SHANGHAI - China's stocks fell on Shenyin & Wanguo Securities Co's downgrade of the steel industry and concern healthcare companies may be overvalued given their earnings outlook.

"A slowing of economic and corporate earnings growth in the third quarter looks certain as a result of tightening measures," said Zheng Tuo, president of Shanghai Good Hope Equity Investment Management Co. "Some of the slowdown may have already been priced into equities and there's a big possibility of a double-dip for the economy."

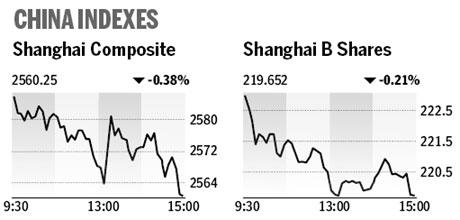

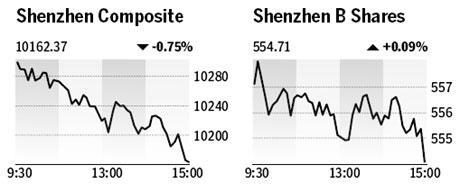

The Shanghai Composite Index dropped 9.70, or 0.4 percent, to 2560.25 at the close. The CSI 300 Index lost 0.6 percent to 2742.73.

The Shanghai gauge has dropped 22 percent this year on concern government measures to rein in housing prices and the European crisis will damp economic growth.

China's steelmaking industry was lowered to "neutral" from "overweight" by Shenyin & Wanguo analyst Zhao Xiange. Major steelmakers will have "slim" profit margins in the third quarter and the outlook for iron ore negotiations isn't optimistic, Zhao said in a report on Thursday.

Hebei Iron & Steel Co fell 1.2 percent to 4.02 yuan (59 cents). Maanshan Iron & Steel Co slid 1.2 percent to 3.42 yuan.

Jiangsu Hengrui Medicine paced declines for drugmakers, sliding 8 percent to 45.09 yuan and trimming its gain to 3.1 percent this year. Harbin Pharmaceutical Group Co tumbled 8.9 percent to 20.23 yuan, its biggest loss since September 2008.

A measure tracking health-care stocks slid 5.8 percent on Thursday, the most among the 10 industry groups of the CSI 300. It had advanced 9.3 percent in 2010 as of the end of last week.

Hang Seng gains

The Hang Seng Index rose 0.4 percent to 20138.40 at the close of trading. It increased 3.9 percent in the past seven trading days.

The Hang Seng China Enterprises Index of Chinese companies' H-shares advanced 0.2 percent to 11583.50.

Bloomberg News