A host introduces one of nine ancient bronze relics returned to China from abroad during a show in Beijing on Mar 20. The set cost a total of 300 million yuan to buy at auction. [Photo / Provided to China Daily]

Chinese nouveau riche join the hunt for 'safe' status symbols. Cheng Yingqi in Beijing reports.Could you spend $82 million in just 16 minutes?

One Chinese antique collector did last month with a winning bid at a London sale for an 18th-century Chinese vase.

The Qing Dynasty (1644-1911) vase that fetched $82 million. Provided to China Daily

With a price tag fit for a painting by Vincent van Gogh or Pablo Picasso, the delicate 16-inch ornament became one of the most expensive artworks in the world."The room was packed with dealers from everywhere, but most were Chinese," recalled Peter Bainbridge, part owner of Bainbridge's, which auctioned the vase on Nov 12. "When I banged the hammer (to start the sale), the room was alive with excitement."

The artwork is the latest in a raft of relics that have returned to China thanks to big-money bids by the nation's nouveau riche.

Yet, although patriotism is playing a part in this hunt to recapture looted treasures, experts say the majority of buyers are in fact more interested in the investment potential of ancient works - and the glamour.

"Buying looted artwork has become high-street fashion among China's elite, especially in the past year," said Zhao Xu, director of Poly International Auction Co Ltd.

No official figure exists for the number of looted artworks bought back by rich Chinese, yet industry insiders say the market is booming.

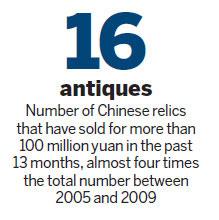

In the past 13 months, at least 16 Chinese antiques have sold for more than 100 million yuan ($14.9 million) at domestic and overseas auctions - almost four times the total number between 2005 and 2009.

"As artworks inside China are rare, more are setting their sights on looted artwork abroad," explained Zhao.

Artifacts seldom go under the hammer on the Chinese mainland, with most already on display at museums nationwide.

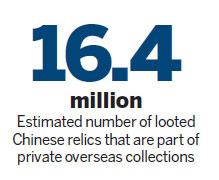

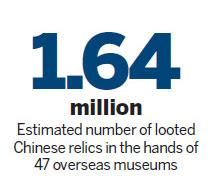

However, estimates suggest that as many as 1.64 million looted Chinese relics are in the hands of 47 overseas museums, with another 16.4 million owned by individuals, according to a Xinhua News Agency report in 2009 that cited statistics from the United Nations Educational, Scientific and Cultural Organization.

"Exports of antique have been restricted since 1949, but before that some businesses and aristocracy in the Qing Dynasty (1644-1911) shipped large numbers of antiques overseas," said Sun Jie, marketing director of China Guardian Auctions.

As China's economy has continued to flourish in the last decade, buyers have increasingly looked abroad for lost treasures, particularly in the United States and throughout Europe.

Sun Haifang began his mission to recover 33 Tang Dynasty (AD 618-907) celadon terracotta warriors in 2001 after learning they had been illegally sold to a Hong Kong entrepreneur.

After getting the buyer's phone number, the mainland collector called and managed to negotiate an initial 250-million-yuan deal for 18 warriors. To get the remainder took six years and another 500 million yuan.

Today, all 33 are on display at Sun's private museum in Shaoxing, Zhejiang province.

"Looking for Chinese antiques abroad is nothing new but it has become more heated (in recent years) and is attracting a lot of entrepreneurs to join the game," said auction house boss Zhao. "A lot of money is being spent."

Sun added that more than 80 percent of collectors in China are bidding for work related to traditional Chinese culture, such as ceramics, painting and calligraphy.

Visitors look at an ancient bronze relic at a Beijing exhibition in March. The item is one of the 300-million-yuan bronzeware bought back from abroad. [Photo / Provided to China Daily]

Break from traditionMainlanders are now leading the market for Chinese relics, with the majority of buyers from banking, manufacturing and real estate backgrounds, say industry experts.

Although there is no reliable figure on the number of collectors, it is believed their ranks have steadily swelled in the last two years.

"Traditional buyers of Chinese art were from Hong Kong, Taiwan and the US until 1999, with a few people from Chaozhou (an ancient city in Guangdong province) and Shanghai," said Nicolas K.S. Chow, vice-chairman of Sotheby's Asia and international director of Chinese ceramics and artwork.

"This spring, more than 50 percent of buyers at our Hong Kong auctions were from the mainland," he said. "Add the Hong Kong dealers acting on behalf of (mainland) buyers and it's fair to say mainlanders took up 70- to 80-percent (at auctions) in the past year."

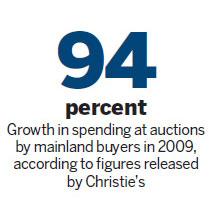

Statistics released by Christie's, another global auction house, show the spending of mainland buyers grew 94 percent in 2009.

However, as many investors entering the market are laymen when it comes to antiques, professional agents are cashing in on the demand for their expertise and services.

Yang Yufeng, a specialist who founded Beijing's Zhilan Yaji art salon, said an agent can charge "millions of yuan" for successfully bidding on a rare treasure.

It was an agent negotiating for a mystery client on the phone who snapped up the 18th-century vase in November. Bainbridge's refused to reveal the name of the winner, although they confirmed he was from the Chinese mainland, probably Beijing.

The ornament, which was made during the Qing Dynasty (1644-1911) under the rule of Emperor Qianlong, is hollow and contains a smaller vase inside that turns independently.

Antique fans look at the scroll oil painting of the Yangtze River at a retrospective exhibition of contemporary artist Wu Guanzhong at Zhejiang Art Museum in Hangzhou on Nov 20. [Photo / China Daily]

But is it worth $82 million?"The vase requires exquisite workmanship. I've not seen such a good vase from the same period in China," said Liu Shangyong, general manager of Rongbao Auction Co in Beijing. "This trumps all other Qianlong vases."

Ma Weidu, owner of Guanfu Museum in Beijing, is not so sure.

"I think the bidders went to London harboring the thought the auction would not be so fierce because the auction house is not famous and the promotion was not high profile," he said. "When they arrived, they were too afraid to lose face in front of (their rivals) and bid higher and higher until it hit $82 million."

Yet, the price could also be a reflection of the shift in bidders from traditional collectors to speculators. To tell them apart, Liu suggests observers time how long it takes to go back under the hammer.

"Collectors don't sell quickly but if you see a piece at auction only two or three years after it was last bought, it's probably a case of hot money driving up the price," he said.

A scroll oil painting of the Yangtze River by contemporary artist Wu Guanzhong sold for about 38 million yuan at a 2006 auction in Beijing, yet this summer went back on the block and attracted a winning bid of 57 million yuan.

The turnaround can be even quicker. In the spring of 2008, a Taiwan trader bought four flower-bird paintings by contemporary artists Yan Bolong in Tianjin for 500,000 yuan and resold them in Beijing just six months later for 2 million yuan.

"The market has seen fast development in recent years and we're expecting consistent growth in the future," said Sun at China Guardian Auctions. "The return from investments in artwork is promising."

Sale of the centuries

The global economic crisis did not only strike down some of the world's biggest financial institutions, it also shook investors faith in the traditional markets, such as property and gold. Enter the art market.

"In a sense, art (and antiquities) started to look relatively safer for emerging Chinese entrepreneurs, as long as the works were authentic," said Wang Dingqian, president of My Humble House, a Taiwan antique dealers.

The price gap between relics from the reigns of emperors Qianlong (1735-95) and Yongzheng (1722-35) is a good example of the impact of hot money. Although experts believed first-class chinaware from Yongzheng's rule is more exquisite, Qianlong items attract high prices.

Yongzheng was on the throne for only 13 years, while Qianlong ruled for 60 years, "so less chinaware was produced under Emperor Yongzheng," explained Liu at Rongbao.

"The limited number puts constraints on the total value of Yongzheng chinaware in circulation," he said. "People are naturally inclined to turn to bigger markets and, consequently, without hot money driving up the price, (items) does not reach the same prices as Qianlong chinaware."

Wang also said he believes the growing influence of mainlanders at auctions is in step with the country's economic development, and that a nation's financial clout determines the depth of its collectors' pockets.

The market for Chinese art, including calligraphy, oil painting and chinaware, started to expand in 2003 amid decline in the domestic stock and stamp market and roaring international gold prices. That year, the country's per capita GDP was $1,090 and cultural consumption volume was 580 billion yuan. Today, those figures have risen to about $3,100 and 700 billion yuan respectively, according to data published online by the Ministry of Culture.

In 2005, a blue and white porcelain pot from the Yuan Dynasty (1271-1368) went for 230 million yuan at a Christie's auction, the first time a Chinese piece had sold for more than 100 million yuan.

"The price of Chinese artwork has been low for a long time because Chinese people used to be poor," said Wang. "The price hike is a signal of China's growing economic force, especially post-financial crisis.

"In the past, Western people bought more chinaware, so we went abroad to buy antiques. Now Chinese people are buying more the auction houses are coming to us."

Auctions for chinaware before 2000 were primarily held in Europe and the US but are now in Hong Kong, while sales of ancient Chinese paintings and calligraphy have slowly shifted to the Chinese mainland.

Sotheby's now hosts exhibitions twice a year in Beijing and Shanghai to introduce the world's art masters, such as Van Gogh and Picasso, to the mainland audience.

"It's a long-term plan," added Sotheby's executive Chow. "I believe that when China's nouveau riche want to buy art, they will buy the classics."