Chinese equities declined yesterday, making the benchmark index the world's worst performer, on concern the government would step up measures to prevent asset bubbles.

Industrial and Commercial Bank of China Ltd (ICBC) led declines among banks after central bank Governor Zhou Xiaochuan said reserve requirements for lenders remain an important tool. Poly Real Estate Group Co, the second-largest developer by market value, slid 2.8 percent.

"The policy front is still the biggest risk to the property industry," said Zheng Tuo, president of Good Hope Equity Investment Co in Shanghai. "Given the importance of property to China's economy, investors are wondering if economic growth may be impacted next year."

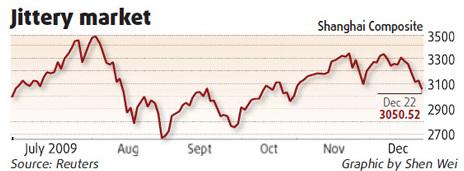

The Shanghai Composite Index lost 72.45, or 2.3 percent, to 3,050.52 at the close, the lowest since Oct 30. The measure has dropped 4.5 percent this month as the government increased down payments on land purchases and a flood of share sales diverted funds from equities. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, fell 2.7 percent to 3,305.54.

Zhou said at a Beijing forum that reserve ratios are a tool "which we still put quite some emphasis upon", fueling speculation they may be increased to limit the risk of asset bubbles. Imbalances in international payments can require "sterilizing" extra money in the financial system, he said.

A record 9.2 trillion yuan ($1.3 trillion) of loans in the first 11 months of this year drove a recovery in the world's third biggest economy and increased the risk of bubbles in property and stocks. The Shanghai gauge has rallied 68 percent this year.

ICBC, the country's biggest lender, fell 1.4 percent to 5.07 yuan, while China Construction Bank dropped 1.7 percent to 5.74 yuan.

Zhou didn't say a reserve-ratio increase was imminent. He also said that policymakers had many tools at their disposal, including "policy rates", interest rate spreads and capital adequacy ratios.

Poly, Vanke slump

Poly Real Estate lost 2.8 percent to 21.52 yuan, the lowest since Sept 1. China Vanke Co slid 3.9 percent to 10.3 yuan after Oriental Morning Post reported that Chairman Wang Shi is concerned that the property bubble would spread to second- and third-tier cities.

The government will target "excessive" growth in property prices in some cities, Xinhua News Agency said last week. That follows the cabinet's statement that it would reimpose a sales tax on homes sold within five years, after cutting the period to two years in January.

Home prices in 70 major Chinese cities, including Shanghai, rose 5.7 percent from a year earlier in November, the fastest pace in 16 months.

An index tracking 33 property stocks on the Shanghai Composite has lost 11 percent this month, the most among the six industry groups, and paring its annual advance to 94 percent.