SHANGHAI: Copper ticked lower Thursday, reversing earlier gains, as uncertainties about an economic recovery and a rebounding dollar weighed.

Prices had edged up in early trade, aided by US Federal Reserve Chairman Ben Bernanke's pledge to keep interest rates low. However, traders had expected remarks about an uncertain economic recovery to weigh on the market.

"Bernanke's comment did not send a very clear direction to the market. On the one hand, the market is relieved that liquidity won't be tightened soon. On the other hand, worries over the economy are growing," said Lin Yuhui, deputy general manager of Jinhui Futures.

"Copper prices will continue to move sideways under the influence of conflicting factors - tighter liquidity in China versus ample cheap money in the US, robust economic growth in China versus tepid economies in major developed countries," Lin said.

Lin expected Shanghai copper to move in the range of 56,000 yuan to 60,000 yuan ($8,203 - 8,789) a ton in the short term.

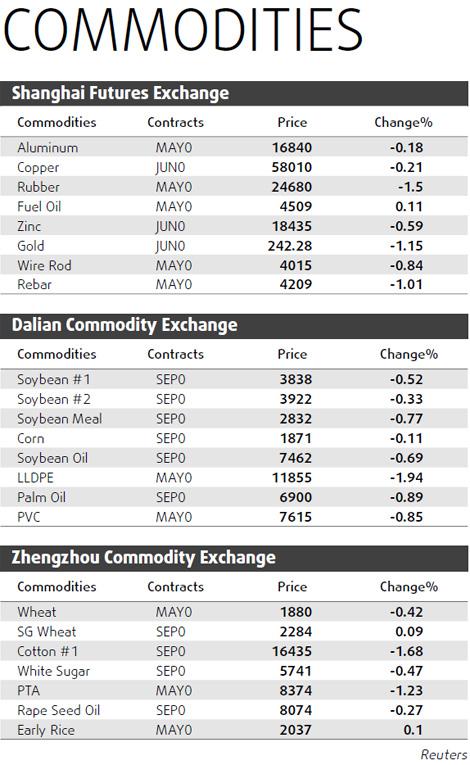

Shanghai's benchmark third-month copper futures contract reversed earlier gains to end down 0.5 percent at 57,890 yuan a ton. It touched an intra-day high of 58,810 yuan.

Three-month copper on the London Metal Exchange wiped out modest gains earlier in the day, and shed $22 to $7,133 by 0701 GMT.

A stronger dollar also weighed on metals, making it more expensive to buy for investors holding other currencies. The US dollar index rose to as high as 81.124 Thursday, not far from the 8-month high of 81.342 hit last week.

Spot supply was abundant in China, which was reflected in a discount of about 200 yuan in spot prices versus Shanghai third-month futures prices.

"There is room for correction in copper prices. If the pressure from oversupply in the spot market stays, future prices aren't likely to move much higher," said Liu Xu, an analyst at China International Futures.

LME copper soared 9 percent last week when China paused to celebrate the Lunar New Year, as investors bet on strong post-holiday buying from the nation, the world's top copper consumer.

But so far the fabled buying spree is unspotted, partly because many factories are still on holiday.

"In 2010 it's unrealistic to expect China to support copper prices. Demand from Europe and the US has to improve. Copper consumption in China is likely to grow at a slower pace from last year," said Liu of China International Futures.

Reuters