LeTV will launch a fee-based Internet protocol television service in the fourth quarter of 2010. [China Daily]

In China's online video market, where firms generate most of their revenue from online advertising, subscriber fee-based LeTV.com seems to be a bit eccentric. But that did not prevent the firm from becoming the first video site to be listed on the mainland stock market.

As many of its rivals such as Youku.com and Tudou.com struggle to turn a profit after years of operation, LeTV.com's net income has easily surpassed 44 million yuan ($6.48 million) last year.

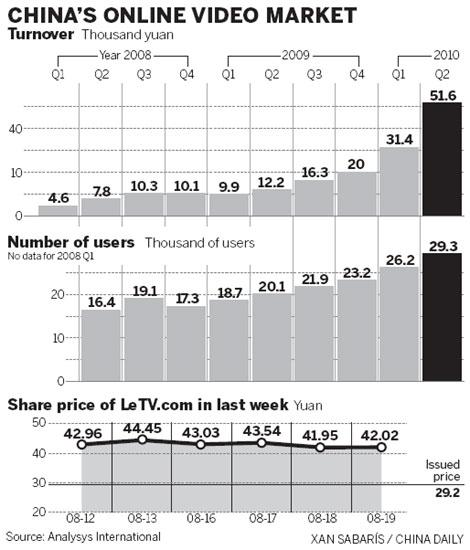

Since its initial public offering last week on the Shenzhen Stock Exchange, the company's share price has surged 43.9 percent

"Charged services will be the next industry trend. Before that we all thought if an online video website wants to survive, offering stuff free is the only way," said Liu Hong, vice chairman and chief operation officer of the company. "But now our experience has proven charging for services is another way out."

Compared with mainstream, free online video websites such as Tudou.com and Youku.com, LeTV.com's operational model is unique in China. About 65 percent of the company's income comes from subscriber fees since it was established in 2004.

According to the company's prospectus, it has an 11 percent market share of the charged online video market, and sales revenue of its subscriber-based high-definition service was 73.54 million yuan last year. The company said it has 9 million customers since it was established, and the new customer rate has increased 60 percent year-on-year. The company had 300,000 paying customers last year.

These figures have been met with a lot of skepticism from the industry. Doubts are mainly centered on whether the website has no way to raise subscriber fees, based on its Internet traffic ranking.

LeTV.com ranks number 118 in China while Youku.com ranks 10th and Tudou.com ranks 12th according to Web information company Alexa. Until now, the other two big companies are still struggling to make ends meet.

The company sought to refute these allegations.

"Usually, advertisements should be a major income generator for online-video companies, with the subscriber service being an (extra) subsidy.

But LeTV.com is very different," said Tang Yizhi an Internet analyst with Analysys International.

According to LeTV.com, advertising income only accounted for about 20 percent of the company's total income last year.

"Free video site services will not meet customer demand for video quality and definition, and charged services are expected to enter a high-speed growth phase," said financial analyst Cui Jian at Bohai Securities.

LeTV said the company would launch a fee-based Internet protocol television (IPTV) service in the fourth quarter this year, because the industry will see "rapid growth in the next few years."

However, many industry insiders are wary of the business model of LeTV.com and even doubt the credibility of the financial figures provided by LeTV.com.

"Its (LeTV's) IPO is a good sign for the online-video industry, and it means the industry is more mature and has entered a virtuous circle," Victor Koo, the founder as well as the chief executive officer of Youku.com, told China Daily.

But he also pointed that his website may not follow this pattern, noting that "every company has its own development path."

Chinese search engine Baidu in January launched an independent video website called Qiyi.com that streams authorized videos online for free.

Aiming to copy the success of Hulu.com in the United States, the company plans to create a new business model in China that benefits both users and advertisers, according to Gong Yu, the website's chief executive officer.

"The fee-based model is not a dead end for Chinese online video websites, but it does require cultivating customers," said Tang from Analysys International.

She said, most Chinese video sites may not follow the business model of LeTV.com despite the company's strong price in the stock market.

The number of China's online video user reached 309 million last year, up 32.1 percent year-on-year, according to research firm iResearch.