More Chinese now willing to pay to keep up appearances, look younger

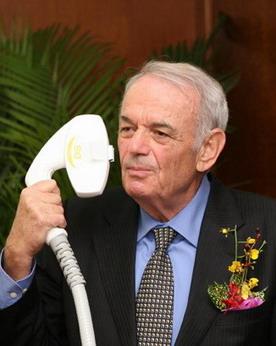

BEIJING - Shimon Eckhouse is co-founder and chairman of a list of companies including Syneron, CardioDex, NanoCyte and Tulip.

Shimon Eckhouse, co-founder and chairman of a list of companies including Syneron, CardioDex, NanoCyte and Tulip.

All of them are concerned with the aesthetic medical business.In addition to entrepreneurship, Eckhouse is the inventor of intense pulsed light (IPL), a technology used extensively for non-invasive aesthetic medical applications and also known as photorejuvenation.

It's difficult to guess the age of this Israeli. His white hair and rich experience in the medical beauty sector indicate he should be in his 60s or 70s, but the well-kept figure and tight skin suggest he might be middle-aged.

Eckhouse told China Daily that the industry developed a lot during the last few decades and it is now "safer, easier and more affordable".

Plastic surgery was the most common treatment in the 1980s and 90s in the developed market to eliminate wrinkles and reduce body fat. Thanks to the development of IPL and laser technologies, non-invasive applications are now more popular because they are less painful and cheaper. Meanwhile, safety has become the biggest concern, adding to the appeal of non-invasive surgery, according to Eckhouse.

Customers have become smarter. They pursue beauty while demanding safety and high cost-effectiveness. As their lives get busier, they also hope to spend less time becoming or staying beautiful in the easiest way possible.

Dong Pingling, who underwent liposuction on her stomach fat in the late 1990s, said that she, then aged 41, spent half a day at the surgery and stayed at home for about half a month. "I can still remember the pain which cannot be exactly described," she said. She underwent the procedure in an army hospital at a cost of 5,000 yuan ($752), the same sum as her monthly salary at the time.Now, thanks to non-invasive technologies, matters are far different. Dong's daughter, 25, said she plans to undergo laser treatment on her thighs. "The treatment involves three courses - no more than one hour each for three weeks - and costs 1,500 yuan, without leaving a wound," she said.

Expansion in China

The gap between China and developed markets, such as the United States and Japan, in the aesthetic medical sector is narrowing fast, as the emerging market develops dramatically, according to Wang Zhijun, vice-director of the medical aesthetic and beauty committee under the China Medical Association.

Statistics from the World Fact Book conducted by the World Bank show aesthetic medical sales in Asia amounted to $38.89 billion last year, with 16.76 percent, or $6.51 billion, contributed by China.

It said the compound average growth rate of the industry is expected to be 13.3 percent in Asia between 2009 and 2014, while the figure for China is 15.7 percent

The booming market, driven by the nation's increased individual income, improvements in people's living standards and large population base, is attracting more businesses. Eckhouse's Syneron is one of them.

Syneron is engaged in developing and producing medical aesthetic medical devices and medical beauty. It entered China in 2008 via a joint venture in Beijing and now has five facilities nationwide.

At the beginning of this year, Syneron acquired Candela, the United States' biggest medical laser company, to become the world's largest medical aesthetic devices and services provider. The new company now has more than 30 percent of the global market with annual sales of $200 million.

"We realized two-digit growth globally, and if our business in China grows much faster, we will become the largest one (in the medical aesthetic industry) here," said Eckhouse.

Syneron's archrival Lumenis was the early bird at the Chinese market. It set foot in the developing nation in 1992. Its Chairman and Chief Executive Officer Avner Raz said that China is now the world's third-largest laser aesthetic medical market, coming after the United States and Japan. The company's business in China is forecast to triple within three years.

To meet the physical and skin conditions of Chinese people, the multinational companies are carrying out technological localization and developing locally-tailored products.

So far, all Syneron's products are imported from abroad. "We will set up manufacturing capability in China," Eckhouse said. Raz disclosed a similar plan.

Although the foreign giants came to China with ambitious plans and plenty of confidence, it is difficult for them to win the dominant market share, said Wang, adding that the domestic market has long been controlled by local players and that the comparatively high prices of overseas companies is an obstacle

Zheng Junli, 36, is running a medical aesthetic chain with five outlets in Beijing. She founded her first salon in 2005 and, with total assets of 10 million yuan now, she said that she will not buy imported devices because of their high prices.

"Usually, the cost of an imported one is five to six times a similar domestically-made one. I cannot afford that," she said.

Syneron and Lumenis clients are usually hospitals, large beauty institutions and luxury salons, but they account for a minority of China's medical aesthetic market, according to Wang.

But both Eckhouse and Raz said they believe their cutting-edge products and technologies will penetrate the emerging market very quickly. Chinese people are becoming quality-sensitive, they said.