An investor at a brokerage in Wuhan, Hubei province. Investment banks including Bank of America-Merrill Lynch expect Chinese equities, which has slumped 8.8 percent so far this year, will soon rebound. [China Daily]

SHANGHAI: China's stocks are "approaching a bottom" as concerns that the government will tighten monetary policy are overstated, according to Bank of America-Merrill Lynch Research.

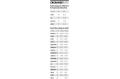

The Shanghai Composite Index has slumped 8.8 percent so far this year on the prospect the government will raise interest rates and curb lending to cool growth in the world's third-largest economy. The Hang Seng China Enterprises Index dropped 9 percent.

"On balance, we believe that the market has misinterpreted many of the latest tightening policies by the government," David Cui, Hong Kong-based strategist at Bank of America-Merrill Lynch, wrote in a report. "The recent sell-off in the market is an overreaction by our assessment and we believe the market is approaching a bottom."

Bank of America-Merrill Lynch joins CLSA Ltd, Morgan Stanley and Macquarie Group Ltd in saying Chinese equities may soon rebound. This year's slump is a "speed bump on the way to a bubble", CLSA Chief Strategist Christopher Wood said.

Policymakers may raise interest rates by the end of June, after already increasing banks' reserve requirements and targeting reduced credit growth, according to the median estimate in a Bloomberg News survey of economists.

Morgan Stanley's China strategist Jerry Lou said on Jan 27 the nation's stocks offer a "buying opportunity" after the Shanghai Composite dropped below 3,000 for the first time since October. The measure trades at 32 times earnings, compared with last year's high of 39 times profit in August.

The Shanghai gauge fell 8.53, or 0.3 percent, to close at 2995.31 yesterday.

China's inflation accelerated to 1.9 percent in December and gross domestic product climbed 10.7 percent.

"China will benefit from a dose of asset inflation in the first half of 2010, as real deposit rates turn negative and funds flow out of banks and into real assets," Macquarie said in a report. This will be supportive of equity markets, they said.

Bloomberg News