Workers make children's shoes for export at a factory in Fujian province. [Provided to China Daily]

Economic rebalancing led to 'significant decline' in surplusBEIJING - The US Treasury did not label China a currency manipulator in its semiannual report to Congress released on Thursday, but an economist at a Chinese government think-tank said this does not mean an end to bilateral disputes over the yuan issue.

"In the short term, China and the US will find no real solution to the issue," said Huo Jianguo, director of the Chinese Academy of International Trade and Economic Cooperation affiliated to the Ministry of Commerce. "The US should continue to closely monitor China's exchange rate policy, but there will be a big gap between what it wants and what China can do."

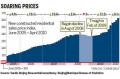

The Treasury report admitted that China's economic rebalancing policies have led to "a significant decline" in its current account surplus and "China has made progress" in rebalancing its growth.

Meanwhile, "US exports to China have rebounded much more rapidly than overall US exports and are now 20 percent above their pre-crisis levels", the report said.

In the second half of 2009, US exports to China increased 15 percent year-on-year, while US exports to the rest of the world fell 13 percent, it said.

The report also acknowledged that China's decision to end the yuan peg to the dollar from June 19 was "a welcome step in fostering stronger, more sustainable, and more balanced global growth".

From June 19 to July 2, the yuan appreciated 0.81 percent against the dollar, according to the report.

However, the report claimed that the yuan remains undervalued. "What matters is how far and how fast the renminbi (yuan) appreciates," it said.

US lawmakers also called for faster yuan appreciation after the release of the report despite China's concern that drastic revaluation of its currency would damage its trade sector, increase unemployment and worsen the expected economic slowdown in the second half of this year.

"China cannot afford big-margin appreciation," Huo said.

"The Obama administration, facing pressure from Congress, has had to demand a bolder yuan revaluation," said Zhou Shijian, a senior economist at the Center for China-US Relations of Tsinghua University. "Such pressure will grow as the US mid-term election nears (in October)."

But the US should understand that China's policy since the June 19 announcement to make the yuan more flexible does not aim at one-way appreciation of the yuan against the dollar, let alone drastic, sustained appreciation, Zhou said.