China's export growth accelerated in November in a possible sign global demand is recovering, government figures showed Friday.

China's export growth accelerated in November in a possible sign global demand is recovering, government figures showed Friday. Exports jumped 34.9 percent from a year earlier to $153.3 billion, boosted by a surge in sales to other developing economies, which are recovering faster than the United States and Europe from the global crisis.

That was up sharply from October's 22.9 percent growth and surprised private sector analysts, who had forecast growth of about 25 percent.

"It suggests there is surprising resilience in global demand and some room for optimism," said Royal Bank of Scotland economist Ben Simpfendorfer.

But he cautioned that November trade, especially with developed economies, was unusually strong because retailers were placing Christmas orders later than usual. "A single month's figure is not enough to assume global demand is bouncing back."

China's imports also grew strongly, rising 37.7 percent to $130.4 billion, up from October's 25.3 percent growth. That was driven by Chinese demand for iron ore and other raw materials from developing economies but imports from the United States and Europe also rose.

The figures appeared to support expectations of a "two-speed recovery," with developing economies in Asia, Latin America and elsewhere rebounding quickly while the United States and Europe struggle to keep up growth. The International Monetary Fund says Asian economies should grow 7.9 percent this year, compared with 4.2 percent for the global economy.

"External demand is recovering steadily," said JP Morgan economist Qian Wang. "We see most of the emerging markets having a very decent rebound."

China's expansion slowed to 9.6 percent in the three months ending in September, down from a post-crisis peak of 11.9 percent in the first quarter.

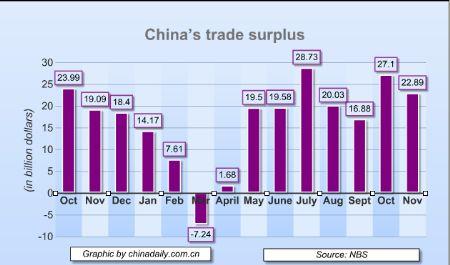

China's trade surplus widened to $22.9 billion in November, up 15 percent from $19.9 billion in October 2009. The surplus with the United States was $16.8 billion while that with Europe was $13.6 billion.

China's yuan was largely unchanged against the dollar during November, rising from 6.69 to 6.67 to the dollar, which along with the wider surplus is likely to add to criticism of China's currency policy from US lawmakers who say Beijing is keeping the yuan artificially low to boost exports.

The United States and Europe remained by far China's biggest trading partners in November but their demand growth lagged far behind that of Russia, South Africa and some other emerging markets.

China's exports to Russia rose 72.7 percent over a year earlier, while exports to South Africa grew 48 percent. By contrast, exports to the United States rose 29.5 percent and those to Europe grew by 33.3 percent.

Some analysts expect average growth in China, India and other emerging markets to be triple that of developed economies next year, making them an important engine for growth in global demand.

Strong imports reflected China's appetite for oil, iron ore and other raw materials. Its purchases from Australia and South Africa, both major miners, grew 55.4 percent and 64.1 percent, respectively.