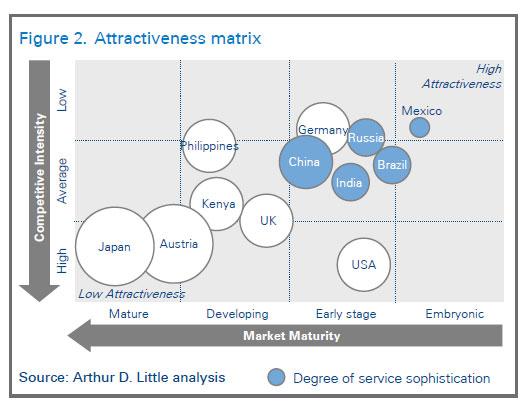

China is now one of the world's five most attractive mobile payments (m-payment) markets, though competition here is high, according to a report recently released by Arthur D Little (ADL), a global management consulting firm.

The ADL report examined current market conditions for mobile financial services in M-BRIC countries (Mexico, Brazil, Russia, India and China), and recommend potential entrants enter this market immediately.

The report said that as mobile financial services are experiencing a global surge, the world's total m-payment transaction volume is to reach approximately $280 billion by 2015.

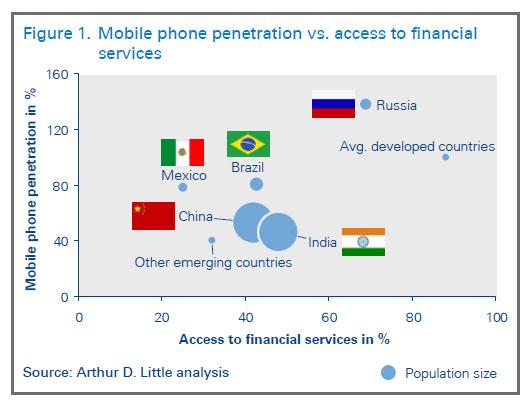

Currently, only 32 million people in M-BRIC use these types of services, with 20 percent of them in China.

The number of users is expected to reach 290 million in the five countries by 2015, accounting for 10 percent of their population. These users are expected to conduct a total of 20 billion transactions in 2015, with 6.9 billion in China.

China's mobile phone users topped 800 million in the first half of 2010, according to the Ministry of Industry and Information Technology.

Despite such a high mobile penetration, China's mobile payments are still in their infancy, and competition in the market is already intense.

A variety of players, such as mobile network organizers, independent service providers and banks, have already deployed a variety of technologies.

Competition between telecom operators and banks for a dominant role in the new industry may also thwart the development of mobile payments in China, Cao Fei, an analyst from research firm Analysys International.

China's biggest mobile operator, China Mobile, said in March it paid 39.8 billion yuan ($5.8 billion) for a 20 percent stake in Shanghai Pudong Development Bank as part of its plan to develop mobile banking and other services. The move provides a model for other operators and banks, according to the bank.

However, in terms of technology, the market here is still premature for advanced technologies for mobile financial services, such as NFC (near field communication) and RF-SIM (radio frequency SIM), the report said, adding that the rollout requires expensive POS devices.

Existing technology on the market, without an immense price tag, can be used to address China's rural areas. Such a network could be quickly and cheaply deployed to provide an SMS-based mobile payment system in remote areas.

Service providers should ensure scalability and performance, especially when it comes to the IT architecture and billing systems. They also need to prevent data transfer disruptions due to network congestion to win consumer trust, said the report.

To access the full report, please visit: www.adl.com/M-Payments

About Arthur D. Little

According to the company's website, Arthur D. Little was founded in 1886 and was the world's first professional management consulting firm. It is a global leader in management consultancy, linking strategy, innovation and technology with deep industry knowledge. These last years, Arthur D. Little developed partnerships with more than 70% of Fortune 100 companies. Its teams conceive and implement sustainable, innovative and operational solutions. Arthur D Little is present in over 20 countries with more than 1000 consultants. With its partners Altran Technologies, the firm has access to a network of over 17.000 professionals.