Since the property regulation policies were launched, more and more real estate speculators became interested in gold, resulting in the question of whether this would lead to another economic bubble when a large amount of floating capital in the real estate market is transferred to the gold market. Experts say that in order to curb the damage to the real economy, some effective measures must be taken to guide floating capital.

The gold price rose to a historic high in May of $1,241 per ounce, and it has been hovering around $1,200 per ounce since June. The share prices of listed gold resource companies also increased.

Cheng Zhang, deputy general manager of China National Gold Group Marketing Company, told reporters that May has historically been a low season for gold sales, but sales conditions in May this year are better than that of previous years. Inflation expectations and a cool property market have made gold the focal point of investment.

Zhou Dewen, head of Wenzhou SME Development Association, said that Wenzhou businesspeople have been discussing withdrawing capital from the property market in recent months. Because gold is easier to transfer into money, it has become a tool for businesspeople to pursue capital appreciation in a short period of time.

"Although the capital transferred from the property market to the gold market is incalculable, it shows a clear trend," said Zhou.

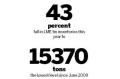

According to the latest announcement by the Shanghai Gold Exchange, the gold trading volume in May was more than 662,000 kilograms, an increase of almost 18 percent from the previous month, or about 141 percent from the previous year. The trade turnover reached 175 billion yuan, an increase of almost 24 percent from the previous month, or about 213 percent from the previous year.

Experts believe there may be a bubble in the gold market after gold prices have remained at high levels for a long period of time. Zhu Zhigang, chief analyst from Guangdong Yuebao Gold Investment Company, reminded investors that gold prices are expected to enter a correction period in July because the gold price level is at a very high level following a decade-long continual rise, and the traditional soft gold trading season is about to begin. Even if idle funds from Wenzhou's businesspeople enter the market, they are unlikely to reverse the trend.

The current domestic gold price would not have been so high without international speculation. As China has become the world's second largest gold-consumption market, international speculators are turning their eyes to the Chinese market.

China should be cautious of international speculators who deliberately drive up the price before tempting investors to enter the market.

"I suggest that investors should not particulate too much in gold speculation," Zhu said. "The current gold buy-back channels in China are not smooth, so gold speculators will be exposed to high risks."

Li Youhuan, deputy director of the Industrial Economy Institute under the Guangdong Academy of Social Sciences, said capital flows to wherever returns are highest and hot money is born from high profits. Because China will possibly increase interest rates and revalue the yuan, huge amounts of hot money have entered the country through various channels. Furthermore, after 30 years of industrial development, there has also been an immense amount of surplus capital in China, which may turn into hot money at any time because of rising inflation expectations.

"As can be seen from the current garlic and gold markets, and from the market of Pu'er tea years ago, it is extremely difficult to control hot money inflows. However, we can increase the cost of hot money flows to reduce its size and flow," Li said.

He suggested that the government should crack down hard on illegal private banks, thereby cutting off channels of illegal hot money inflows from abroad.

Li Jianjun, a professor at the School of Finance under the Central University of Finance and Economics, said the key to controlling hot money is to manage price expectations, but prices of agricultural products are closely related to natural conditions, and gold and the US dollar are somewhat lined in value. These have all made it difficult to control price rise expectations.

Li said according to the recently released "Opinions of the State Council on Encouraging and Guiding the Healthy Development of Private Investment," private capital is now allowed into certain monopolized industries and will most likely flow into the financial industry and the tertiary industry. This will change China's processing and secondary industry-based economic pattern, and hot money will no longer be a "troublemaker," but rather become an effective tool to promote economic development.