An investor checks share movements at a securities office in Nanjing, Jiangsu province. [China Daily]

Stocks of China's gold miners reached their daily limit soon after the Shanghai and Shenzhen bourses resumed trading on Friday, fuelled by record prices for the precious metal.Zijin Mining, Zhongjin Gold and Shandong Gold rose the maximum permitted 10 percent after the market opened after the eight-day National Day holiday, quickly followed by gold retailer Lao Fengxiang.

Zijin Mining's shares were also boosted by its announcement that it was acquiring Canadian Continental Minerals Corporation, which, according to the company, could increase the miner's gold and copper reserves.

Chinese investors' fervor for gold is in line with hikes in global prices for gold during the past week.

"The fervor is a catch-up in the buoyancy on the global gold market while trading was suspended for China's National Day holiday," said Yu Zuojie, a market strategist at Shanghai Securities.

Spot gold hit a record high of $1,061.20 an ounce on Thursday following three days of consecutive hikes.

Analysts at Barclays Capital said earlier their outlook on gold was bullish, with a momentum toward $1,120 an ounce now a possibility.

Gold's advance was stoked by a weakening US dollar and concerns over inflation, both of which increase the appeal of gold as a traditional hedge. Adding to the fervor was a recent report in a British newspaper that Arab states, along with China, Russia, Japan and France, were in talks to move away from using the dollar for oil trading, which further weakens the dollar. Several countries have denied such talks.

"China's gold market closely tracks the global trend," Yu said.

Gold retreated to around $1,050 an ounce on Friday.

The lust for gold also spread into consumer sector where prices were breaking records. Gold jewelry became a best seller as consumers feared prices will soar even higher.

Other non-ferrous metals including aluminum, copper and zinc also hit the rising limit on Friday over expectations that a real economic recovery had set in.

Aluminum producers such as Aluminum Corporation of China, Nanshan Aluminum, Yunan Aluminum, all of which hit the rising ceiling, were the leading performers of the main boards on Friday.

The non-ferrous metal sector outperformed the broad market by advancing 8.64 percent.

Such rises may indicate confidence in an economic rebound, said analysts. Analysts, however, doubt whether the current stock boom is sustainable.

"Today's boom unleashed cautious sentiments that prevailed before the national holiday," said Yu.

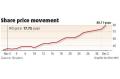

The benchmark Shanghai index rose 4.76 percent to close at 2,911.72 point on Friday, bringing to an end days of drops before the public holiday.