BEIJING - The government has signaled that it will "gradually" levy tax on holding of property.

The tax, which is similar to a property tax in other countries, is expected to increase the cost of holding more than one apartment and help prevent speculation.

The State Council, China's cabinet, has approved guidelines on the systematic reform of the economy submitted by the National Development and Reform Commission, which included the clause "gradually push the reform of tax on holding of properties".

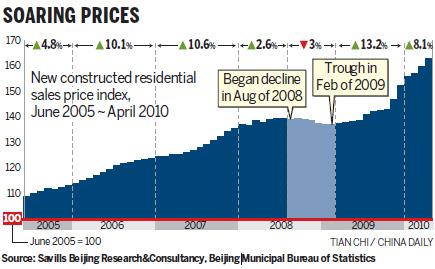

Speculative property holdings have been blamed for soaring home prices, which the government has tried to rein in through a series of measures.

China's key stock index fell 2.4 percent on Monday on concerns the new tax could hurt the real estate sector. The benchmark Shanghai Composite Index ended at 2,592.1 points, making it one of the worst performing in Asia, down 21 percent on the year.

A government source told China Daily that the tax would be levied on State-owned properties, starting with Wuhan, capital of Hubei province, on a trial basis.

Chen Qiwei, a spokesman for the Shanghai municipal government, said on Friday that the city is mulling rules on property tax, in line with the central government's policy. Earlier reports said that Beijing, Shanghai, Chongqing and Shenzhen will be the first cities to pilot property tax collection.

Sabrina Wei, head of research at property consultancy DTZ North China, said the property tax is largely aimed at increasing the fiscal income of local governments, thus reducing their reliability on land sale revenues.

Local governments' appetite for selling land at high prices to increase revenues is considered one of the major factors behind surging home prices.

"Though collecting property tax will help restrain property speculation, its real purpose is not to force real estate prices to fall," said Wei.

Nie Meisheng, president of the China Real Estate Chamber of Commerce, said defining the criteria for collecting the tax is "a hard nut to crack" because it needs millions of professional appraisers and a long time to assess the value of properties.

"The central government will probably issue guidelines and leave it to local governments to formulate detailed rules based on their specific markets," said Edmund Ho, managing director of DTZ North China.

However, the status quo may not change any time soon, analysts said.

Liu Shangxi, vice-director of the research institute for fiscal science affiliated to the Ministry of Finance, said differences among the public remain huge, which means the tax would not be levied soon.

The tax may generate 120 billion yuan ($17.6 billion) of revenues annually for governments, according to a report by Australia and New Zealand Banking Group Ltd.

The tax may be 0.8 percent of the market value of properties and be levied on people with multiple homes, beginning with the second home, ANZ economist Liu Ligang wrote in a note distributed on Monday. About 20 percent of China's real estate is owned by people with multiple properties, according to estimates by Liu.

Bloomberg contributed to this story.