A still from the film The Founding of a Republic, produced by China Film Group.

State-run firm may list shares on bourses this year to boost capital needsBEIJING - State-run film producer and distributor China Film Group Corporation has resumed plans for a domestic stock listing this year to bolster capital and provide further muscle to its dominant status in the movie industry.

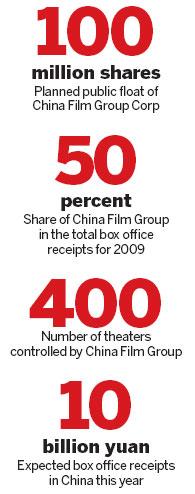

The company plans to issue up to 100 million shares through the initial public offering (IPO) and rope in Shanghai-based Kunlun Film Company as a strategic investor by divesting a stake ahead of the listing, a source familiar with the situation told China Daily on Tuesday.

The relevant government departments are currently reviewing the IPO proposal, the source said.

The source, however, did not reveal where the company intends to list its shares. An earlier report quoting China Film Group's Deputy Chief Executive Shi Dongming said the company might consider a listing in Shanghai.

The film producer had charted plans for a Hong Kong listing in 2004, but failed to get approval from the State Administration of Radio Film and Television (SARFT), the country's media watchdog.

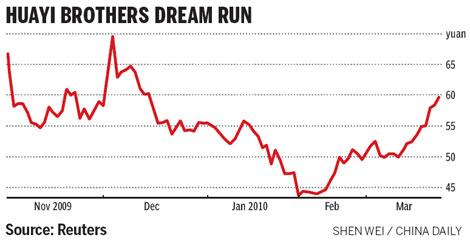

The current moves to accelerate the listing plan seem to have been prompted by the successful listing of Huayi Brothers Media Corporation on ChiNext. The market value of Huayi Brothers has soared to 9.8 billion yuan since its debut last October.

While it is still early days in terms of estimating how much funds will China Film Group mop up from the market, analysts said the IPO proceeds will boost capital and help the company strengthen its competitive edge in the film distribution market.

"It is possible that China Film Group will invest the capital it raises to set up more movie theaters in the country," said Gu Jia, an analyst at Guolian Securities.

But the company's dominant position in the market has also drawn criticism from other industry players. It controls the Beijing Film Studio and China Children's Film Studio and is the country's largest film distributor, operating seven circuits with 400 theaters. It is also the country's sole film importer and exporter and owns the nationwide movie channel CCTV 6.

Last year, China Film Group made six of the 11 highest-grossing films at the box office. The Founding of a Republic, a movie it produced last year to mark the 60th anniversary of New China, made about 420 million yuan at the box office.

Analysts said the infusion of cash from the stock market may also help China Film Group expand its production business, a weaker unit of the company compared to its rival Huayi Brothers who have signed many A-list directors and actors including Feng Xiaogang and Li Bingbing.

"It would mean more production if the company invests the money to foster more young directors and actors, which would help expand the overall production market," Gu said.

The listing of China Film Group will potentially boost the stock prices of the communication sector as it would convince investors of the growth potential of the country's film and TV industry, he said.

"It's not a zero-sum game. Huayi Brothers will probably see its share price go up on investor expectations of a stronger film industry after the listing of China Film Group," he said.

Box office receipts are expected to hit 10 billion yuan this year in China, while the number of movie theaters may go up to 4,700.

It is also speculated that by introducing investors in China Film Group, the government is loosening rules on the import of foreign films.

But analysts said the film industry will remain highly regulated in China and it is unlikely that the authorities will open doors for foreign film producers as it may squeeze the domestic film market.