BEIJING - The potential of the Chinese micro-credit market has attracted the attention of private capital searching for higher rates of return, and provides business opportunities for micro-finance service companies.

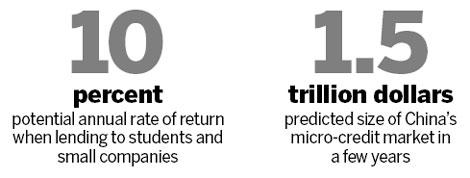

"The scale of China's micro-credit market will reach more than 10 trillion yuan ($1.5 trillion) during the coming years, and we see huge business opportunities in the micro-finance service industry," Tang Ning, chief executive officer of Beijing-based financial service company CreditEase Business Consulting Co Ltd, told China Daily in an exclusive interview.

Along with the government's plan to accelerate the development of the service sector, the number of small private companies requesting access to investment capital will soar, said Tang. "The key is to help them find appropriate money lenders."

CreditEase has launched a peer-to-peer (P2P) referral engine on its website to help under-funded graduate students and poor farmers receive micro loans to start their own businesses. Individual lenders can select borrowers on the company's P2P platform, according to those borrowers' registered information, including extensive proof of income and living costs.

The average annual rate of return for lending money to farmers in rural areas is 2 percent, while that of students and urban small companies can be as high as 10 percent. Creditors can provide loans as small as 100 yuan, Tang said. "The core of credit-finance services is risk management. CreditEase has maintained a default rate below 2 percent," he said.

All borrowers are subject to extensive independent background checks, and the invested funds are diversified into different brackets, which allows the company to accurately measure and control risks. In addition, the company launched a risk fund to cover losses when debtors pay late or default.

Compared with the central bank's benchmark one-year saving rate, the micro-credit service provider offers relatively higher investment returns.

CreditEase has partnered with four local micro-finance institutions in China to increase its rural market coverage. It also partnered with more than 50 educational institutions to introduce financial services to students.

Kleiner Perkins Caufield & Byers, an international venture-capital company, has injected capital into CreditEase, eyeing the fast-growing Chinese micro-finance market.

According to a report from China e-Business Research Center, Internet financial services have helped issue micro loans totaling more than 7.5 billion yuan for small- and medium-sized businesses in the first half of the year. The total amount of loans for 2010 is expected to be about 13 billion yuan.

Micro credit is an efficient tool to provide solid funds for those on low incomes and to improve their quality of life, and allows financial institutions to balance corporate social responsibilities with profitability, Tang said.

Du Xiaoshan, vice-director of the Rural Development Institute at the Chinese Academy of Social Sciences, said that the micro-credit industry in China is at the early stage, and lacks supporting policies from the government.