By KIT GILLET

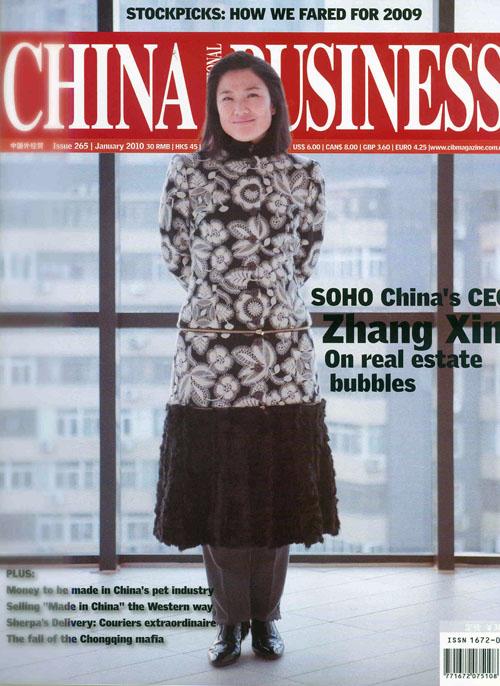

NAME: Zhang Xin

POSITION: CEO SOHO China

EDUCATION: BS Economics, University of Sussex, MA Development Economics, Cambridge University

WHAT S IN HER PURSE: iPhone, Blackberry

In 1994 Zhang Xin, recently returned to China from working as an investment banker for Goldman Sachs on Wall Street, met Pan Shiyi. Four days later he proposed. Thus began one of the most fruitful partnerships in recent Chinese business history.

For, as well as marrying, the pair formed a real estate company, SOHO China, which has gone on to become Beijing s largest commercial property developer its 2007 IPO, in which 31% of the company was put up for sale, has the distinction of being Asia s largest commercial real estate IPO to date, bringing in USD 1.65 billion and in the process made the pair billionaires (they were ranked 53rd on 2009 Hurun Rich List).

Fifteen years after founding the company, Beijing s landscape is dotted with SOHO s unique buildings, while Zhang s mantelpiece is filled with awards for her achievements, including her selection among The Financial Times Top 50 Women in World Business 2009 and Forbes March 2009 ten Billionaire Women We Admire list.

Zhang sat down with CIB to talk about the current property bubble, the state of urban development in China, and what it s like working with top architects.

What is your overall approach to the real estate market today?

Basically other than Qianmen [Street] in Beijing, which is the only project we decided to hold long term, our strategy for today is to sell everything we have. The real estate business should really be looking at rental yield; build a building and then lease it out with the rent giving a decent return. But, because of where China is with asset bubbles, people want to buy the assets regardless of whether they can be leased out or not. People just want to hold [property], even if it is empty.

Was this always the plan for SOHO?

Right after we went public we contemplated the idea of gradually moving more towards holding properties versus selling everything having a long-term undisrupted income. Then very quickly we moved into the financial crisis, and then the bubble stage. Now, if you look at the prices for the property being sold versus the rent you collect there is a real disconnect. Prices are too high, rent is too low, so if you hold property in order to get yield you are likely to get very little. For us it makes no sense to hold property, so our strategy is to sell everything. We see ourselves very much as a manufacturer. We buy land, we build, and then we sell. And the asset bubble has compelled us to be even more of a manufacturer.

Does your belief in asset bubbles in today s market mean you are scaling back operations?

My view is that the real estate business has a lot of asset bubbles, but even with asset bubbles it doesn t mean that we are getting out of the business. The strategy is not giving up or leaving, the strategy is to keep a lot of cash, to sell as fast as possible, and to turn around assets faster even faster than before.

When do you think the bubble will burst?

I don t know. We don t really have a view on when it will end; [but] we do have a view that this is a bubble. Real estate is very much driven by government policy. This year we have RMB 4 trillion through the stimulus package, another RMB 6 trillion from municipality bonds, another RMB 10 trillion from bank loans: We have RMB 20 trillion in the system and it all finds its way to real estate. If the government next year decides to continue the relaxed monetary policy the market will continue like this, regardless of whether this is a wasteful investment or not people will still buy and we will still be building and selling.

These buildings are not fully occupied and people should be worried about it. I am sure the government is worried about it, but what do you do, they want the stimulus and if you want to create jobs then this is a by-product. There are a lot of dilemmas in this area it is not a black and white easy decision.

As well as starting projects from scratch, SOHO also purchases completed structures. Is this one way of speeding up turnaround?

When we buy buildings, like the one we bought from Morgan Stanley (the rebranded Exchange SOHO in Shanghai), and turn it around to sell it doesn t attract much excitement, but I think it still has a special role in society. If you look at why Morgan Stanley wanted to sell and we wanted to buy, it is a very telling story. They only wanted to lease it to institutional tenants Morgan Stanley, Goldman Sachs, there aren t that many of those tenants. They tried that for about a year and a half and only leased 30%.

We look at it differently. We don t need to lease it to institutional tenants. We know that when we buy the building, we will bring the Chinese tenants in by selling to Chinese investors. The role that we are playing is vital we are filling up buildings that would otherwise have just been empty. It is a new market and frankly, only we are doing it. It provides a service to an untapped pool of demand.

Do you think foreign property developers will eventually alter their strategies?

They will have to. As an owner you should just lease to anyone who pays you. It is not without reason [however]. They don t know who the Chinese companies are, will they honor the contract? If you are Hewlett Packard they don t worry. We take a different view. Whoever comes to pay, we will lease it to them. If they go out, we lease it again. Credit-worthiness doesn t really matter.

What is your time period for selling properties?

As soon as possible. We came in [for the Exchange] when it was 30% full and now it s selling out very quickly. I think in the next few months it is all going to be sold out. People want to buy. It has already reached 50% occupancy.

[Beijing s] CBD has 35% vacancy but our buildings are all over 95% occupied because we push all these Chinese companies to come in. [Normally] if you go to Guomao as a small Chinese company there is no chance they will lease it to you, they won t even talk to you.

How did SOHO China transform itself from a start-up to a multi-billion-dollar company in just 15 years?

There are several stages of a company s growth. The early stage is all about survival. Can we make a profit? Can we pay the salaries? Every day it was a question of can we sell? [In the beginning] we didn t have a brand name and the market was just starting out. Back in 1995 there was hardly any real estate market. Those were the most difficult times.

By 1998 the company moved onto the second stage. The real estate industry began, with the most important factor for change being that banks began to provide mortgages. From then onwards it became can we sell? and building our brand name. Then in 2007 we went public. It was a good ten years of building a brand name, building the cooperation, getting the brightest talent to come to work for us.

How has going public changed your business practice?

Having capital is like oil you run much faster. Along with the capital came the demand to continuously grow and generate profit. So now we are planning and developing in a much more systematic way because frankly, being a public company you are constantly being compared to other listed companies, you don t have the luxury of saying, Oh this year I don t feel like doing so much. Before that I could say, Well this year is looking too dangerous.

SOHO buildings are increasingly iconic in character. Has this been an organic development?

We didn t start off trying to build a brand. It started as us recognizing that inside, a building is one family, one apartment, one office but outside the building is part of the city. I am very aware of architecture as a cultural element of a country. Despite a building being used inside for a very functional purpose it is also part of the city and has its own cultural responsibility.

How do you think you personally growing up in 1970s Beijing affected your ideas for buildings?

Because we grew up with so little hardly anything got built the opportunity to build is so immense. What do you do? You can t just copy what you had before. You have to look and see what is out there and available in today s world. We just search around for the best talent and luckily design is a worldwide exportable skill.

Your latest Beijing project, SOHO Galaxy, was designed by Zaha Hadid. How did that partnership come about?

The Galaxy [project] is interesting. We had been trying to work with Zaha Hadid on a couple of projects but it didn t quite work out, so when we had this site I thought, Who is the right architect? It wasn t a project where we called for a competition, I went straight to Zaha and said This is yours.

If you look around Beijing you have got Rem Koolhaas who did the CCTV [Headquarters], Herzog & de Meuron who did the Bird s Nest, you ve got Norman Foster who did the airport, but no building of Zaha s. Really, of the top ones, she is the only one missing. She is the most dynamic among them all in terms of architectural language and she didn t disappoint us.

We actually prefer [architects] who haven t done much commercially, who have very fresh eyes. We will bridge the gap of them not having enough business experience. We have that. We have a big group of in-house people engineers, architects who are doing that. Zaha Hadid s team is actually stationed here so everyday we meet them. They design something and we comment on it. This should be slightly different, let me tell you how the business flow works.

Your decision to work on the Qianmen Street renovation just south of Tiananmen Square is a notable departure from SOHO s other developments. Why did you take on this project?

I grew up in Beijing with the little hutongs, alleys and old buildings. Seventy-five percent of old Beijing has already been destroyed. The remaining 25% is largely the Forbidden City, the Summer Palace. There is so little of the old architecture of Beijing that can be seen and used by modern life. Qianmen is an area that still has the chance.

We really wanted to do this. A lot of media were saying these people build skyscrapers; they will come in to build skyscrapers. That was never our intention, and we wouldn t have been allowed anyway every single square meter is carefully controlled. As a developer usually you would have a say on the design, product building, leasing even leasing there were a lot of constraints. We needed to lease to laozihao, the traditional Chinese brands; regardless of whether the market wants to buy it or not, the government want them there. We realized it was more of a government project; we are there merely to execute the government s decisions. When we came in, this project was at the point where all of the relocation was done. We were never involved in the relocation.

Are you pleased with your involvement?

Qianmen was a unique experience. If I had a free hand I would have taken the conservation even more seriously. There were already many [structures] there that could be used. But that was not my decision.

What is your view on modern Beijing?

Beijing as a city has been phenomenal at creating icons CCTV, Bird s Nest but we haven t been so good at creating streets. You can t think about any new streets that have been developed Wangfujing is an old street, Xidan, even Qianmen. Where are the new streets?

It is a planning issue. When you have a piece of land and the government tells you that you need to have 30% green area, which you can only really put on the edge, the result is a building, green, then a building, then more green. On the street level it is not continuous, that needs to change. If we are really serious about building neighborhoods we need to give pedestrians the incentive to walk. They have no incentive to walk if the streets are not interesting. You need an interesting street full of shops, full of life, full of activities. It makes each of the buildings an island; the green areas are like water and are not helping create a neighborhood.

So far the majority of your developments have been in Beijing. (SOHO China has a hotel in Hainan and one property in Shanghai.) Why this singular focus?

It is largely a function of there having been enough opportunities. If there were not enough, we would be moving into other places. But we continue to see opportunities in Beijing, and we are now in Shanghai and see a lot of opportunities there too. Maybe, five years later, it has all been built, and then we will move to other cities.

What was the reasoning behind the Commune by the Great Wall hotel project?

Those were the early days when we were not as focused on doing business buildings. We were implementing lots of designs and we had the idea to have an exhibition of private house architecture. So [the buildings] started as an experiment rather than a mature business project with calculations and numbers supporting it. It was really a pet project for the love of architecture. But once it was built and we were invited to the Venice Biennale to exhibit and won an award, then came the decision that we needed to make it into a viable business.

Chinese SOEs have become increasingly involved in property development. How has this affected SOHO China?

SOEs can be irrational. CEOs of SOEs have short tenures and often they are not quite matching with their responsibilities so their decisions can be short term focused. If you know that your tenure is only three years you want to maximize your achievements, so whether you buy this land at the highest price doesn t matter because [it is] only finished down the road you are no longer there. That is why we are worried.

Today [December 3] there was an auction, look at this price, it s crazy. It was down to two SOEs competing. [Nowadays] if we want to bid on residential land it is unlikely we will get it. It is so expensive and all the SOEs are bidding the prices up to the sky.

How has this altered your short term plan?

It hasn t really. You find a strategy that works. What we found is that there are many buildings like the Morgan Stanley one; they re empty and we can quickly turn them around. We just bought another building on [Beijing s] East Third Ring Road. These things fill the void. Also, this year we are likely to hit RMB 15 billion in revenue and we still have over RMB 50 billion in the pipeline for the next few years. So there is enough for us to build for the next few years; we really don t need to go to compete at those auctions.

How is SOHO China growing as an organization?

We [now] have over 2,000 employees. Up until very recently we haven t done property management it was all outsourced but we have just made a decision that the properties we built should be self-managed. The property management industry [in China] is very low-end; they try to squeeze every penny to get a profit and as a result the quality of the service is bad. When we do property management we don t seek a profit. Because of this [decision] we now have thousands of employees you have guards, cleaners and so on. Before that our development people, in terms of building, selling and leasing, were only about 600; development is very lean, [while property management] is the very labor intensive area.

Are there any difficulties having two people yourself and your husband (Pan Shiyi, who has the role of company chairman) at the top?

One of the great characteristics of the Baha i faith (the religion both Zhang and Pan now subscribe to) is consultation. We consult not just with each other but with colleagues. No decision is made dictatorially by anybody in this company. I think that is the real character of SOHO, it has always been very open, even more so today.

Do you think people associate SOHO China heavily with Pan and yourself?

They do, but what can you do? When you think about Apple you think about Steve Jobs. But it was very organic: it wasn t designed. We needed to sell, we needed to build a brand name, so we needed to come out and talk, and the media likes to talk to private entrepreneurs. We are not state-owned so we don t have restrictions on what to say and what not to say. We can speak very honestly and the media needs that honesty so naturally it became this way.

Is there a dream project out there waiting for you?

I don t think anyone is as privileged as we are we built next to the Great Wall, we built next to Tiananmen Square, across [Beijing s] CBD, and by the water in Hainan. I think we have been the most privileged developer in terms of what opportunities have been presented to us.

http://www.cibmagazine.com.cn/Features/Face_To_Face.asp?id=1190&zhang_xin.html

Related News

Photos

More>>trade

market

- SOHO China - The Commune is Selected as One of the 10 Best Boutique Hotels in

- SOHO China - SOHO China Donated One Million Yuan to Tsunami-Struck Areas

- SOHO China - Zhang Xin was Selected as a Young Global Leader by the World

- SOHO China - Commune by the Great Wall Selected as One of

- SOHO China - Kempinski is Going to Run Commune by the Great Wall

finance

- SOHO China - The Power of Symbol Exhibition Opened in Beijing

- SOHO China - Commune by the Great Wall was Named as a New Architectural Wonder

- SOHO China - Jianwai SOHO Wins 2006 Business Week/Architectural Record China

- SOHO China - Commune by the Great Wall Kempinski Opens

- SOHO China - SOHO China Launches its Fifth CBD Project Guanghualu SOHO