A salesperson waits for customers at a dealership in Nanjing. China's automobile sales dropped by 5.25 percent to 1.13 million units in June from May. [China Daily]

Automobile sales slowed for the third consecutive month this year in June as inflationary pressures continued to weigh heavily on new purchases, analysts said on Monday.

Sales were also hampered by concerns that tightening measures to cool the economy will further slow the scorching growth of last year, which was backed largely by government incentives.

Domestic automobile sales dropped by 5.25 percent to 1.13 million units in June from May, clocking the lowest year-on-year growth rate of 13.97 percent, the Tianjin-based China Automotive Technology Research Center said in a report on Monday.

That compares to the robust 29.8 percent year-on-year growth rate in May and the record high rate of 111 percent in January this year.

China's inflation rate accelerated to 3.1 percent in May, the quickest in 19 months. Measures to slow the economy may weigh on auto sales after government stimulus measures boosted demand by a record 46 percent last year, said a Bloomberg report on Monday citing Tim Dunne, an analyst at JD Power and Associates.

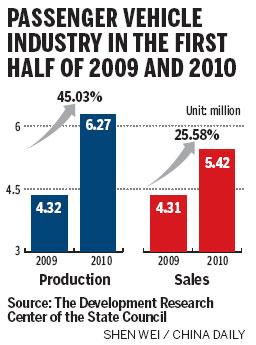

Sales of cars, sport-utility vehicles and multipurpose vehicles increased 10.89 percent in June to 839,228 units last month, and grew by 25.6 percent to 5.42 million units in the first half over the same period last year, said the center.

At the same time, the slowdown has also impacted dealers with inventories set to surpass the 1 million-unit mark soon, the center said.

"China's vehicle market is witnessing a dull period in terms of sales, with inventories soaring," said Zhao Hang, director of the center.

Grappling with the slowdown and rising inventories, dealers are now going the extra mile to prop up sales. While price cuts seem to be the order of the day, some of the dealers are also throwing in more incentives like tax-free purchase, free insurance and gift packages to bring back the elusive customers. So much so that dealers are offering discounts of over 20,000 yuan ($2,941) for a new 200,000 yuan Toyota Camry in Beijing.

"We are not hopeful of a pick up in demand until September," said a Toyota dealer from Beijing surnamed Wu. "The sales slow down has put pressure on our bottom line and inventories are surging."

Wu said his 4S store now has over 100 cars in stock, much more than what he sells every month. "We had stocks of around 50 cars in our dealership last year."

A Dongfeng Nissan dealer who did not want to be named told China Daily that "monthly sales in our store have nearly halved from 110 units to 60 units in June. The fall has been worse in the past one week."

"It is a tough situation for the dealers. They have no choice but to go for promotions and freebies to trim their inventories as well as maintain cash flow," said Su Hui, an auto analyst with China Automobile Dealers Association.

Su, however, feels that price wars are not something that the industry should rely on to boost sales. "It should not last for more than three months and is not ideal for the healthy development of automobile industry."