While the economic downturn has put some venture capitalists in the doghouse, figuratively speaking, one investment fund for a Chinese website catering to pet lovers has raised more than $10 million.

The fund, initiated by a cooperative including International Data Group, SoftBank and Alibaba Group, boosted Aigou.com (for "love dogs" in Chinese) to China's largest pet website in terms of registered users.

People close to the deal said the investors plan to ramp up promotion of Aigou.com within a few years. The site was established in 2006.

Investors' enthusiasm for Aigou.com is for its content, as the pet industry in China has not only escaped the economic slowdown largely unscathed, but also looks poised for a continued upswing.

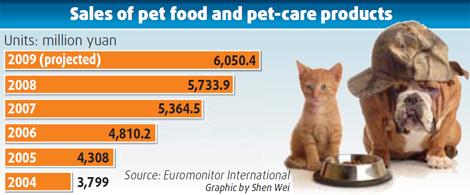

Chinese consumers spent 5.73 billion yuan on pet food and pet-care products in 2008, a 6.9 percent increase over the previous year, according to Euromonitor International.

The global market research and consulting company predicted the market will rise 5.6 percent in 2009, to 6.05 billion yuan.

Although the growth rate this year is a slight decline over last year's rate, China's consumers remain loyal to their pets and the market.

Lifestyles fuel trend

Chinese people's ever-increasing affection for their dogs, cats, fish, birds, rabbits, miniature pigs and other pets has been stimulated by an increase in household disposable income in recent decades.

Analysts also found that changing lifestyles, notably the strong growth in the number of small and single-person households, represents a significant counterweight to the current economic climate.

Pet ownership also counteracts the weakening of traditional social networks and helps owners combat loneliness, they added.

Fang Weiwei, 29, has lived in Beijing with her cat, Chouchou, for five years.

"I take care of her like a baby," said Fang, a public relations manager. "She is my anchor in my busy work and in my loneliness without a boyfriend."

Fang and Chouchou are hardly a rarity in China's big cities. There are about 100 million pets across the country, and that number is expected to rise, according to Nestle SA, a major manufacturer of pet food.

The trend is helping the sellers of pet food and pet-care products, especially international corporations, to continue their development in China and buck economic trends; while many consumers are trading down to less-expensive goods for themselves to save money, they refuse to pinch pennies as they lavish their attentions on Buddy and Fifi. As a result, premium products are seeing sales increases.

Declining sales of lower-priced products might largely be a result of rising unemployment among lower-income households in China. Those people have usually chosen economical products for their pets.

Collapsing export demand has resulted in the closure of many factories in the country's more economically developed coastal provinces, forcing millions of migrant workers to return home from cities such as Shanghai and Shenzhen.

With more laid-off workers who have less money, the socioeconomic patterns of pet ownership are changing. Marginal consumers are abandoning packaged pet food products entirely, analysts said.

The annual household disposable income in China is forecast to grow just 4.1 percent in 2009, the worst performance in a decade, compared with 8.4 percent last year, according to the Blue Book on Chinese Society issued by the Chinese Academy of Social Sciences.

On the other hand, the rise in smaller households, particularly the single-person households and dual-income, no-kids - or so-called DINK - families, has increased the demand for pets.

Attitudes have changed, with pets regarded more as family members than as working animals, especially among young urban residents.

They are able and willing to indulge their pets with premium food and other products.

According to the China Small Animal Protection Association, annual spending per pet in China was about 3,000 yuan on average in 2008. The expenditure was more than 6,000 yuan per pet in five key cities - Beijing, Shanghai, Guangzhou, Chongqing and Wuhan, that are the hubs of single-person and DINK households.

In Beijing alone, spending on pets exceeded 2 billion yuan last year.

The figure includes food and care products, veterinary care, grooming and recreation.

Pet food and care producers are competing to cash in on a market with huge potential, and the international manufacturers have a competitive edge over domestic companies, thanks to their research and development and investment in brand building.

In keeping with the fixation on "luxury" pets, the owners of such animals generally prefer international brands, which are perceived to be healthier and more nutritious.

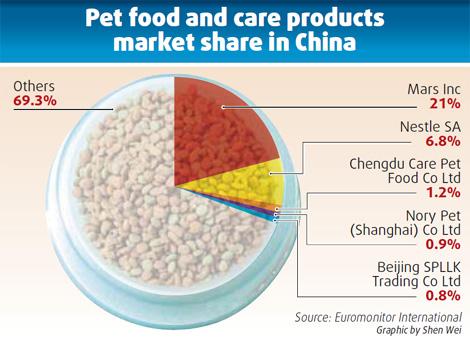

The Euromonitor survey showed that US-headquartered Mars Inc and Switzerland-based Nestle SA held 21 percent and 6.8 percent of China's pet food and care products market last year, respectively. The third largest - the Sino-UK joint venture Chengdu Care Pet Food Co Ltd - commands 1.2 percent of the market.

Nestle established its first pet food manufacturing facility in China in Tianjin in February 2007, with an initial investment of 80 million yuan.

The company's Purina subsidiary holds 24.5 percent of the global pet food market. The company started selling pet food in China in 2003 and the Tianjin plant, producing dog food under the Pro Plan and Dog Chow brands and Friskies cat food, enabled Nestle to meet market demand in China more efficiently and with lower costs.

The company estimated there are more than 100 million pets in China, and the number is expected to reach 150 million by 2010.

Ownership boom forecast

The potential in China is still huge, considering that Americans own 80 million dogs, and Japanese 20 million.

Only 5 percent of owners in key cities feed their pets packaged food, while the figure is 80 percent in the US.

Chinese consumers spent 5.73 billion yuan on pet food and pet-care products in 2008, a 6.9 percent increase over the previous year. [China Daily]

Chinese consumers spent 5.73 billion yuan on pet food and pet-care products in 2008, a 6.9 percent increase over the previous year. [China Daily]

In previous years, most Chinese pet owners fed their pets non-industrially prepared pet food. However, a marketing and consumer education push is paying off for manufacturers, as more pet owners appreciate the benefits of nutritionally balanced pet food.

More pet owners are also giving their animals dietary supplements such as calcium and multivitamins.

Differentiating their products has been a challenge for manufacturers, especially in midpriced and economy-brand pet foods, where differences in quality and in unit prices tend to be small.

Manufacturers are striving to distinguish their products in terms of ingredients and added-value features.

Milk formula, for example, is being introduced into dog and cat food. In early 2008, Effem, a snack and pet food subsidiary of Mars Inc, updated its dry dog and cat food formula under its core brands Pedigree and Whiskas. Both Pedigree Puppy Bites and Whiskas Dry Kitten Food include milk formula, which the company says provides the supplementary calcium necessary for the healthy growth of puppies and kittens.

The company has marketed the two products as balanced nutritional meals for dogs and cats, backed by in-store promotions in key cities such as Shanghai and Beijing.

French pet food and care expert Royal Canin reclassified its product portfolio, developing a line of cat food it says is beneficial for health and fur.

Its Royal Canin Hair & Skin 33 has added soybean oil and omega-3 fatty acid, ingredients the company says improve skin health for humans.

The trend of incorporating human-use ingredients is expected to continue in pet foods. Concepts such as enhancing a pet's immune system or beautifying its skin have already been recognized by many Chinese consumers, and will increasingly be applied in pet food products over the forecast period, the Euromonitor report said.

Fang is a loyal consumer of Royal Canin. She has chosen various brands for Chouchou, since the cat came to her home five years ago.

"Chouchou prefers the French brand," she said. "Though Royal Canin is a little more expensive than others, I don't care, as long as Chouchou likes it."

The rising cost of raw materials, labor, production and transportation drove up pet food prices in 2008. Foreign companies, in particular, have increased the price of their products.

According to trade sources, the average monthly spending on pet food will increase by 20 yuan as a result.