BEIJING - A senior member of an influential government think-tank said on Friday that China's inflation could rise to near 6 percent during the first quarter of next year, but Liu Mingkang, chairman of the China Banking Regulatory Commission, said the nation will still be able to control it.

Liu Shijin, deputy director of the high-profile Development Research Center under the State Council, said at the Caijing Annual Conference in Beijing that the index will not exceed 6 percent and also said the peak is likely to be hit during the first quarter of 2011.

"After that, it will drop gradually," Liu Shijin predicted.

Liu Mingkang, who is also a member of the central bank's monetary policy committee, said, overall, inflation next year will not be a serious problem for the nation's policymakers. "It will be controlled at a relatively reasonable level," he said.

Liu Mingkang said a slew of measures taken so far to combat rising consumer prices have generated positive market reactions.

"In addition, unlike the inflation peak period in the past, this time, supply of the majority of industrial products will outweigh demand," which will help reduce inflationary pressure, he said.

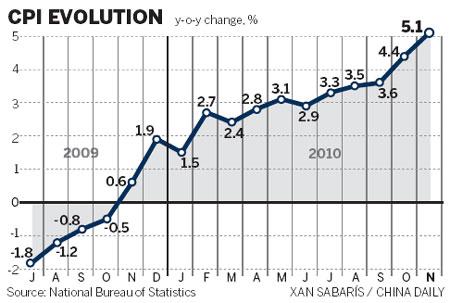

China's consumer price index (CPI), a key gauge of inflation, rose by 5.1 percent year-on-year in November, marking the fastest clip in 28 months. It was mainly driven by surging food and residential prices, the National Bureau of Statistics said on Dec 11.

Despite Liu Mingkang's optimism, some observers expect inflation to be an issue.

"The biggest risk facing the Chinese economy will still be inflation (next year)," said Deutsche Bank's Greater China Chief Economist Ma Jun.

The monetary easing policies taken by major world economies, including the United States, have led to increasing capital flows into emerging markets, which is pushing up inflation.

Analysts said excessive liquidity is the main contributor to China's white-hot price surges. To cage the inflation tiger and stabilize economic growth, the government has put suppressing inflation at the top of its agenda for 2011 while shifting its monetary stance to "prudent" from "moderately easy".

But those measures may not be enough, said Ma of Deutsche Bank. He said China should further tighten the new credit target for next year to prevent inflation from spiraling out of control.

"If the new loan target stays at 7.5 trillion yuan (the pre-set 2010 target), it will be too difficult to keep the annual CPI increase over the whole year below 4 percent."

The National Development and Reform Commission said earlier that the nation has set a target of 4 percent for CPI growth next year.

Ma suggested that the government should reduce the growth rate target of M2 - the broad measure of money supply that includes cash and all types of deposits and indicates the amount of general liquidity - to 15 percent. It should also keep new yuan loans below 6.5 trillion yuan and increase interest rates by as much as 150 basis points in 2011.

China's M2 growth was 19.5 percent at the end of November while its new yuan lending will be close to 8 trillion yuan for the whole of this year. It raised the benchmark one-year savings rate to 2.5 percent in October.

Liu Mingkang said he is confident that China will achieve a soft landing as its growth rate gradually slows following its double-digit annual growth earlier this year. Growing speculative capital inflows, however, will put policymakers from emerging economies to the test.