BEIJING China has overtaken Japan to become the world's second-largest economy, the fruit of three decades of rapid growth that has lifted hundreds of millions of people out of poverty.

Migrant labourers work at a construction site for a railway in Shanghai July 27, 2010. [Agencies]

Migrant labourers work at a construction site for a railway in Shanghai July 27, 2010. [Agencies] Depending on how fast its exchange rate rises, China is on course to overtake the United States and vault into the No.1 spot sometime around 2025, according to projections by the World Bank, Goldman Sachs and others.

China came close to surpassing Japan in 2009 and the disclosure by a senior official that it had now done so comes as no surprise. Indeed, Yi Gang, China's chief currency regulator, mentioned the milestone in passing in remarks published on Friday.

"China, in fact, is now already the world's second-largest economy," he said in an interview with China Reform magazine posted on the website (www.safe.gov.cn) of his agency, the State Administration of Foreign Exchange.

But China'a per-capita income of about $3,800 a year is a fraction of Japan's or America's.

"China is still a developing country, and we should be wise enough to know ourselves," Yi said, when asked whether the time was ripe for the yuan to become an international currency.

Can it be Sustained?

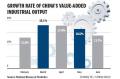

China's economy expanded 11.1 percent in the first half of 2010, from a year earlier, and is likely to log growth of more than 9 percent for the whole year, according to Yi.

China has averaged more than 9.5 percent growth annually since it embarked on market reforms in 1978. But that pace was bound to slow over time as a matter of arithmetic, Yi said.

If China could chalk up growth this decade of 7-8 percent annually, that would still be a strong performance. The issue was whether the pace could be sustained, Yi said, not least because of the environmental constraints China faces.

If China can keep up a clip of 5-6 percent a year in the 2020s, it will have maintained rapid growth for 50 years, which Yi said would be unprecedented in human history.

The uninterrupted economic ascent, which saw China overtake Britain and France in 2005 and then Germany in 2007, is gradually translating into clout on the world stage.

China is a leading member of the Group of 20 rich and emerging nations, which since the 2008 financial crisis has become the world's premier economic policy-setting forum.

However Yi said Beijing had no timetable to make the country's currency to be freely exchanged.

"China is very big and its development is unbalanced, which makes this problem much more complicated. It's difficult to reach a consensus on it," he said.

China was in no rush to turn the yuan into a global currency.

"We must be modest and we still have to keep a low profile. If other people choose the yuan as a reserve currency, we won't stop that as it is the demand of the market. However, we will not push hard to promote it," he added.

No Big Rise in Yuan

China has been encouraging the use of the yuan beyond its borders, allowing more trade to be settled in renminbi and taking a series of measures to establish Hong Kong as an offshore center where the currency can circulate freely.

But Yi said: "Don't think that since people are talking about it, the yuan is close to becoming a reserve currency. Actually, it's still far from that."

He said expectations of a stronger yuan, also known as the renminbi, had diminished. There was no basis for a sharp rise in the exchange rate, partly because the price level in China had risen steadily over the past decade.

"This suggests that the value of the renminbi has moved much closer to equilibrium compared with 10 years ago," he said.

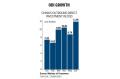

China scrapped the yuan's 23-month-old peg to the dollar on June 19 and resumed a managed float. The yuan has since risen 0.8 percent against the dollar.

China would stick to the principle of holding its $2.45 trillion of official reserves in a mix of currencies and assets.

The stockpile - the world's largest - was so big that it was impossible to adjust its currency composition in a short space of time: "We won't be particularly bearish on the dollar at a given time or particularly bearish on the euro at another time."