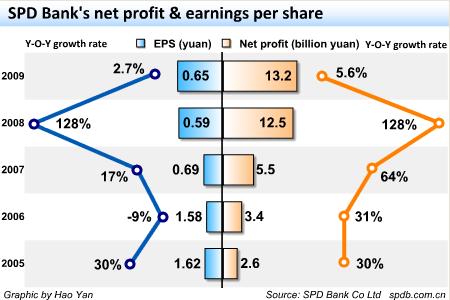

BEIJING - Shanghai Pudong Development Bank said Tuesday its 2009 net profit rose 5.6 percent from a year ago on lending boom and increased commission fees.

Net profit climbed to 13.2 billion yuan ($1.93 billion) last year, with earnings per share at 1.621 yuan in 2009, up 2.66 percent over 2008, the lender said in its 2009 annual report to the Shanghai Stock Exchange.

The profit growth was because of rising operating revenue as credit boomed and commission fees increased, said the bank.

Operating revenue grew 6.55 percent year-on-year to 36.8 billion yuan last year. Commission fees rose 16.51 percent from a year earlier to 2.72 billion yuan.

Income from lending which was encouraged by the government to boost domestic demand, rose 4.97 percent year-on-year to 46.7 billion yuan, the lender said. By the end of 2009, the bank's outstanding loans in Renminbi and foreign currencies reached 928.9 billion yuan, up 33.16 percent year on year. Special Coverage:2009 Annual Reports of Listed CompaniesThe bank's core capital adequacy ratio up to 6.90 percent by the end of last year, from 5.03 percent at end of 2008. Non-performing loan rate was 0.8 percent at the end of 2009, down from 1.21 percent from a year earlier.

The bank said it targeted at above 25 percent annual growth in after-tax profit for 2010.

The bank's share price rose 0.35 percent to 22.99 yuan on Tuesday.