Federal Reserve Chairman Ben Bernanke said China is risking inflation in its own economy, while threatening other nations, by not allowing its currency to appreciate.

Reuters

ReutersU.S. Federal Reserve Chairman Ben Bernanke

In an interview with CBS s 60 Minutes posted on the program s Web site, Mr. Bernanke said China s policy was not even in their own interest in addition to hurting others. Keeping the Chinese currency too low is bad for the American economy, because it hurts our trade, he said. It s bad for other emerging market economies. It s bad for China. Because among other things, it means that China can t have its own independent monetary policy.

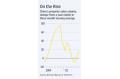

If they fix their currency to the dollar, then they have to have the same monetary policy, essentially, that the United States has, Mr. Bernanke said. Now, the United States needs and has a relatively supportive monetary policy. China is growing very quickly. They re risking inflation by importing U.S. monetary policy. And that that s a problem for them.

Mr. Bernanke appeared Sunday on the 60 Minutes television program. CBS posted parts of the recorded interview that did not air on television on its Web site Sunday night.

In the interview, the Fed chairman said the central bank could ultimately decrease or increase the size of its $600 billion bond-buying program if necessary. We re gonna be regularly reviewing this, he said. This is not something that we ve set into automatic motion going forward. We want to continue to think about it whether it needs to be changed, whether it needs to be increased or decreased or modified.

He also expressed surprise at the public reaction to the program, which the Fed started signaling in late August, after the formal announcement in early November. In fact, on the day we announced it, the markets barely moved, because everybody anticipated this was gonna happen, he said. The one thing that I did find a bit surprising was that after two months of essentially broadcasting to the world that we were gonna do this, that only after we made the announcement suddenly there was concern raised.

Looking at the troubles in Greece and Ireland, Mr. Bernanke said U.S. policymakers need to address the nation s long-term budget deficit before it s too late while being careful not to do anything in the very near term that will arrest the ongoing recovery.

We don t want to wait for however many years until we are at that point and we are forced the way Greece and Ireland are to make radical changes, radical cuts in their budget, essentially overnight, which is very painful, very difficult, he said. It s much better to to plan well in advance for these necessary changes, and to think about our budget situation not just this year or next year, but what it s gonna look like in 10 or 15 years.

And if we act now and make progress on that problem now, then we ll never be in the kind of situation where we have to make huge cuts in a very, very short period of time, he said.

He also criticized banks for problems with foreclosures, calling their actions sloppy. But he said they re moving in the right direction overall.

Banks should have the documentation to show that they have appropriate title, appropriate ownership of a mortgage, he said. And that they are doing a foreclosure, if they have to do a foreclosure, that they re doing it in an appropriate way that doesn t run over anybody s rights. I think banks need to follow good business practices. They need to make sure that their paper s in order. And that they re making good sound business decisions. And that s where we want them to be.

CSudeep Reddy