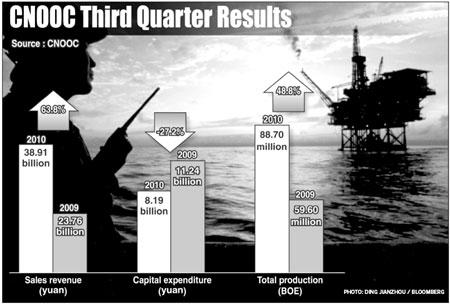

Oil exploration firm CNOOC Limited reported on Thursday that its unaudited revenue for the third quarter rose to 38.91 billion yuan ($5.79 billion) from 23.76 billion yuan a year earlier, a surge of 63.8 percent.

For the first nine months to end September 2010, unaudited revenue accumulated to 107.23 billion yuan, up 88.8 percent compared with the same period last year.

CNOOC attributed the rise in revenue to an increase in net production and higher oil prices.

The company achieved total net production of 88.7 million barrels of oil equivalent (BOE) in the third quarter, an increase of 48.8 percent year-on-year.

CNOOC said the increase in net production was due to new fields which came on stream in 2009, better-then-expected performance of existing fields, less impact from typhoons, and the contribution from newly acquired projects in Argentina and offshore China.

Looking ahead, CNOOC Chief Financial Officer Zhong Hua said that with the company's newly acquired projects in Bozhong, Luda and Weizhou having started production, the company forecasts that its 2010 net production may achieve 319 to 329 million BOE, exceeding its original target by about 10 percent.

During the period, the company's average realized oil price increased 9.3 percent year-on-year to $74.15 per barrel. Meanwhile, the realized gas price was $3.96 per thousand cubic feet, very similar to the previous year.

CNOOC's capital expenditure, however, tumbled 27.2 percent year-on-year to 8.19 billion yuan, mainly due to a combination of cost savings, a delay in certain projects and the intensive workload scheduled for the fourth quarter of this year.

Zhong reiterated that many exploration and production projects will commence in the final quarter, so the company remains committed to its own forecast of 22.6 billion yuan in capital expenditure.

And with oil prices likely to stabilize at $80 per barrel for the next nine months, the outlook of CNOOC is good, Hani Securities (HK) Director K. L. Yu told China Daily.

However, Yu says that with the global economic recovery still facing uncertainty, demand for oil could weaken.

"If oil prices are depressed because of fragile economic growth, and the organic growth of CNOOC is still sluggish, we predict the business performance of the company may only be mediocre in the long term," he added.

Yu also said that CNOOC is a cyclical stock, so investors should be aware of this when investing in it.