Bags of rice for sale at a grocery store in Beijing. [Photo / Bloomberg]

New kid on the block makes his mark during staple price talksBEIJING - The season for autumn grain purchasing is upon us but this year various factors are making it more complicated, partly because of the involvement of a new participant, the Yihai Kerry Group.

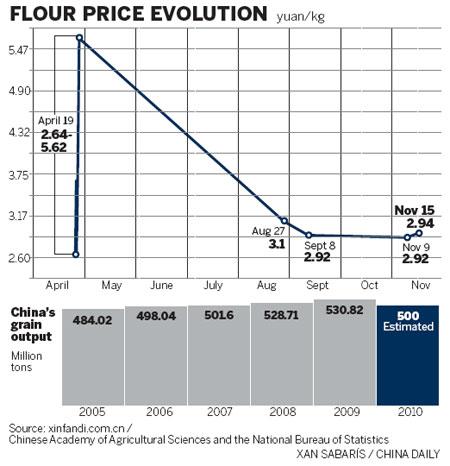

As a result of adverse weather, international price fluctuations and speculation, grain prices for corn, wheat and rice have been vacillating widely, despite repeated assertions that stockpiles are abundant.

Average purchasing prices for rice and corn in major autumn grain production areas have surged by 20 to 30 percent from a year earlier, said Li Guoxiang, researcher of the Chinese Academy of Social Sciences' Rural Development Institute.

In contrast to the rise in prices, market trading is relatively inactive. Higher prices have raised farmers' expectations for even higher prices in the future, prompting them to store grain rather than to sell it, Li said.

Furthermore, favorable prices offered by big companies such as Singapore agricultural business Yihai Kerry have also fuelled farmers' market expectations, said analysts.

Yihai Kerry is the Chinese subsidiary of Singapore agribusiness conglomerate Wilmart International Ltd. It is the biggest edible oil supplier in the Chinese market and is run by chairman and chief executive officer Kuok Khoon Hong, one of Singapore's richest businessmen.

To support the rapid growth of its grain processing business, Yihai Kerry has joined in the grain purchasing process in major production areas.

"I haven't sold a grain of my paddy rice so far, and most farmers in my county are reluctant to sell their grains," said Shan Yiheng, a farmer in Zhaodong, Heilongjiang province.

Zhaodong is famous for its corn and rice in Northeast China. Shan is one of the biggest local farmers in terms of sown area. His approximately 20-hectare farmland performed very well this autumn with yields of about 100 tons of paddy rice.

"The current purchasing price here is about 140 yuan ($21.2) for every 50 kilograms of paddy rice, higher than last year's 124 yuan, but it's still lower than my expectation. All kinds of costs are rising this year, so why not grain?" he asked.

Shan said Yihai Kerry has started purchasing rice in neighboring cities in Heilongjiang province such as Wuchang and Jiamusi since this autumn with prices about 10 yuan higher for every 50 kilograms.

"It's obvious that farmers prefer to sell grains to companies such as Yihai Kerry because the price is more favorable," Shan said.

However, Shan's opinion isn't shared by everyone.

Grain issues are extremely sensitive and can easily trigger arguments over food safety in a country where agriculture has been the dominant economic sector in its long history. As the old Chinese proverb goes, "Food is the God".

Yihai Kerry's participation has made the grain purchasing market more complicated, said Ma Wenfeng, an analyst at Beijing Orient Agribusiness Consultant Ltd.

In previous years, about 60 percent of the grains were purchased by Stated-owned companies such as the China Grain Reserves Corporation (Sinograin) and the rest went to small- and medium-sized private companies.

"Supported by the relatively high profits gained from China's oil market, Yihai Kerry can purchase grains at cost price, but small- and medium-sized grain processing companies will go into bankruptcy if they do the same thing because of the small margins for profit in the processing industry," Ma said.

Grain purchasing needs a large amount of liquidity. It's very hard for small private processing companies to get financial support. A group of companies will be forced to close by this kind of competition, added Ma. "The speed of Yihai Kerry's expansion is amazing."

According to Ma, the company's flour processing capacity in China is about 4,000 tons per day. Compared with the 7,000 ton daily turnover of the Cofco Group and 13,000 tons by the Hebei-based Wudeli Group, China's biggest flour processing company by volume, Yihai Kerry's market share remains small, Ma said.

"But with the current speed of expansion, the company can catch up its competitors and become China's biggest grain processing company within five years. By then, it will have a big say in pricing," Ma said.

The company's rice milling capacity is about 3,000 tons per day, ranking it among the top 10 in China, Ma said.

Yihai has built 130 large-scale manufacturing plants in more than 35 "strategic locations" in China, with a nationwide sales and distribution network, the company's website said.

Yihai Kerry declined to provide the numbers of its wholly-owned companies and joint ventures in China.

Adams Li, a press officer for Yihai Kerry Foodstuffs Marketing Co, said Yihai's purchasing activity and market share has been exaggerated.

"We have yet to start purchasing for autumn grain. This year we only purchased about 500,000 tons of wheat and about 191.7 tons of early Japonica rice," he said.

Revenue in China exceeded 100 billion yuan in 2009, with the major element coming from the oil sector, he said. Wilmart's global revenue was $23.89 billion in 2009.

"We are keeping a close eye on Yihai Kerry's operations in China, although its market share is not big, but rapid expansion has posed a threat to China's food security," said an official from Sinograin, who declined to be named.

Sinograin is the largest State-owned grain storage company. Besides stockpiling and rotating government grain reserves, the company also has a processing business.

"A deep concern is that the flour processing industry may fall into the same trap as the edible oil industry," he said.

Yihai Kerry became China's biggest edible oil manufacturer by purchasing a dozen domestic oil makers between 2003 and 2005 after 70 percent of Chinese soybean oil companies went into bankruptcy as a result of vicious competition from international players, said analysts.

"As the biggest edible oil supplier in the market, Yihai Kerry has gained a dominant say in pricing," said Ma.

Yihai Kerry's share in China's oil market exceeds 30 percent and once rose to as much as 50 percent in 2007, said analysts.

Cheng Guoqiang, a researcher at the Development Research Center of the State Council, said it was very rare to see foreign investors get involved so deeply in a country's grain purchasing and processing.

"Its risks to food security and market stability are obvious and the situation must be watched," Cheng said.

China's grain industry was opened up to capital enterprise after reform in 2004.

There are no limitations on foreign investors, but such an example of deep penetration into the market might go beyond policy maker's expectations, Cheng said.

Food prices account for about 30 percent of the consumer price index in China. Frequent price fluctuations of grain have brought great pressure on those trying to manage inflation.

The government has halted Sinograin's sideline trading business and urged the business to focus on stockpiling and rotating government reserves. It aims to stabilize the market by reducing the number of participants.

Foreign investment in the agricultural sector is regarded as a double-edged sword by industry observers.

"I think the advantages of foreign investment in the agricultural industry outweigh the disadvantages," said Li of the Chinese Academy of Social Sciences.

The technology of foreign investors' and their advanced management skills are useful references for domestic companies, and they have not brought substantial harm to China's purchasing market, Li said.

In 1989, when agriculture was neglected by most foreign investors, Singapore businessman Kuok Khoon Hong, the nephew of Malaysian tycoon Robert Kuok, started a Chinese agribusiness venture with a refinery in the southern Chinese city of Shenzhen.

During 20 years or so of expansion, Yihai Kerry has aggressively expanded to oilseed crushing, specialty fat processing, rice and flour milling and biofuel energy.

The Chinese operation has laid a sound basis for Kuok's international business in eastern Asia and other countries.

Kuok ranks No 4 in Singapore's 40 richest in 2010 with a net worth of $3.5 billion, according to Forbes magazine. He is the chairman and chief executive officer of Wilmart International Ltd.