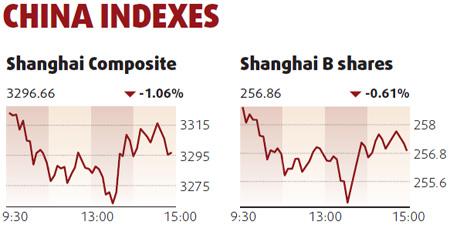

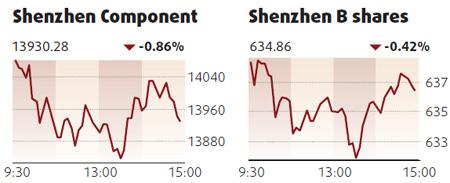

Mainland stocks fell, dragging the Shanghai Composite Index from a two-week high, as raw-material producers and brokerages dropped after commodity prices slid and a shareholder sold a stake in Haitong Securities Co.

The benchmark index fell 35.23, or 1.06 percent, to 3296.66 at the close, after reaching its highest level since Nov 23 on Monday.

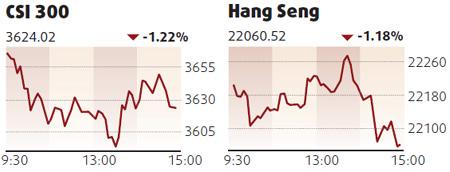

The CSI 300 Index dropped 1.22 percent to 3624.02.

"Current earnings growth for commodity stocks doesn't justify their high stock prices and valuations," said Zhang Ling, who helps oversee about $7.21 billion at ICBC Credit Suisse Asset Management Co. "Some investors are taking profit from the market now."

Indexes tracking energy and materials producers on the CSI 300 have rallied more than 125 percent in 2009, making them two of the top three performers among the 10 industry groups.

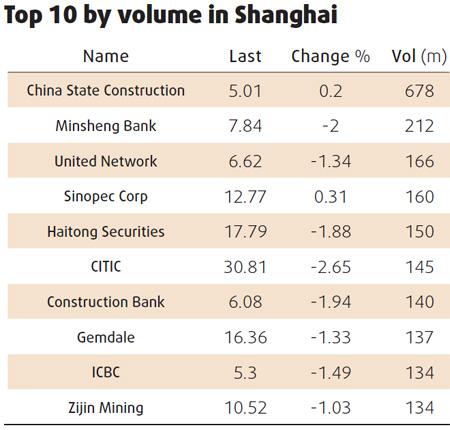

Zijin Mining Group Co, the nation's biggest producer of gold, dropped 1 percent to 10.52 yuan. Jiangxi Copper Co, China's biggest copper producer, fell 1.1 percent to 42.62 yuan. China Shenhua Energy Co, the nation's largest coal producer, dropped 2.6 percent to 35.65 yuan.

The London Metals Index, a measure of six metals including lead and aluminum, retreated 0.8 percent to the lowest this month. Crude oil for January delivery slid 2 percent to $73.93 a barrel in New York on Monday and gold lost 0.5 percent.

Haitong Securities, the country's second-largest listed brokerage by market value, fell 1.9 percent to 17.79 yuan after Shanghai Jinqiao Export Processing Zone Development Co said it sold 3.19 million shares in the company. Other brokerages also declined, with CITIC Securities Co slumping 2.9 percent to 30.81 yuan.

Insurers declined on concern recent gains had outpaced prospects for earnings growth. China Pacific Insurance (Group) Co slid 2.6 percent to 26.41 yuan. China Life Insurance Co lost 1.4 percent to 32.7 yuan.

Hang Seng falls

Hong Kong stocks fell, dragging the benchmark index to the lowest close this month, after the Federal Reserve Chairman Ben Bernanke said the US economy faces "formidable headwinds", heightening concern that demand for companies relying on overseas sales will slow.

The Hang Seng Index fell 1.18 percent to 22060.52, its lowest close since Nov 30. The gauge has surged 94 percent from this year's low on March 9.

Shares on the gauge are priced at an average 17.4 times estimated profit, up from 10.6 times at the start of 2009, according to data compiled by Bloomberg.

The Hang Seng China Enterprises Index fell 1.5 percent to 13152.1.