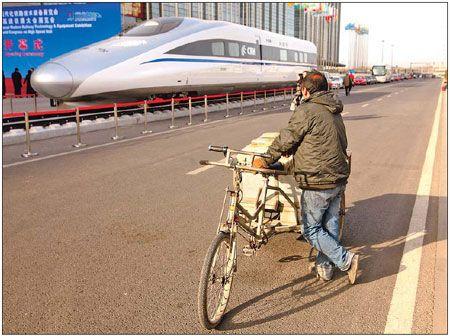

A man looks at China's home-built bullet train that set an operating speed record of 486.1 km per hour during a test run on the Beijing-Shanghai line. The bullet train is made by China North Locomotive &Rolling Stock Industry Group Corporation. Provided to China Daily

The State-owned Assets Supervision and Administration Commission (SASAC) restarted the consolidation plan of China's two largest train makers as it hopes to enhance competitiveness and improve operations in government-controlled companies.

The proposed merger, first mooted in early 2003, will involve China North Locomotive &Rolling Stock Industry Group Corporation (CNR) and China South Locomotive &Rolling Stock Industry Group Corporation (CSR), an executive from CSR said.

SASAC, which is both a regulator of and shareholder in China's largest State companies, regarded the merger of CSR and CNR as a new target in the 12th Five Year Plan (2011-2015), according to a report from 21 Century Business Herald.

Earlier in 2003, media reported that SASAC expected CSR and CNR to be merged, but the plan was set aside as none of the two parties was willing to follow through with the plan.

But since August 2010 when Wang Yong replaced Li Rongrong as SASAC director, the plan was restarted and set as a new target in the next five year plan, an unnamed executive from CSR was quoted by 21 Century Business Herald.

A company insider told China Daily that the plan is yet to be implemented at the company level.

CSR and CNR were separated from its former China Railway Locomotive &Rolling Stock Industry Corporation by northern and southern regions in 2000.

The two companies are matched in strength, by 2015, CSR is projected to achieve revenue of 150 billion yuan ($22.77 billion) and CNR's revenue to reach 140 billion yuan.

"Products from CSR and CNR are quite similar, so they always have competition, especially in the international markets," said the company insider. "The Ministry of Railways and SASAC propelled the merger to avoid hostile competition and to enhance China's international position in the high-speed train manufacturing sector."

"But neither of the two companies is willing to be merged due to the inevitable realignment of the management team," he said.

Last year, SASAC encouraged State-owned enterprises (SOEs) to accelerate the pace of consolidation, axing 122 central SOEs.

Since China rolled out the first high-speed railway between Beijing and Tianjin in 2008, the country's high-speed rail network ranks No 1 for both speed and distance.

China's latest fast train, the CRH380A, built by CSR, set a world record on Dec 3 by hitting 486.1 km an hour during a trial run on the Beijing-Shanghai High-Speed Railway.

China is operating a high-speed rail network with a combined length of 7,531 kilometers, the world's longest. By 2012 this figure will almost double to 13,000 km.

CSR, now the word's third-largest high-speed train producer, behind Bombardier and Alstom, is aiming to become the global No 1 in the high-speed railway manufacturing sector, Zheng Changhong, president of CSR said.

"The next five years will be a peak-period in terms of railway construction in China, with annual investment touching 700 billion yuan," he said.

CSR and CNR both aimed to take a bigger slice of the global pie.

CSR signed an agreement with General Electric in December 2010 to establish a 50-50 joint venture to manufacture high-speed trains in the US using China's technology.

Alstom may bid with Chinese partners for high-speed rail contracts in the US, Brazil and Argentina under an agreement to boost cooperation, CEO Patrick Kron was quoted by Bloomberg on Dec 8.

Since 2003, China has signed agreements or memoranda of understanding for bilateral cooperation on railways with more than 30 countries, including the US, Russia, Brazil, Saudi Arabia, Turkey, Poland and India.

According to the government's blueprint, China's railway network will serve more than 90 percent of the population by 2020, with a budget of 2 trillion yuan, and 16,000 kilometers of new lines.

China Daily