David M. Rubenstein

David M. Rubenstein However Carlyle Groups Rubenstein admits he turned down investment in Facebook

BEIJING - Very few billionaires don't play golf. David M. Rubenstein, The Carlyle Group's co-founder and managing director, however, is one of the very few.

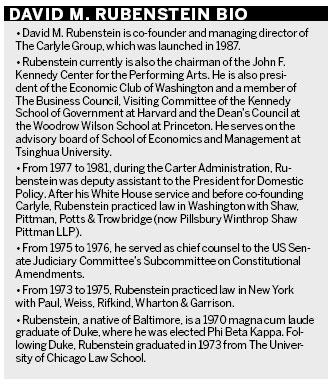

His personal interests, Rubenstein said, are largely in philanthropy and the performing arts. He has a long list of titles that he uses at different charity events and museums in the United States. For example, he is chairman of the John F. Kennedy Center for the Performing Arts, he is a Regent of the Smithsonian Institution and he is on the board of directors of the Trustees of Duke University and the Memorial Sloan-Kettering Cancer Center.

As a key man of the world's leading private equity (PE) firm, investment is also a form of art that Rubenstein specializes in.

The Washington-based firm returned a record $6.4 billion in deal profits to clients in the first quarter after distributing $7.5 billion last year, it said in its annual report to clients.

Carlyle completed 13 initial public offerings during 2010 and the first quarter of this year, using those offerings to pare debt or distribute profits to investors, according to the report.

In China, the company has so far spent $3 billion on around 50 investments, with the average return the company has seen in the country being higher than the average 30 percent it has made on its investments throughout the world, the tycoon said.

"We will increase the amount of investment in China very dramatically this year," Rubenstein said.

Carlyle has just closed a second round of fund raising for its Beijing yuan-denominated fund, which now totals 3.2 billion yuan ($492 million). It now runs two yuan-denominated funds in China: a $100 million joint-venture fund with Fosun Group, a private conglomerate in Shanghai, and a fund in Beijing that the company hopes will eventually total 5 billion yuan.

Rubenstein disclosed that the Beijing fund has just signed a deal with a company from the technology, media and telecom (TMT) industry, without giving the name of the company or the scale of the investment. The deal marks Carlyle's first use of its renminbi fund.

"Right now, we tend to focus on companies that we think we can spend four to five years making them more valuable, and focus on companies applying to the domestic market instead of export-oriented ones," he said, adding China's financial, food and healthcare industries will particularly interest Carlyle because the country's middle class is becoming increasingly wealthy and is increasing its demands for luxury products.

China's PE industry has witnessed fast development over the past few years, with the emergence of thousands of small-scale funds fueling concerns that the industry is overheated.

But Rubenstein said the market still has lots of potential because it has a comparatively low penetration rate in China and the country is experiencing robust economic growth momentum.

"If you look at the amount of equity firms and the amount of capital they have, China's private equity market is still much smaller than the US and Europe," he said.

Industry statistics show that the annual trading value of domestic PE is only around 0.3 percent of China's gross domestic product, compared with 1 percent in developed economies.

According to Liu Lefei, chairman and chief executive of Citic Private Equity Funds Management Co Ltd, the total volume of China's PE will probably see a 10-fold growth within a decade.

"Remember, deals that have been done today were mostly in the country's eastern region. There are vast areas in the west where people haven't spent much," said Rubenstein.

Carlyle, with an office in Chengdu, Sichuan province, is the first foreign PE firm to open office in the country's western region.

With more domestic players emerging, Carlyle does face more competition in the market.

"I would not say there is too much competition. There is definitely more competition but this is a very big market," said Rubenstein.

"In fact, we are not against having more and more competition from local players because the emergence of a domestic private equity market will let the government recognize it is helpful for the development of the Chinese economy, which in return is good for us."

The biggest challenge Carlyle facing in China, according to Rubenstein, is to retain the talented people that the company already has and hire more skilled staff, to find good deals and keep very disciplined in pricing.

Currently, Carlyle has 89 employees in China and four offices in Hong Kong, Beijing, Shanghai and Chengdu.

Other challenges as an investor in China include making sure that the government continues to think that PE is a good endeavor and regulations are favorable for PE, making sure that investors get a good return and people think that the fund added value to the companies in which they invested, he said.

Rubenstein has made thousands of decisions in his investment life, many challenging and some regarded as ill-founded.

Rubenstein missed his chance to be one of the first investors in Facebook.com.

His son-in-law was a high school classmate of Mark Zuckerberg, the founder of Facebook. When Zuckerberg was planning to drop out of Harvard to launch the social network, the son-in-law asked Rubenstein if he would like to meet Zuckerberg who was looking for investors to fund the new website.

"I said to myself, what are the chances of this guy becoming the next Bill Gates? So I didn't meet with him," Rubenstein said. "So now I have to work for a living."

Recently, Carlyle has also drawn criticism after two of the companies in which it had invested - the Hong Kong-listed China Forestry Holdings Inc and the Nasdaq-listed fertilizer maker China Agritech Inc - were suspended from trading. Rubenstein said neither suspension has been a catastrophe.

"Investment cannot be perfect, and the investigation is still ongoing," Rubenstein said, adding that more than 95 percent of Carlyle's deals are successful and its investment in the companies is small when compared with Carlyle's total investments in China.

Compared with its major competitors, Blackstone Group LP and Kohlberg Kravis Roberts & Co (KKR), Carlyle invests enormous amount of its own money in transactions, Rubenstein said.

In an industry often dominated by men, Carlyle is also different.

"We have a large number of women professionals in Carlyle, probably more than any other private equity firms," he said. "We shall have more women in this business."

Although earlier reports said Carlyle was considering a listing this year, Rubenstein said the company hadn't decided yet and it is still too early to say even though they have thought about it for a long time.

Blackstone, KKR and Apollo Global Management LLC, all based in New York, have gone public. Blackstone, one of the world's largest private-equity companies, has gained 57 percent during the past 12 months.

Rubenstein described himself as a hard-working, focused, and philanthropic person, if asked to limit his pen portrait to three adjectives.

When he was 27-years-old and serving as the deputy assistant to the President for Domestic Policy during the Carter Administration, Rubenstein was always first in the office and the last to leave. Some people even thought he lived in the White House. He largely relied on vending machine food during that period.

After his White House service and before co-founding Carlyle, Rubenstein practiced law in Washington with Shaw, Pittman, Potts & Trowbridge (now Pillsbury Winthrop Shaw Pittman LLP).

In the eyes of his employees, Rubenstein is an easy-going person without a haughty manner.

"In the office, everybody can talk to him and he will be always ready to follow good advice," said Brian Zhou, director of China communications at Carlyle. "He is quite straightforward and keeps close contact with the staff on the front line."

A billionaire and a strict vegetarian, Rubenstein remains intelligent, hardworking and traditional. "He probably spends more than 200 days traveling on business," Zhou said. "I will not be surprised to see him appear in the Beijing office quietly any morning by himself without anyone accompanying him."