The AWEX Regional Indicators finished 3.9% higher, on average, at sales in Sydney, Melbourne and Fremantle last week, when the average AWEX Superfine Micron Prices Guides rose by a further 5 to 9% on top of last week's rises of 5 to 7%.

The market is operating independently of the US exchange rate which rose by a further rose by 3.1% this week.

51,522 bales were on offer, compared with 50,028 bales last week. 4.7% were passed in, comprised of 3.2% in Sydney, 3.3% in Melbourne and 9.6% in Fremantle. Pass-in rates for Merino fleece and skirtings were 4.4% and 3.5%, respectively.

858 bales (1.6%) from the expected offering of 52,380 bales were withdrawn prior to sale and re-offered bales made up 6.7% of the final offering. 49,122 bales were cleared to the trade.

The US exchange rate rose back above 99¢ on Tuesday following the 0.25% lift in the official Australian interest rate earlier in the day. This was not expected by most experts and had not been factored in the exchange rate prior to the Reserve Bank announcement. The rise to above parity on Thursday was associated with the announcement of a further stimulus package in the United States and a weakening of the US Dollar.

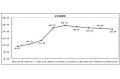

There was an exceptionally strong start to the week with large price rises across all micron ranges and wool types on Wednesday, particularly at the fine end, where the average AWEX MPGs were up by 86¢ and 98¢ respectively for 16.5 and 17.0 microns. Further large rises were seen at the fine end on Thursday. The gains in the fine wool MPGs from the start of the season can be seen on the last page of this Review.

There was some easing from 20 microns up on Thursday, but not enough to cancel out the previous day's large gains.

The closing EMI has risen by 83¢ in Australian currency in the last three sales.

The previous highest daily closing EMI was 992¢ in February 2008 and the previous highest day-to-day change in the closing EMI was 41¢ in November 2007 when the EMI rose to 1000¢ from 959¢ on the last day of the previous week.

When looked at in US terms, the EMI at 996¢ is 82¢ above the previous highest value in January 2008. Thanks to some information supplied by Brian Clancy of the Weekly Times, it may to be at its highest level ever. It is 55¢ above the value of 941¢ in mid-April 1988, when the EMI reached 1271¢ in Australian currency and the exchange rate was 74¢.

The trade reports strong enquiry continuing after Thursday's sale.

Demand for skirtings again followed the fleece types with keen demand and good prices, particularly at the fine end, where prices were reported to be up by 30 to 40¢ greasy on Wednesday. Crossbred average AWEX MPGs all rose on Wednesday, but eased on Thursday. Nevertheless, all average crossbred MPGs were up for the week except at 28 microns where it fell by 1¢. Oddments had a mixed week, with strong rises in the North on Wednesday, followed by a slight easing on Thursday. Overall, the average AWEX Merino Cardings Price Guide was up by 1.3%.

Buyers from China were again dominant followed by buyers for India and Europe.

The increase in demand from Europe and India has played a major part in the lift in the market this season. This increase in demand is reflected in the latest export data from the Australian Bureau of Statistics which shows that the share of Australia's exports in the first three months of the season have changed as follows:

• India has moved from 7.8% for all of last season to 10.6% this season.

• Italy has moved from 2.8% to 5.3%.

• The Czech Republic has moved from 3.4% to 4.6%.

• China has moved from 78.1%% to 68.6%.

Sales will be held in Sydney, Melbourne and Fremantle next week, when 51,235 bales are currently rostered for sale. Present estimates for the following two sales (Weeks 20 and 21) are 47,450 and 46,750 bales, respectively; an increase of 6.1% over the three sale period when compared with last year.

The New Zealand Merino Company is rostered to offer 3,000 bales in Week 20.

In South African sales, the Cape Wools Indicator was up by 3.9% since last week against a 1.7% appreciation of the Rand against the US Dollar and a 0.2% appreciation against the Euro. 9,960 bales were on offer.