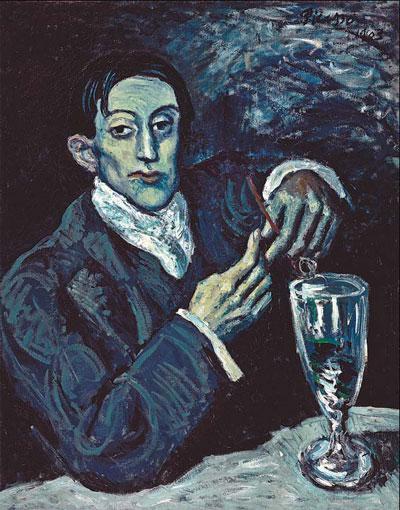

"The Absinthe Drinker" - a 1903 work by the great Spanish artist Picasso - has a guide price of between 300 and 400 million yuan. Christie's will be hoping to lure a major Chinese buyer when it exhibits the painting this week in Hong Kong. [China Daily]

Newly rich splashing out millions on Western works

BEIJING: Chinese mainland's billionaire art buyers, who are taking the international market by storm this year, could be about to make their next move in Hong Kong this week.

The art world is at fever pitch after an anonymous telephone bidder, now believed to be Chinese, paid a world record $106.4 million for a work by Pablo Picasso at a Christie's sale in New York earlier this month.

The purchase of the 1932 portrait of his blonde mistress called "Nude, Green Leaves and Bust" was one of a whole series of art auction scalps by mainland Chinese buyers this year.

These collectors, many of them newly rich entrepreneurs, are transforming the fortunes of the art market, which last year saw auction art prices fall globally by 30 percent, according to the Mei Moses Fine Art Index, following the onset of the economic crisis.

The world's focus this week will be on the The Hong Kong International Art Fair, where a number of high profile works, including a $12 million Andy Warhol and a Picasso, which could easily exceed that amount, are up for sale.

At the same time Christie's will again be hoping to lure a major Chinese buyer when it exhibits another painting by Picasso this week, also in Hong Kong.

"The Absinthe Drinker" - a 1903 work by the great Spanish artist - has a guide price of between 300 and 400 million yuan and is being paraded before going up for sale in London next month.

Ken Yeh, chairman of Christie's Asia in Hong Kong, said China's billionaire art buyers are creating something of an electric atmosphere in the art world.

"I think the potential for Western art in China is huge, just massive. There have been a very few Chinese people buying impressionist modern paintings since 2004 and 2005 but suddenly, since last year, there has been almost a surge," he said.

The auction house head believes this surge has been created by up to 20 Chinese buyers who have suddenly embarked on a mission to buy Western art.

"The Chinese mainland buyers have only just started buying impressionist works so there is a lot of potential for this to go a lot further than it already has," he said.

Mei Jianping, professor of finance at the Cheung Kong Graduate School of Business in Beijing and co-creator of the Mei Moses Fine Art Price Index, believes recent activity could send the price of Western art, particularly impressionists, soaring.

He believes what is happening is similar to the Japanese art spending spree in the late-1980s, which saw the impressionist art index increase by more than 200 per cent. The Japanese were buying $10 billion of art every year at auction.

"The joke at Sotheby's or Christie's at the time was whenever you see an Asian face the prices go up by 10 per cent," he said.

"With China being a much bigger country with potentially many more rich individuals, the scale could be even bigger this time.

"Chinese collectors are the new kids on the block and they want to demonstrate they are sophisticated and are in the same league as some of the best collectors in the world. We could be at the start of another spectacular impressionist boom."

There is a sense of anticipation ahead of the Hong Kong International Art Fair, which opens on Thursday.

The leading Asian art event at the Hong Kong Convention and Exhibition Centre has no fewer than 155 galleries represented this year.

The Warhol for sale is a 1981 silkscreen ink work called "Myths". The Picasso is a 1936 example of the artist's work and is called "Figure". There are also installations for sale by the British contemporary artist Damien Hirst, which may or may not appeal to Chinese tastes.

Magnus Renfrew, the fair's director, is bullish about the prospects for major sales to mainland art collectors.

"We are increasingly seeing far greater numbers of Chinese mainland collectors buying top level international modern and contemporary art," he said.

"The Chinese now have their luxury cars, yachts and properties and they are looking for different ways to express their wealth and sophistication."

Renfrew says Chinese buyers have become very discerning and are having an impact right across the art market, not just with record-breaking lots.

"They are doing their research. They know what they are interested in and are asking the right questions, whether the artist has exhibited, whether they are at the beginning of their careers and whether they have an established reputation," he said.

One who believes Chinese buyers are already having an impact on the world's art market is Morgan Long. She is head of art services at The Fine Art Fund (FAF), a London-based financial vehicle for investing in art.

"There have been examples recently where we have been bidding to acquire items for our fund but have come across frantic bidding from people from the Chinese mainland. We haven't been able to buy anything we wanted at the prices we were looking for," she said. She confirmed the world's art market has been buzzing after the Christie's sale in New York.

"There has been talk of one or two major buyers from China for quite some time but recently there seems to be a lot of interest from Chinese buyers for art works across a wide variety of price ranges," she said.

The FAF has been trying to capture some of the interest by setting up a dedicated Chinese fund, although it would be buying Chinese art works and not Western ones.

"We have been on a marketing trip to Hong Kong and Beijing recently and we have found quite a lot of interest," he said.

To capture this interest in art China might actually be getting its own first traded art fund.

The Shenzhen Culture Equity Exchange is later this year expected to launch one. It will be open to investors who want an alternative to investing in individual works of art.

Professor Mei from the Cheung Kong Graduate School of Business, who has been consulted on the new fund, said it could produce a better return than Picassos at $106 a throw.

"Major art works are to some extent like investing in blue chip stocks like Google in that they have already had their major price growth. If you invest in new talent and up-and-coming artists the returns can be better," he said.

But Ben Brown, who owns Ben Brown Fine Art, which runs major galleries in both Hong Kong and London, believes there is too much hype about the recent activity of Chinese buyers.

"I think there may actually be more of a market right now for major works in the Flemish part of Belgium than in the whole of China. I think mainland buying of significant Western art is a long way off," he said.

He said it could only benefit the auction houses, pointing to a Renoir in the recent Christies's New York sale which went for $8.8 million but had a guide of $5 million. The price was reportedly pushed up by a Chinese underbidder.

"Without the underbidder it would more than likely have sold for its reserve. He, however, has had the effect of increasing the price by around $4 million and generating some $600,000 of commission for Christie's, which more than pays their presence in China for a year. Just that one underbidder is worth his weight in gold," he said.

Ken Yeh at Christie's, who was present at the New York auction, has no doubt that the recent activity of mainland buyers is real and the start of something big.

He also believes they are making sensible investment decisions and not bumping up prices by paying silly money.

"They are buying because they like art but also for investment. If they spend $1m, $2m or $10m for a painting they want to make sure they will get a return five, six, seven years down the road. These are people who have got properties, shares and other investments and art is becoming part of their investment portfolio," he said.