 from 776.5 billion yuan last year, the chairman said. The pension fund started with assets of just 80 billion yuan a decade back.

The SSF got investment yields of 84.9 billion yuan on its investments in 2009, with a return rate of 16.1 percent, according to figures posted on the fund's website. The realized gains on its investments stood at 42.6 billion yuan by the end of last year.

The SSF's total investment yields rose to 244.8 billion yuan in 2009, with an average annual return rate of 9.75 percent. It had total assets of 776.5 billion yuan, an increase of 38 percent from the previous year.

The SSF reported its first annual loss in 2008, losing 6.79 percent on its investments.

But in 2009, nearly 60 percent of SSF's returns came from equity investments thanks to the booming stock markets, said Dai.

The chairman said fluctuations in the stock market are "normal", and 2010 is a difficult year due to the economic situation.

But he remains optimistic on the stock market prospects in the long term.

The pension fund is seeking a yield that exceeds the increase in the consumer price index by a "wide margin", the chairman said.