An employee checking containers for shipment at Yangluo Port in Wuhan, Hubei province. [China Daily]

Full-year figures set to remain insurplus, despite March deficit

BEIJING: China's full-year trade balance will still be in surplus and there is nothing to be alarmed about the figures turning into a deficit in March, economists said on Wednesday.

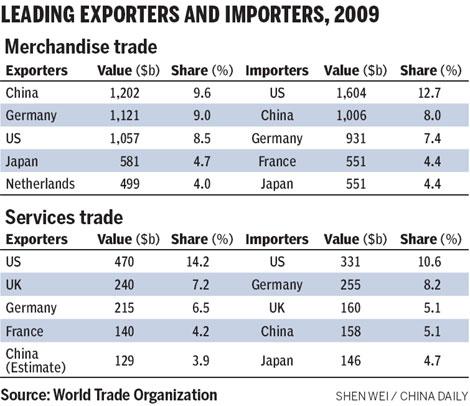

The nation in 2009 surpassed Germany as the second largest importer in the world after the United States, according to a recent report from the World Trade Organization.

That in turn also explains the reason for the March deficit to some extent.

The surging imports may helped China to register a trade deficit in March, Premier Wen Jiabao and Minister of Commerce Chen Deming said last week. It would also mark the first monthly deficit in the past six years.

The March deficit will also to some extent reduce the heat that China faces from other nations, led by the United States, to revalue the yuan.

But the nation will still face pressures on this front, as the deficit is albeit only a temporary phenomenon, said the economists.

Many US politicians have of late been pressuring the Barack Obama administration to label China as a currency manipulator and have also threatened the use of punitive measures on China's exports.

China has been a major victim of these trade measures, such as anti-dumping duties, in the past 15 years, and incurred losses of $30-$40 billion so far, said a report by the Ministry of Commerce.

China is scheduled to release its trade figures for March on April 10. The nation's trade surplus has plummeted by over 50 percent in the first two months of the year.

"Considering the price hikes on many categories of imports and the still weak exports, there are high chances that the nation imported more goods than it exported in March. But the trade deficit cannot be that big and it will not last long," said Dong Xian'an, chief macroeconomic analyst of Shanghai-based Industrial Securities.

"There would be a trade surplus for the whole year. It may be a tad lower at around $137.5 billion this year," Dong said.

Last year, China reported a trade surplus of $196.1 billion, down 33.7 percent from $295.5 billion in 2008.

China's monthly trade surplus dropped to $7.6 billion in February from $24 billion in October 2009. Moreover, in terms of services trade, China suffered a deficit of $29 billion last year.

"While the continued fall in the trade balance is a positive sign in terms of correcting global imbalances, we are not sure whether a deficit can be sustained in the coming months," said Barclays Capital China in a report.

"For 2010, our forecast calls for the trade balance to fall to $186 billion, but the latest development suggests some downside risks."

From January to February, China imported record high volume of resource-related commodities, such as copper, iron ore and crude oil. "Actually, the commodity import boom had waned since late last year, but there are signs of revival now as imports are needed to feed stimulus projects in the first quarter," said Jinny Yan, an economist with Standard Chartered Shanghai.

The strong demand is likely to continue into the second quarter of this year also. That in turn, could lead to a decline in the trade surplus, but it is not something that would be sustainable in the medium term, they said.

In March, crude prices rose nearly 50 percent from a year earlier, while iron ore soared by over 10 percent in the same period.

Developed nations represented by the US recently saw a rebound in domestic consumption and job creation. With China's import growth likely to falter later this year, there is no doubt that it will still end up with a trade surplus in 2010.

Another factor that could aid the trend is the fact that Chinese manufacturers still have a strong competitive edge globally. "China can record rapid growth in exports and maintain its leading edge for a long time," said Ma Yu, senior researcher from the Trade Research Institute of the Ministry of Commerce.