|

|---|

Rex Features |

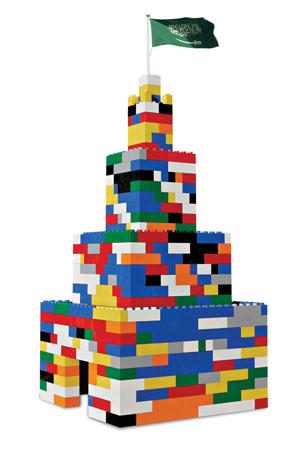

The Middle East started off exporting just oil and gas, which were abundantly available, but has used this feedstock advantage in the past 10 years to catapult itself to the status of a leading olefins and polymers exporter.

"It won't be too long before it becomes the world's premier polymer producer and exporter, edging out less cost-advantaged suppliers from the global marketplace," says one Saudi Arabian polymer producer.

SAUDI ARABIA PUSHES PROCESSORS

Not content with making and exporting millions of tonnes of polymers, the region is now focusing on going further downstream. And leading the charge are Saudi Arabia and the United Arab Emirates (UAE), home to a significant proportion of the surplus polymer capacities that have come up in the past couple of years.

"Although Saudi Arabia is a major polymer exporter, by 2012, we expect around 2.5m tonnes/year of polymers to be consumed within the country," says Laith al-Shebel, vice president of the Saudi Clusters Development Program, a government-supported initiative that aims to encourage the growth of small and medium-sized enterprises (SMEs) for plastics and metals processing.

Although the country has around 900 plastics processors, only 600 are currently operating, and 100 at a reasonable scale. Of these, 20 are large, but only 10 can be called worldscale (consuming over 10,000 tonnes/year of resin), says Al-Shebel. The aim of the Saudi Clusters Program is to get the number of worldscale processors to snowball, he adds.

As part of its Vision 2020 agenda, the Saudi government plans to set up 14 new industrial cities in the country over the next 10 years, which will, among other things, promote investment in the plastics conversion industry.

"The projects could turn into white elephants"Source close to a plastics processor |

|---|

To provide a backup to the long-standing Jubail Industrial City, theRabigh Conversion Industrial Park,for instance, is already being promoted by Saudi Aramco and Japan's Sumitomo Chemical to plastics processors producing automotive components and packaging materials, as well as additives and masterbatches.

Also in the pipeline are the Sudair Industrial City and Dammam Industrial City, which will offer fresh opportunities for plastics processing units.

US-based pipe manufacturer MFRI for instance, announced in May that it planned to set up a plant by 2011 to make insulated pipes in Dammam Industrial City to serve the requirements of the oil and gas industry in Saudi Arabia.

The location is ideally suited to feedstock procurement, being adjacent to large polymer plants, such as Petro Rabigh's polyethylene (PE) and polypropylene (PP)facilities.

But how will the country address the important issue of the skills shortage that has kept many of its dream projects moored to the drawing board? According to Al-Shebel, steps are already being taken to resolve this problem.

The Higher Institute for Plastics Fabrication, supported by Saudi Arabian petrochemical companies such as SABIC, TASNEE and Eastern Petrochemical (Sharq), is conducting a two-year course and the first group of 210 will graduate this year, he points out. Another initiative is the Product Development Centre, supported by the Saudi government and the private sector to foster downstream development and new applications in plastics.

ABU DHABI EMERGES

Abu Dhabi in the UAE is also emerging as an important hub for plastics converters. The promoters of Abu Dhabi Polymers Park claim it is strategically located to supply major markets such as Europe and the Indian subcontinent.

Housed close to the Borouge petrochemical and polymers complex, the park offers incentives such as duty-free imports and exports, and competitively priced and well-developed infrastructure and utilities.

A plastic pipe maker that plans to shift its factory from Jebel Ali, in Dubai, to the Abu Dhabi Park next year is convinced it will benefit substantially from the move. "Although the port infrastructure is not very good in Abu Dhabi and we will have to transport our finished goods to Jebel Ali port, the additional transportation costs will be offset by a host of incentives," says a source close to the company.

For instance, there would be a 40% reduction in electricity costs and 30% savings in water charges after the relocation, he says. "The centralized utilities in the new park will also be much better than in Jebel Ali, which has become quite crowded," he says.

In addition, it offers an excellent business opportunity as the Abu Dhabi Park authorities are aggressively encouraging foreign investment, he contends. And proximity to the Borouge petrochemical plant was another reason to relocate.

But others are not so starry-eyed. A source close to a plastics processor that has opted to stay on in Jebel Ali says it will be a long time before plastics clusters such as the Abu Dhabi Park and the Dammam Industrial Park can attract enough investment to make them viable.

"Right now, it is just a pipe dream. What I fear is that if there is no critical mass of processors, the projects could turn into white elephants," he cautions.