SHANGHAI - Rio Tinto Ltd, the world's No 2 iron ore miner, will drop its prices by up to 3 percent for Chinese steel mills for the third quarter, sources with knowledge of the contract details told Reuters.

The modest price cut was in line with a decline in spot prices of the steelmaking raw material. Global miners have been using spot values as the basis for setting contract rates since the industry moved to a more flexible quarterly system after scrapping a decades-old annual pricing scheme.

The modest price cut was in line with a decline in spot prices of the steelmaking raw material. Global miners have been using spot values as the basis for setting contract rates since the industry moved to a more flexible quarterly system after scrapping a decades-old annual pricing scheme.

Rio has asked some Chinese steel mills to pay $2.7234 per dry metric ton unit (dmtu) for iron ore fines and $3.0109 per dmtu for lump ore for the July-September period, sources told Reuters on Thursday.

Those compare with Rio's second-quarter price of $2.7638 for fines and $3.1063 for lumps, the sources said.

The price puts Rio's 62-percent Pilbara Blend fines at $168.85 per ton, compared with $171.35 in the second quarter, in line with initial industry estimates.

An official who buys iron ore for a mid-sized steel mill in northern China said the company had received the pricing details from Rio Tinto on Wednesday.

Several more steel mills in eastern China had received the notice with the same pricing details, another market source said.

Contract prices jumped 20 percent to a record in the second quarter as spot iron ore prices peaked near $200 a ton in February, buoyed by booming demand from top consumer China.

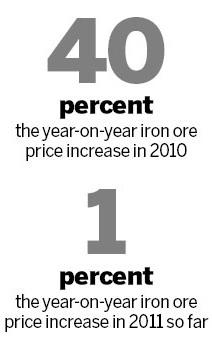

After rising more than 40 percent in 2010, iron ore prices are up just around 1 percent this year, as a February rally fizzled out after Chinese appetite stalled along with a drop in steel prices.

Rio, Vale and BHP Billiton Ltd, who together control more than two-thirds of the global iron ore seaborne market, dumped a 40-year-old system for pricing iron ore contracts annually in favor of an index-based quarterly pricing mechanism to capture sharp swings in spot prices.

Prices for quarterly contracts are largely based on average index prices over a three-month period ending a month before the start of each quarter. The three major index price providers are Platts, The Steel Index and Metal Bulletin.

A Chinese mill official said the company has yet to receive a contract price notice from Vale, the world's top iron ore miner.

Vale may keep prices of key products unchanged for clients who have agreed with the miner not to adjust prices if a quarterly change is smaller than 5 percent, Platts said in a report earlier this month, citing Vale's customers in China, Japan and South Korea.

Those that do not have such a clause in their contracts will see prices drop between 1.4 to 1.5 percent, Platts said.

Reuters