HONG KONG - China ITS (Holdings) Co Ltd, a transportation infrastructure technology solutions provider, plans to raise up to $119 million in a Hong Kong initial public offering, according to a term sheet obtained by Reuters on Monday.

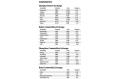

The company, in which Temasek owned about 5 percent ahead of the IPO, is selling 236.8 million shares, with an indicative price range of between HK$2.85 and HK$3.90 per share, the term sheet said.

Among the offered shares, 84.4 percent are primary and the rest secondary.

ITS also pledged other investors ahead of the IPO, including NWS Holdings Ltd China Merchants Securities Co Ltd, CCB International Asset Management Ltd, GE Capital, Intel Capital, Investor AB, Mizuho and Baring Private Equity Asia, a source close to the deal said.

BofA Merrill Lynch , CCB International and Macquarie Capital are bookrunners for the deal.

The company, which kicked off its IPO marketing roadshow on Monday, plans to price the deal on July 7, with trading scheduled to begin on July 15 under the symbol "1900".