SOE chief and former deputy mayor attributes profits to skills

Li Jian says he is an average stock investor but the Chinese media call him a genius.

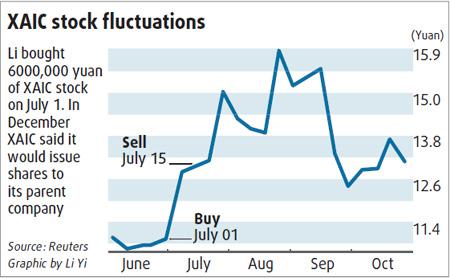

His track record speaks for itself. In just 11 trading days last July the 40-year-old made 170,000 yuan ($25,000).

Impressive as his performance was, Li would not have aroused nationwide attention in this highly volatile market but for allegations he was trading on insider information. It is claimed he invested in a company and then became senior executive of its parent corporation.

Adding to the murkiness is the fact he was deputy mayor of Shaoguan city in China's Guangdong province, where he was in charge of finance.

"I'm no different from any other ordinary investor (when buying stock)," Li told the media. "It was a normal individual investment."

Critics, however, have been quick to condemn him, claiming it would have been impossible for him to have profited so handsomely without insider knowledge gained from his government position.

Li said that despite his official title as deputy mayor, he spent a long time researching Xi'an Aircraft International Corporation (XAIC), a domestic A-share listed company, before he made an investment in it.

His explanation failed to disperse public skepticism because he applied for the post of deputy general manager of an aircraft company under the Aviation Industry Corporation of China, which owns XAIC. Given the two companies' close connection, the public has expressed doubts that Li is as clean as he claims.

Li's case has triggered hot debate in China, where the public has long harbored suspicions about insider trading despite the strengthening of regulations concerning information disclosure in recent years.

While some believe Li should resign and be held responsible for what they claim is a misdemeanor, if not a crime, others are urging regulators to hold a formal investigation into the case to restore investor confidence in the young and sometimes controversial market.

Crime and no punishment?

According to media reports, Li bought 600,000 yuan of XAIC stocks on July 1 last year. Its parent company started to launch a global recruitment program seeking senior managers in late February and Li applied and got the opportunity to be interviewed in mid-June. In August, he was short-listed and finally became deputy general manager of the firm.

At that time, the price of XAIC stock was rising strongly because of market speculation that its parent company would inject highly profitable assets into the listed company.

In early December, XAIC confirmed that it planned to issue shares to its parent company for the latter's asset injection, which verified previous market speculation. Some analysts say Li must have used his connection with the parent company to know in advance about the asset restructuring.

Sina.com.cn, the country's major news portal, conducted an online survey, in which more than 93,000 people participated from Jan 12. More than 87 percent of the respondents said they believed there must have been some insider trading.

He must have known that the stock price (of XAIC) would rise, something that other ordinary investors didn't know," said 41-year-old Zhao Yong, a Beijing taxi-driver.

"He, as deputy mayor, must have known something before he bought the stock," said Yang Qian, a sales manager of an auto-parts dealer in Beijing.

Li said although he applied for a position with XAIC's parent company, he never took advantage of that to benefit his investment decision-making.

"To be frank, I'm an expert in stock investment," he said. "I'm no novice at stock buying; I started investing in the stock market in 1994 (four years after the launch of the country's stock market), when I majored in accounting and finance in the graduate program of Shanghai University of Finance and Economics."

China's Securities Law and the Criminal Law have stipulations banning insider trading on the stock market, but they are both highly theoretical and hard to implement, analysts said.

In Li's case, the stock regulators at least should launch an investigation since it has aroused widespread public attention, said Zhang Yuanzhong, a lawyer with Beijing's Wentian Law Firm. "The public must be informed if and how Li knew the stock price would rise and whether he was involved in insider trading."

If that were the case, Zhang said, investigators should try to discover whether someone had tipped him off for the purpose of bribing him, because he was deputy mayor at the time.

If an investigation found him to be innocent of the allegations, it would do him good because it would clear up public doubt, Zhang said. "The regulators must act now," he added.

There are few signs, however, of regulators having started an investigation.

The company to which Li belongs claimed that there was no insider trading involved, although it found 37 people, including Li, shouldn't have but did buy XAIC stocks. They were mostly relatives of corporate executives.

The company said it would confiscate their earnings from the investment in the XAIC stock but would not take further action against them.

"Although no investigation has yet to confirm it, this seems like typical insider trading," said Zhong Jiyin, a Chinese Academy of Social Sciences economist on corporate governance. "Li couldn't explain in a rational way why he had singled out that stock" among the more than 1,600 listed companies, he said.

Successful career

Zhong said there have been several similar cases but few have been indicted for insider trading. "Regulators have failed to do a good job," he said.

Analysts have argued that China should adopt the "inversion of evidential burden" rule in cases involving alleged insider trading, one that requires the accused to prove himself innocent.

In this way, it would make it harder for those engaged in insider trading to defend themselves, they said.

In Li's case, Zhong argued, he needs to show, for example, that he has made similar investments previously in the same stock using similar amounts of money to indicate that it was part of his regular investment behavior.

Were it not for the insider trading allegations, Li's career would have been as an example of success for many Chinese.

He majored in medical science in college and then graduated from Shanghai University of Finance and Economics. After that he became an accounts manager for a major joint-venture pharmaceutical company in Shanghai. Then he was admitted into the doctorate program of the Ministry of Finance's Research Institute of Fiscal Science before becoming an independent board member of the Guangzhou Baiyunshan Pharmaceutical Co Ltd of Guangdong province.

Later he became deputy general manager of the Guangzhou Automobile Group, one of the country's largest automakers. In early 2008, he was appointed deputy mayor of Shaoguan city in Guangdong province.

His career record as a successful businessman and high-ranking government official indicates that Li is capable of making investments in the stock market and be able to profit, according to some observers. Others say he should not dabble in stocks because he is a government official, although no laws or regulations forbid him from doing so.

"He's a (deputy) mayor and he shouldn't invest in stocks," said sales manager Yang. "If he really wanted to do that, he should first quit his job."

Many Chinese like Yang do not agree with government officials buying stocks because they suspect those officials would make use of their influence to profit, which distorts the market, analysts said.

Despite Yang's resentment of government officials investing in the stock market, China has no rules forbidding it. It used to ban government officials doing that, but that has now been relaxed.

Li told the media that the government actually encourages it, citing a rule issued in 2001 that said government officials can invest in stocks using their legitimate income.

However, the rule does state that insider trading is forbidden.

The rule also stipulates that if one assumes a new post that gives the person access to insider information, he or she should sell off the stocks involved within one month after he or she takes the new post.

"I sold the XAIC stock on July 15 to steer clear of suspicion after I knew that it was very possible I would join its parent company," Li is on record as saying.