China's top decision-making body on Friday pledged to maintain its pro-growth fiscal and monetary policies next year amid growing concerns that rising prices could create an asset bubble.

"We will maintain the continuity and stability of the macro-economic policy," Xinhua News Agency said, quoting the Political Bureau of the Communist Party of China (CPC) Central Committee.

The Political Bureau meeting, chaired by CPC Central Committee General Secretary Hu Jintao, on Friday used the exact wording - "active fiscal policy and relatively loose monetary setting" - which it adopted a year ago for its pro-growth policy.

The decision comes after Dubai's debt crisis, which came to light a few days ago, renewing worries that the global financial meltdown was not yet over.

The announcement is supposed to set the tone for the upcoming central economic work meeting, where next years' economic growth policies will be decided.

Jia Kang, director of the Research Institute for Fiscal Science, affiliated to the Ministry of Finance, said the message from the meeting was that China would not adopt the exit strategy now. Instead, the policies would be "adjusted" according to the demand of different sectors.

The meeting also said there was a need to make the policies more flexible, especially to change the GDP growth's focus from quantity to quality.

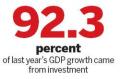

Many economists have been criticizing the country's imbalanced and unsustainable nature of growth, which is driven by high investment, heavy industry and exports.

Analysts and investors had been looking closely at the meeting for clues of policy changes because the government's $586-billion stimulus package had succeeded in boosting growth and helping overcome the impact of the global downturn.

"I think it may be a prelude to exit strategy. The economic policies need to be changed gradually instead of a sudden reverse," said Han Qi, a professor of Chinese economy at the University of International Business and Economics.

Liu Junyu, China Merchants Bank macroeconomics analyst, said that the government might switch to neutral wording on economic policies in mid-2010, and its exact timing would depend on the strength of the recovery against the risks of bad loans, asset bubbles and resurgent inflation.

"We believe the government will maintain the pace of bank lending, although it may not be as massive as this year's," Liu said. The total lending next year could be between 6 and 8 trillion yuan.

Morgan Stanley analyst Wang Qing believes it is too early for the country to adopt tightening measures because the recovery is still in the early stage and there are still a lot of uncertainties.

Wang said he feared a slump in China's stock market after Dubai's attempt to reschedule its debt amid signs of fragile market sentiment.

The Shanghai Composite Index fell 74.72 points, or 2.4 percent, to close at 3,096.27 on Friday, sending the benchmark index to its biggest weekly loss of 6.4 percent in three months.

Earlier this week, a year after the global downturn derailed Dubai's explosive growth, the city's main investment arm, Dubai World, said it would seek at least a six-month delay on paying back its $60-billion debt.

Dubai's debt crisis may not stall China's economic recovery, but it is a timely warning for the government, which has been "lending a lot to State-owned enterprises at low interest rate", Liu said.