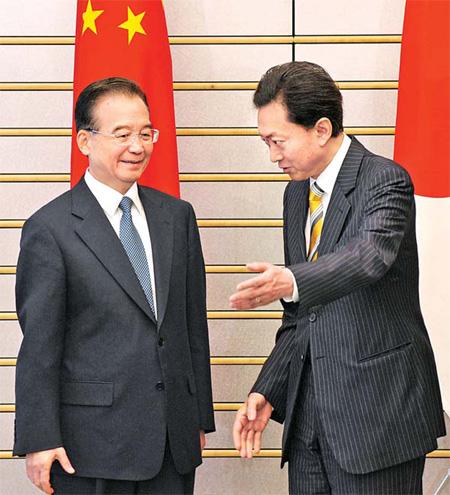

Japanese Prime Minister Yukio Hatoyama (right) welcomes visiting Chinese Premier Wen Jiabao before their talks at Hatoyama s official residence in Tokyo on Monday.[Agencies]TOKYO - Global economic growth remains vulnerable due to sovereign debt risks and the possibility of a second downturn, but China's growth is on track, Premier Wen Jiabao said on Monday.

Japanese Prime Minister Yukio Hatoyama (right) welcomes visiting Chinese Premier Wen Jiabao before their talks at Hatoyama s official residence in Tokyo on Monday.[Agencies]TOKYO - Global economic growth remains vulnerable due to sovereign debt risks and the possibility of a second downturn, but China's growth is on track, Premier Wen Jiabao said on Monday. "Some people say the global economy has already recovered, and we can now consider exit mechanisms. I believe that this judgment is premature," Wen told an audience of Japanese business executives on the second day of a three-day visit to Japan. The speech lasted for nearly one hour.

Unemployment in the United States and other economies as well as sovereign debt risks laid bare by Greece's crisis could all drag down the global recovery and trigger a second dip in growth, Wen said.

"Some people ask: Is there a possibility of a double dip in the world economy? I believe we can't say with absolute certainty so we must undertake close observation and act to prevent a double dip," he said.

"In these circumstances, all countries must coordinate in unity and strengthen policy support for the economy. There cannot be any relaxation on the issue," the premier said.

"To ensure that the (Chinese) economy continues growing in a steady and relatively fast pace, we must maintain a certain level of intensity in economic stimulus," he said.

China's economic growth reached 11.9 percent year-on-year in the first quarter.

In response to the spike in China's consumer price index (CPI), especially affecting low-income groups, Wen said Beijing is confident of cooling down the prices.

China's CPI rose 2.8 percent in April from a year earlier, nudging close to the target of keeping it within about 3 percent across the year. Market speculation is believed to have spurred the recent price hikes in rice, garlic, vegetables and green beans.

Despite the natural disasters this year, including a persistent drought in Southwest China, the country's grain output in the summer is still expected to be the same level as that of last year, Wen said.

"A special circumstance in the Chinese economy is that farm products account for a large part of the CPI," he said.

"If the price of farm products can be held in check, then so will the CPI."

The government has called for a control of prices, which shows that the inflationary expectation is quite strong, said Guo Tianyong, director of the China banking research center of the Central University of Finance and Economics.

"China's economy is in a very subtle scenario. On the one hand, we must prevent fast rising prices; meanwhile, we must keep alert against economic slowdown," Guo said.

"The Chinese economy is facing some uncertainties. If the prices continue to rise by, say, 3 percent or 4 percent, the central bank would have to raise the interest rates. But that would hurt the economy as a whole," he said.

Japan-based Nomura Securities, in a report released recently, said recent worries of a sharp economic slowdown in China - akin to that of 2008 - have been spurred by measures to tighten the property market and fears of contagion from the European fiscal crisis.

"We believe such worries are unjustified and reiterate our forecasts of real GDP growth of 10.5 percent in 2010 and 9.8 percent in 2011," it said.