The Chinese flag on an electronic screen at the Nasdaq on May 11, 2011, in New York, the day when Jiayuan.com, China's largest dating website, was listed. Provided to China Daily

The Chinese flag on an electronic screen at the Nasdaq on May 11, 2011, in New York, the day when Jiayuan.com, China's largest dating website, was listed. Provided to China Daily

Chinese companies listing overseas are expected to seek to improve their image to shake off the credibility crisis they face in the United States stock market, say analysts.

Three Chinese companies, Longtop Financial Technologies Ltd, ShengdaTech, and China MediaExpress, have been delisted from the Nasdaq in the United States for accounting irregularities.

The price of other Chinese companies' stocks on the Nasdaq and the New York Stock Exchange plummeted as a result of the credibility crisis. Some stock owners even swore off from ever buying Chinese stocks again on stock-related websites. Credit-ratings firm Moody's Investors Service also warned of "red flags" at 61 rated Chinese companies, further affecting the price of Chinese equities.

Some US-listed Chinese companies expressed confidence with their company's future stock performance and believed that the recent panic by share owners is only temporary.

"The recent credibility crisis for some Chinese companies is part of a near-term market fluctuation and will have little bearning on our company's fundamental business and long-term trajectory and performance," said Catherine Zhang, chief financial officer (CFO) of AutoNavi Holdings Ltd, a leading provider of digital map content and navigation and "location-based solutions in China".

Qihoo 360 Technology Co Ltd, a company that provides free and comprehensive Internet and mobile security products, remains optimistic as well. Qihoo's CFO, Alex Xu, said: "Investors will increasingly trust our stock performance if they notice our steady path of development." Xu believes that Qihoo's business model is unprecedented in either the US or China. "While it takes some time to explain our unique model, American investors are especially drawn to the model's creativity," Xu said.

Zhang said: "The US equity capital markets maintain high listing standards for all companies that list on their exchanges through the IPO process, and Chinese companies are no exception. Even beyond listing requirements, we've always believed that it's important for companies to be transparent and to demonstrate high standards of corproate governance. The US capital market system is relatively rational and ultimately rewards companies that demonstrate solid performance in the long run."

Zhang believed that in some ways the rash of recent scandals has helped weed out many fraudulent Chinese companies and will ultimately benefit those in high growth industries and maintain proprietary technological advantages over competitors.

"Unlike some of the exposed companies that used backdoor listings, AutoNavi underwent strict and legitimate due diligence by top-tier investment banks, lawyers and auditors prior to its initial public offering," she said, adding that she stood by the quality of AutoNavi's internal control processes and its employees' ethical standards.

Similarly, Xu said that although Qihoo cannot control external factors that influence the company's stock price, such as some investors' impressions of Chinese companies in general or China's alleged lack of protection for intellectual property, "we do our best to implement marketing strategies and reach our company's goals".

"To us, the effect of ratings from Moody's is rather insignificant," Xu told China Daily.

Xu said that unlike some other HK/US- listed Chinese companies, Internet companies such as Qihoo and Sina do not finance through the bond market and are not subject to recent warnings by Moody's of "red flags".

Xu acknowledged that Moody's ratings reflect the general suspicion of Chinese companies. "A Moody's red flag is yet another reminder of Chinese companies' lack of corporate governance," Xu said.

AutoNavi and Qihoo both chose to list on the US stock market because they saw a better investment environment. "By listing in the US, we can offer our employees an ownership stake through company stock, allowing them to benefit from being a shareholder through stock option programs. This is a benefit that is much easier to implement as a US-listed company as compared to a company listed in China," Zhang said.

Xu added that Qihoo hopes to gain access to better acquisition financing by listing in the US. Both AutoNavi and Qihoo are expecting to reach out to global investors by listing in the US. While listing in China would receive mostly domestic attention, listing in the US serves as an international branding event for a company. The day Qihoo listed on the New York Stock Exchange attracted much international attention and Qihoo's stock price rose 135 percent.

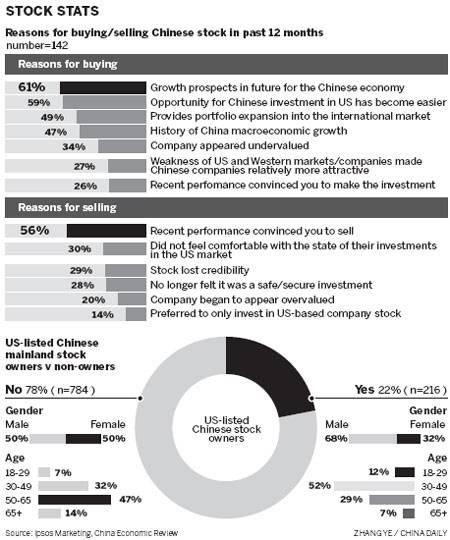

A survey designed by China Economic Review magazine and Ipsos Marketing indicated that ordinary US investors in Chinese stocks made a net profit trading Chinese shares over the 12 months ending on May 1 this year. The survey further showed that retail investors are also more bullish on China shares than they were last year.

The mechanism protects newly listed companies from stock rushes. "Hedge funds are more sophisticated and they understand the potential of listed companies. Retail investors, regardless of their nationality, do not have a hedge fund's capacities to build reliable financial models and estimate a company's market potential or future stock performance," according to the securities analyst who declined to be named.

The survey also indicated that the most active investment sectors are electronics and technology, telecommunications and the Internet. This trend will most likely continue as both AutoNavi's navigation application and Qihoo's mobile phone security software become increasingly popular among smart phone users, observers said.

"Currently, more than half of the existing 800 million smart phones use our 360 mobile phone security software," Xu said. "Because most Nokia smart phone users will start switching to Android and Apple smart phones in the near future, we hope to use this transition period to further develop and promote our smart phone software."

Source:China Daily

Weekly review