A worker cultivates chick embryos at a Sinovac Biotech laboratory. China's on-going healthcare reform is boosting market demand and expected to attract domestic and foreign investors to invest in vaccine sector. [China Daily]

A worker cultivates chick embryos at a Sinovac Biotech laboratory. China's on-going healthcare reform is boosting market demand and expected to attract domestic and foreign investors to invest in vaccine sector. [China Daily]

The domestic vaccine production market is expected to expand quickly in the years ahead as investors look to capitalize on the nation's healthcare reforms and enhanced public awareness about inoculations.

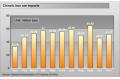

China's vaccine sector will grow 25 percent annually, according to a report from Zero2IPO, a Chinese venture-capital firm. In 2012, the size of the market will reach "8 billion yuan ($1.17 billion)", the report said.

Attracted by the growing vaccine market, "investors from home and abroad will be piling into China", said Zheng Yufen, senior manager for healthcare at the investment banking division of Zero2IPO.

China is the world's largest vaccine manufacturer, and most of the companies in the sector are privately owned.

The local vaccine market has enjoyed strong growth worldwide, but vaccine sales accounted for only less than 1 percent in the nation's healthcare industry, according to figures from CITIC Securities. "That number is comparatively low considering China's large population base," said Zheng.

Ongoing healthcare reform is giving the vaccine sector a boost because the Chinese government is expected to spend 26 billion yuan on improving public healthcare services before the end of 2011.

During the past year investors have been researching the vaccine market, waiting for the opportune time to enter. "The time is ripe for venture capital to take some action in the sector," said a venture capital industry insider surnamed Wang.

During the past three years, Wang's firm has been in contact with five vaccine companies, but no deals have been signed yet.

"There is the strong possibility that we will make some investments this year, the vaccine sector is now one of the few key areas that we are eyeing the most," he said.

Several other venture capital companies also have the same idea. Last year, IDG established a healthcare team to study the industry for potential investment targets.

"Nobody likes to come in second place when cashing in on a sector that shows promise," said Wang.

According to Zero2IPO, the gross profit rate for vaccine companies on average is 70 percent. But challenges do exist. "Compared with their foreign counterparts, Chinese vaccine makers lag behind in innovation and management," Wang said.

Nationwide, China has over 40 vaccine manufacturers. Other than State-owned companies like Shanghai-listed Tiantan Biological Products and US-listed Sinovac Biotech, many of China's vaccine makers are private and still small in size. "Money is their biggest concern when they plan to expand," said Zheng.

In 2009, a batch of international pharmaceutical firms entered the vaccine sector through mergers and acquisitions. In late 2009, Novartis International AG, the world's sixth largest pharmaceutical company said it agreed to acquire an 85-percent stake in a Zhejiang-based private vaccine producer.

And last year, GlaxoSmithKline (GSK), the world's leading vaccine producer wrapped up two deals in China to establish vaccine manufacturing joint ventures with two local firms committed to researching and developing vaccines in various categories.

"We have great confidence in China," said the spokesperson from GSK China who declined to be named.