Mutual funds investing overseas to spur inflows to emerging markets

SHANGHAI - China will boost the number of mutual funds that can invest overseas next year, spurring inflows into other emerging markets and slowing the yuan's appreciation, according to fund research companies Z-Ben Advisors and Howbuy.

The number of funds investing in global stocks and bonds under the qualified domestic institutional investor (QDII) program may reach 60 by the end of next year, compared with as many as 26 this year and nine in 2009, according to Shanghai-based Z-Ben.

"We should be expecting to see more QDIIs," said Andy Mantel, Hong Kong-based managing director of hedge fund Pacific Sun Investment Management Ltd. "They have huge potential and are building quality the right way."

The increase represents a turnaround for QDII, which was started in 2006 to help domestic money managers diversify their risks by investing abroad. Investors lost as much as half their money when the funds plunged during the global financial crisis, forcing the government to slow approvals, said Francois Guilloux, regional sales director at Z-Ben.

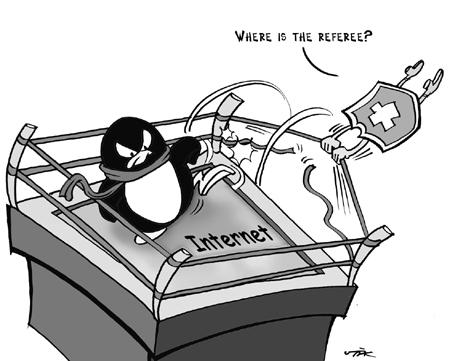

Netizens give QQ thumbs down

Netizens give QQ thumbs downChina's regulators had approved domestic fund management firms, brokerages and banks to sell a combined $64 billion QDII funds as of July. That is a tiny proportion of China's foreign-exchange reserves, which reached a record $2.65 trillion in September and has constantly prompted criticism from the United States for artificially undervaluing its currency.

Investment strategists at Bank of America Corp, Credit Suisse Group AG and Societe Generale SA have all said in the past two weeks that emerging-market stocks may climb above levels justified by companies' assets and earnings because of surging economic growth and US government efforts to reduce yields on debt securities. China International Priority Equity Fund has a return of 14 percent this year, the most among China's QDII funds, according to data compiled by Bloomberg. The fund is managed by a local venture with JPMorgan Asset Management.

"There's a growing demand from China's households to diversify their asset allocations and QDII funds have filled the niche as channels for domestic investment are still limited," said Yuan Fang, an analyst at Shanghai-based Howbuy, a data compiler for China's mutual fund industry. "It also helps to remove some pressure on the yuan."

Bloomberg News