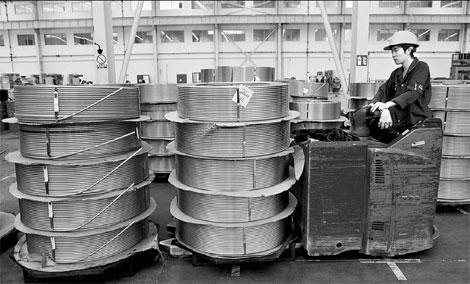

A worker in the production workshop of Jiangxi Copper Co in Nanchang, Jiangxi province. The copper producer lost 1.3 percent to 36.77 yuan ($5.68) on Wednesday, leading declines among raw-material companies. Wang Qi / For China Daily

A worker in the production workshop of Jiangxi Copper Co in Nanchang, Jiangxi province. The copper producer lost 1.3 percent to 36.77 yuan ($5.68) on Wednesday, leading declines among raw-material companies. Wang Qi / For China DailyStocks on the Chinese mainland fell, sending the benchmark index to the lowest level in a week, on speculation the central bank may keep raising interest rates and tightening policies will slow economic growth and curb commodities demand.

Jiangxi Copper Co and China Shenhua Energy Co, the nation's producers of copper and coal, led declines among raw-material companies. Zijin Mining Group Co slid 3.1 percent on speculation President Barack Obama's plan to cut the US deficit will reduce the bullion's appeal.

The stock market's drop was limited as liquor maker Kweichow Moutai Co led a rally for consumer staples producers after its parent company forecast a jump in output.

"There are a lack of catalysts to support the rally and everything positive such as expectations about policy easing seems to be priced in," said Wang Zheng, Shanghai-based chief investment officer at Jingxi Investment Management Co, which manages about $120 million. "Inflation is still a big issue and where it's heading will affect stocks."

The Shanghai Composite Index, which tracks the bigger of China's stock exchanges, dropped 2.78 points to 2794.21 at its close, the lowest since July 12. The CSI 300 Index slid 0.1 percent to 3091.57.

The Shanghai gauge has lost 0.5 percent this year on concern the government's efforts to curb inflation will hurt economic growth. The central bank has raised rates five times and the reserve-requirement ratio 12 times since the start of 2010 to stem inflation.

China should raise borrowing costs to correct the current situation in which real interest rates are negative, He Keng, a vice-chairman of the financial and economic affairs committee of the National People's Congress, said in Beijing on Wednesday. The government should adopt tighter fiscal policy to help curb inflation, He said.

Jiangxi Copper lost 1.3 percent to 36.77 yuan ($5.68). Shenhua retreated 1.2 percent to 29.63 yuan. Western Mining Co dropped 1.3 percent to 15.67 yuan.

Investors should be cautious on energy, material and industrial stocks as the global economy has yet to "see the full brunt" from China's tightening measures, according to Michael Darda, chief market strategist for MKM Partners LP.

Record-high Chinese bank reserve requirement ratios and three-month China Interbank Offered Rates that are above the April 2008 peak signal "wider risk spreads, a dramatic compression in the term structure of interest rates and slower liquidity growth," he said.

There is "a growing chorus expecting Chinese equities to continue rallying during the second half of 2011," Darda said. "We are happy to take the other side of this trade."

China's benchmark money-market rate will remain at about a record high this quarter as the central bank drains cash from the financial system to damp inflation, according to a survey of bond analysts.

The seven-day repurchase rate, a measure of interbank funding availability, will average 4.0 percent, based on the median of 12 estimates in a Bloomberg poll. That's almost double the 2.1 percent recorded in the same period of 2010 and compares with a second-quarter level of 4.2 percent that was the highest in data going back to 2004.

Zijin Mining slumped 3.1 percent to 5.65 yuan. The shares tumbled as much as 8.4 percent in Hong Kong after a shareholder offered a 5.6 percent stake for sale at a discount.

Six Zijin senior employees pleaded guilty to negligence charges related to a dam collapse that killed 22 people in Guangdong province, Xinhua News Agency said on Tuesdayciting court proceedings.

Source:China Daily

Weekly review