'Suitable approach' for country to meet green targets mulled

BEIJING - The country is set to begin domestic carbon trading programs during its 12th Five-Year Plan period (2011-2015) to help it meet its 2020 carbon intensity target.

The decision was made at a closed-door meeting chaired by Xie Zhenhua, deputy director of the National Development and Reform Commission (NDRC), and attended by officials from related ministries, enterprises, environmental exchanges and think tanks, a participant told China Daily on Wednesday on condition of anonymity.

"The consensus that a domestic carbon-trading scheme is essential was reached, but a debate is still ongoing among experts and industries regarding what approach should be adopted," the source said.

The meeting concluded that such efforts are self-imposed and should be strictly separated from ongoing international negotiations for a successor to the Kyoto Protocol to fight global warming, the source said.

As a developing country, China does not shoulder legally binding responsibilities to reduce carbon emissions, according to the basic principle set by the United Nations Framework Convention on Climate Change.

Putting a price on carbon is a crucial step for the country to employ the market to reduce its carbon emissions and genuinely shift to a low-carbon economy, industry analysts said.

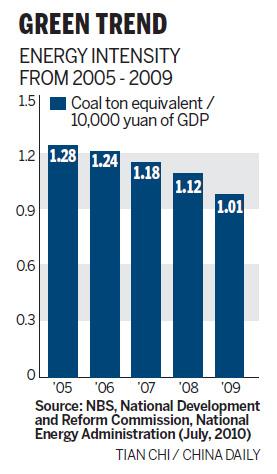

China has mostly relied on administrative tools to realize its 20 percent energy intensity reduction target between 2006 to 2010. To that effect, the country's top 1,000 energy consumers have signed contracts with the central government to improve their energy efficiency.

But with rising domestic energy demand, administrative measures are too expensive for the country to meet its future energy conservation targets - something that was also agreed at the meeting, said Tang Renhu from the low-carbon center at China Datang Corporation who also joined the discussion.

Although China has refuted the International Energy Agency's label of being the world's top energy consumer, its energy consumption for 2009 stood at 2.132 billion tons of oil equivalent, according to the National Bureau of Statistics. [NEA denies top energy user tag]

"The market-based carbon-trading schemes will be a cost-effective supplement to administrative means," said Yu Jie, an independent policy observer who previously worked for several international climate-related institutes.

Tang also said the differences are centered on whether the pilot carbon trade projects should start from a selected industry, or a certain area.

Possible sectors for piloting carbon trade projects include carbon-intensive industries such as coal-fired power generation, Tang said.

One of the proposals include setting an absolute cap on carbon dioxide emissions in a certain area or industry. Others argue that the country's carbon intensity target can be converted to some carbon-related allowances for trading schemes.

China has pledged to cut its carbon emissions per unit of economic growth by 40 to 45 percent by 2020 from 2005 levels.

Yu said it would be very complicated to work out a trading scheme that allocates the carbon-related emission permits among the enterprises in an open and fair manner.

"My suggestion is that the number of participating enterprises should be limited, as the goal of pilot trading is to try out the rules and establish a mechanism especially suitable for China," Yu said.

China has been testing the waters with voluntary carbon trade, aimed at developing the necessary financial systems and policy tools.

The country's first voluntary carbon trade was sealed last August, with a Shanghai-based auto insurance company buying more than 8,000 tons of carbon credits generated through a green commuting campaign during the Beijing Olympics. The trade was carried out through the China Beijing Environment Exchange.

Sun Cuihua, an official from the NDRC's climate change department, earlier said the government is also working out rules to guide voluntary carbon trade projects in China.