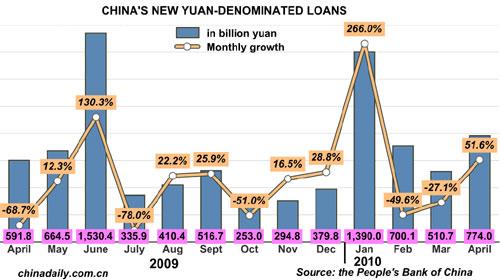

China's April new yuan loans rose to 774 billion yuan ($113.37 billion) from March's 510.7 billion yuan, the People's Bank of China announced today.

Special Coverage:China Biz & Economic StatisticsIt was also an increase of 182.2 billion yuan from the same period last year, according to the statement published on its website.

The April figure brought new loans in the first four months to more than 3.37 trillion yuan, nearing half the total of 7.5 trillion yuan China has targeted for the full year.Analysts said the amount of new lending in April was above market expectations but was still reasonable.Ding Zhijie, a professor at the University of International Business and Economics in Beijing, said the April loan figure reflected China's real economy was still on track for a good recovery and private investment was on the rise.He expected the pace of bank lending would continue to even out as required by the country's banking regulator, after banks lent 1.39 trillion yuan in January this year and a record 9.59 trillion yuan last year.To mop up excessive cash in the market, the central bank has raised the deposit reserve requirement ratio for most financial institutions three times this year amid growing pressure caused by inflation and property price increases.

China's consumer price index (CPI), a main gauge of inflation, picked up at faster rate in April rising 2.8 percent year on year. Home prices in 70 large and medium-sized cities increased 12.8 percent last month, a record high since 2005.Tang Min, vice secretary-general of China Development Research Foundation, said the tightening policy on the property market, unveiled in April, had not affected lending much yet. However, he expected a decline in credit in May.

The country's M2, or the broad measure for money supply that includes cash and all types of deposits, grew 21.48 percent year-on-year in April, down from 22.5 percent year-on-year growth in March, the central bank said.

The country's M1, or the narrow measure of money supply, which covers cash in circulation plus current corporate deposits, accelerated 31.25 percent year-on-year in April. The gowth rate was 1.31 percentage points higher than that in March.