Editor's Note:

The global financial crisis has created several opportunities for China to woo back its overseas financial talents, as the economy has been on a robust growth track, while Western economies are floundering. A number of high-profile bankers are said to return to China, including Lee Zhang, Fred Hu...

Lee Zhang

Lee Zhang, head of Global Banking Asia-Pacific at Deutsche Bank AG, is expected to be the first top-notch investment banker from a Western bank joining a Chinese State-run leader.

Zhang 45, is not an outsider to China's political world. As a member of the country's top advisory body, a political status rarely offered to Chinese who work for Western firms, Zhang has the chance to meet top government officials and regulators and advise on various social and economic issues.

Zhang set to join ICBC as vice-president

Deutsche Bank AG's top Asian executive Lee Zhang is expected to join the Industrial and Commercial Bank of China (ICBC) as vice-president, sources familiar with the matter said on Thursday, April 15.

Zhang's return is seen as a victory of sorts in the government efforts to bring home top financial talent employed in Western firms to man State-owned enterprises. [Full Story]

Deutsche Bank exec eyes ICBC gig

If Lee Zhang makes the move, Zhang would be the most senior investment banker at a Western firm to join a Chinese State-owned lender.

A move might entail a pay cut: ICBC Chairman Jiang Jianqing was paid 1.61 million yuan ($236,000) in 2008, about 12 percent of Deutsche Bank Chief Executive Officer Josef Ackermann's salary that year. [Full Story]

Fred Hu

Fred Hu was Chairman of Greater China at Goldman Sachs. Before joining Goldman Sachs in 1997, Hu was a staff member at the International Monetary Fund (IMF) in Washington DC, where he was engaged in macroeconomic research and policy consultations for a number of member country governments including China. [Full Story]

Hu has been in the spotlight since he announced on March 10 that he will quit his 13-year career with Goldman Sachs. Will he become a vice-governor at China's central bank? Will he establish a private equity fund of his own? Or will he take up a top job at one of China's major State-owned lenders...

Guess 1: Top Goldman partner Hu may go to PBOC

High-profile dealmaker and Goldman Sachs top Asian executive Fred (Zuliu) Hu is seen as the right candidate for appointment as the vice-governor of the People's Bank of China (PBOC) after formally stepping down from the Wall Street bank in April, people familiar with the matter said. [Full Story]

Guess 2: Hu may go to State-owned lender

Besides the PBOC job, policymakers are also evaluating Hu as a candidate for a crucial position at one of the country's State-run lenders. [Full Story]

Guess 3: Hu may sign up to PE in China

Fred Hu was rumored to establish a private equity fund in China. His resignation followed the footsteps of several former colleagues who left to establish private equity funds focused on Chinese deals.[Full Story]

Let's look at reasons for these possibilities...

Reason 1: Government determination

"Sending a paratrooper to a crucial post at a government financial department is indeed rare. It also indicates the government's determination to achieve breakthroughs in selecting officials and also promote the openness of the financial sector," said He Jun, a senior analyst at Anbound Consultancy. [Full Story]

Reason 2: Rapid growth of Chinese banks"Chinese banks are growing both domestically and globally and this may be one of the reasons they're attracting bankers from the private sector," said Manfred Jakob, a Frankfurt-based analyst at SEB AG. [Full Story]

Reason 3: Confidence in China's PE market

"Having senior talents join the PE/VC practice is a sign of confidence in China. Besides, the growth of yuan-denominated funds requires seasoned professionals who have seen several economic cycles, have strong industry expertise and not just financial skills, and have high personal integrity," said Andre Loesekrug-Pietri, chairman of the Private Equity and Strategic M&A Working Group of the European Union Chamber of Commerce in China. [Full Story]

Other Banking High Flyers

Fang Fenglei, a former Goldman Sachs investment banker, left in 2007 to form a $2 billion PE fund in early 2008 with Singapore's investment arm, Temasek, with a China focus. Both Fang and Hu are known as rainmakers in investment banking circles.

Other high profile movers included Jonathan Zhu who left Morgan Stanley China in 2006 to join Bain Capital, where he oversaw the acquisition of a controlling stake in electronic retailer Gome. At Morgan Stanley, Zhu managed the $9.2 billion initial public offering for China Construction Bank as well as the listing of China Unicom. [Full Story]

China hires Pimco brain, may lead to bold deals

Changhong Zhu, who previously managed the absolute return strategy fund at Pimco, is SAFE s most high-profile hire to date. [Full Story]

China's 1,000-Talents Scheme

China fishing in pool of global talent

When Ding Hong quit his post as a physics professor at Boston College last summer to return to work in China, it caused quite a stir among his peers. And after 18 years living in the United States, he said even he was surprised by his decision.

The 40-year-old academic is among the first batch of top-class minds lured to China as part of its 1,000-Talents Scheme, launched to help with the nation's transition from a manufacturing hub to a world leader in innovation.

Ding is now the principal investigator on two major projects at the institute of physics for the Chinese Academy of Sciences (CAS) in Beijing. [Full Story]

Talent scheme attracts first group of foreigners

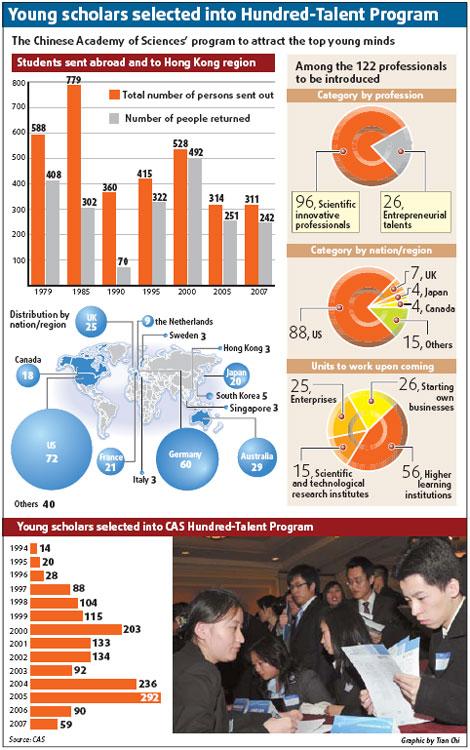

The ambitious plan to attract talents from overseas has attracted the first group of 96 scientists and 26 entrepreneurs to the Chinese mainland.

Li Yuanchao, head of the Central Organization Department, said earlier the plan aims to help the country achieve its goal of becoming an innovation-oriented nation. It aims to attract 2,000 talents in 5-10 years. [Full Story]

China tries to lure overseas talent

Under a new program to hire 1,000 overseas specialists, the central government will offer each 1 million yuan ($146,000) in subsidies. [Full Story]

More Stories

Wuxi City grows with Thousand Talents program

China urges step-up efforts to attract overseas talent

China calls for more overseas talents

Shanghai recruitment fairs hot on Wall Street

Overseas Chinese heading home

Shanghai casts job net for overseas talent

State firms seek global talent