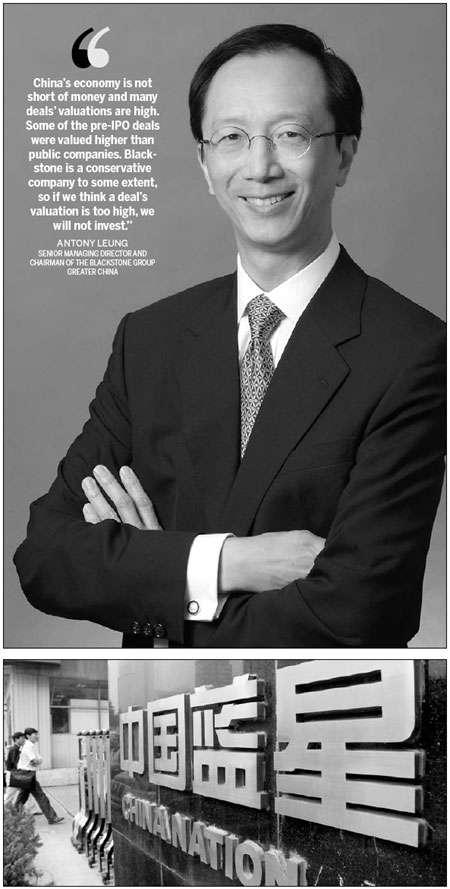

China Bluestar Group's headquarters in Beijing. The Blackstone Group supported Bluestar's acquisition of a chemical company in northern Europe for $2 billion. Provided to China Daily

China Bluestar Group's headquarters in Beijing. The Blackstone Group supported Bluestar's acquisition of a chemical company in northern Europe for $2 billion. Provided to China DailyWhile private equity (PE) and venture capital (VC) institutions are pursuing pre-float deals with high valuations in China, the world's fastest growing market, Antony Leung, senior managing director and chairman of The Blackstone Group Greater China, is on record as gently saying that his firm prefers to be patient and discover appropriate opportunities in sectors the government supports.

According to a report released by China Venture Group, a leading Chinese PE research agency, 214 Chinese enterprises listed at home and abroad in the first half of 2011, among which 100 had capital injections from PE or VC agencies. Shenzhen Capital Group, a leading domestic VC, accomplished nine initial public offerings (IPOs) over the six months.

However, Blackstone, the PE firm known for raising the largest buyout fund in the world, did not make any big moves in China during that period.

"We have a strong desire to invest more in China, but we are patient. We are waiting for proper opportunities," said Leung.

Blackstone's investment pace in China is comparatively slow since arriving in Asia four years ago. So far it has only five equity investments in the emerging market, including China Bluestar Group, a State-owned company engaged in specialized chemistry, Dili Group Holdings Co, a Chinese agricultural company, Channel One, a retail business based in Shanghai, a real estate development in Dalian, Liaoning province, and China Animal Healthcare Ltd, an animal medicine business.

"China's economy is not short of money and many deals' valuations are high. Some of the pre-IPO deals were valued higher than public companies," Leung said. "Blackstone is a conservative company to some extent, so if we think a deal's valuation is too high, we will not invest."

Blackstone has been in the PE business for 25 years, with total assets under management of $150 billion. The annual returns on investment to its PE limited partners (LPs) has been 23 percent on average.

Investment in China

"The prospect for the Chinese market is very good over the long term," Leung said.

He suggested investors follow the government's annual report and the five-year plans to find potential opportunities.

In the West, a government mainly serves as the regulator and policymaker. In China, the government participates in the economic operation and can play a significant role in financing, giving it the ability to implement its economic plans.

He believed the good opportunities in China now are in domestic consumption, healthcare, urbanization, outbound investment, industrial upgrades, new energy and materials, all of which are highlighted in China's 12th Five-Year Plan (2011-2015).

Although he is keeping an eye on those sectors, he maintains he is still prudent. Regarding the Chinese property market, Leung said it depends on government policies but its prospects in the long term are good.

Blackstone's abundant funds and global merger and acquisition (M&A) experience enable the PE firm to help Chinese companies expand overseas.

It supported Bluestar in successfully acquiring a chemical company in northern Europe for $2 billion.

According to Leung, unlike investment banks, in addition to arranging the acquisition, PE firms can help in providing capital, due diligence, deal structuring and post-deal integration, which are what Chinese companies really need when going abroad.

"Our goal is to make the acquired company stronger and help our co-investors (the Chinese companies) make profits. Only by doing this can we make a success as well," Leung said.

In recent years, M&As by Chinese companies overseas have boomed but the results have not always been good.

According to the Ministry of Commerce, direct investment abroad in the non-financial sectors amounted to $59 billion in 2010, a year-on-year increase of 36.3 percent. It involved 3,125 foreign enterprises in 129 nations and regions.

In the past two decades, 67 percent of overseas M&As by Chinese companies ended in failure, a study by global management consulting firm McKinsey &Co shows.

Experts said the reasons are mainly inadequate analysis of the industry chain, incorrect market trend forecast, excessively high self-evaluations and lack of understanding of the local law and tax environment.

"In this area, Blackstone can take a bigger role," Leung said.

Yuan-denominated fund

In 2009, Blackstone was the first foreign PE firm to set up a yuan-denominated fund, with a target to raise 5 billion yuan. By the first closing, which finished in October, more than half the sum had been raised.

Leung said it was taking so long to raise the cash because of the need to seek a series of approvals from various government departments.

He said the fund managers intend to seek funds from the National Social Security Fund (NSSF) of China, a strategic reserve fund collected by the nation's central government to support future social security expenditure and other social security needs.

"It will be great to have the NSSF, which is currently China's largest LP in PE funds. The NSSF intends to invest 10 percent of its assets under management in PE funds - about 100 billion yuan ($15.47 billion). That is a very large sum," Leung said.

Leung said there are excellent Chinese managers running yuan-denominated funds, but the Chinese PE market is still in the early stage of development. "Experienced foreign PE firms participating in the yuan-denominated PE market can provide options to the Chinese LPs such as the NSSF, benefiting the people it protects," Leung said.

Life experience

Before working in Blackstone, Leung was Financial Secretary of the Hong Kong Special Administrative Region between 2001 and 2003.

Newspapers said Leung gave up a plump banker's package of more than HK$23 million ($3 million) a year for a comparatively modest HK$2.45 million.

While at his government post, Leung made significant reforms including raising taxes and cutting the government expenditure to balance the budget, as well as signing the Closer Economic Partnership Agreement with the central government.

After leaving the job, Hong Kong media reported that many things he did in office were "correct, but politically incorrect".

"The circumstances might not have been happy when I left, but it has been a great blessing for me because I learned to be more humble and considerate of others," said Leung.

Looking back, Leung said his business life had been so smooth that he became too confident and did not fully consider some people's feelings when implementing some reforms.

Before becoming Hong Kong's Financial Secretary, Leung had 28 years of experience in the world of finance and was Asia chairman for JP Morgan Chase &Co.

Leung said that ever since he was young he wanted to make a contribution to society.

Born to an ordinary family (his father was a shopkeeper), Leung was the third child of nine sisters and brothers. He was his year's top student in the university entrance exam in Hong Kong. He chose to major in economics at university because he believed it could benefit people and society.

"Later I found many people who studied economics actually became professors," Leung said. "I always hope to do something good for my nation and people, which explains why I do other things while working for commercial sector."

Leung served as chairman of the Education Commission and the University Grants Committee, both advisory bodies to the government in education, for more than 10 years while working for Citibank and JP Morgan.

Now Leung said his family is a blessing from God. His wife, Fu Mingxia, used to be a top diver and was a four-time Olympic gold medalist. They have three children.

"I believe many opportunities are arranged by God," Leung said, reminiscing about his first impressions of the woman who was to become his wife while watching a diving competition of the Barcelona Olympic on television in 1992.

Leung said Fu, 14 then, had short hair and looked like a boy. He was amazed when she achieved a perfectly clean entry from a dive that created almost no splash. "I would not have dreamed that 10 years later she would marry me and we would have children together," Leung said with a smile.

Besides working for Blackstone, Leung also serves as the chairman of Heifei International Hong Kong, a non-profit organization providing animals and training to help impoverished families become self-reliant.

The organization's projects in China have been carried out in 16 provinces and autonomous regions, and more than 72,000 families have received assistance.

Fu also participates in the charity and accompanies Leung to remote villages to visit families around China every year.

Spending more than half the time on business trips, Leung cherishes his time at home with his daughter and two sons, and likes to share with them his education philosophy.

"They are encouraged to develop their hobbies and determine their own career paths, but I hope they will always act justly, love mercy and have humility in mind," Leung said.

Source:China Daily

Weekly review