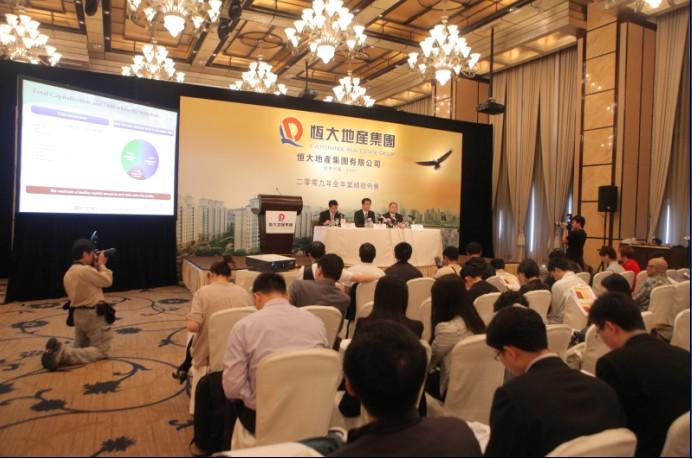

On April 12, Evergrande Real Estate Group announced the 2009 results and achievements in Hong Kong. A series of achievements further consolidated the leading position of Evergrande in the real estate market of China. Last year, Evergrande realized the net profit of 1.046 billion yuan (in RMB, the same below), an increase of 100% compared with that of the same period in the previous year, with the profit per share of 7.

4 cents, and the final dividend per share of 0.7 cents. The interim contracted sales amount was 30.3 billion yuan, an increase of 400% compared with that of the same period in the previous year. The total assets value of the Group was over 63 billion yuan, with an increase of over 120%. The sales amount of the first quarter this year was about 8.

39 billion yuan, with an increase of 170.0%. Xu Jiayin, Chairman of the Board of Directors, released the achievements in the conference, namely, as of April 11, the sales amount was up to 1.6 billion yuan, and the expected sales amount this year would be 40 billion yuan.

The contracted sales amount increased by 400%.

The annual report showed that as of December 31, 2009, Evegrande had been in the 30-billion club of real estate enterprises in China, with the contracted sales amount of 30.3 billion yuan, with an increase of 400% compared with that of the same period in the previous year. The interim net profit was 1.

05 billion yuan, with an increase of nearly 100% compared with that of the same period in the previous year, the profit per share of 7.4 cents, and the final dividend per share of 0.7 cents. The great increase of profit was mainly due to the great increase of revenue from the sales of properties and the real estate development.

By the end of 2009, Evergrande had owned 41 projects under construction, with the salable area under construction of 16.479 million square meters including 32 on-sale projects and the annual sales area of 5.637 million square meters, increasing by about 400% compared with that of the same period in the previous year.

Xia Haijun, Vice-chairman of the Board of Directors and President of Evergrande, said that the average selling price last year was 5,375 yuan per square meter, and the average selling price of the fourth quarter was 6,352 yuan per square meter, increasing by 40.8% compared with that of the first quarter in 2009, which was 4,511 yuan.

The liability rate target was no higher than 40%

The Performance Report showed that by the end of last year, Evergrande had held the cash (including cash, cash equivalent, and restricted cash) of 14.38 billion yuan, with the total amount of bank loan of 14.18 billion yuan, the unused bank financing amount of 20.45 billion yuan, and the recoverable contracted sales amount of 5.7 billion yuan.

On January 22 this year, Evergrande completed the issuance of 5-term senior notes of 750 million U.S dollars, creating a new record of debt scale of real estate enterprises of Mainland China listed in Hong Kong, and fully repaid the structured secured loan of 290 million U.S dollars that will expire in October 2010.

Xu Jiayin said, from the end of last year to now (4 months), Evergrande had been in a status of holding net cash. It was hoped to keep the non-restricted cash of over 4 billion yuan all throughout the year, with the liability rate target no higher than 40%, the gross profit rate of 30%-40%, the net profit no lower than 15%, and the target EBITDA interest coverage rate no less than 5 times.

The sales amount of the first quarter of 2010 was 8.39 billion yuan, an expected annual increase of 20%

compared with that of the same period in the previous year. In the results announcement conference, Xu Jiayin said that as of April 11, the sales amount had been up to 1.6 billion yuan, with an expected annual increase of 20% compared with that of the same period in last year. For the upcoming May Day Holiday, Xu Jiayin hopefully said, the sales performance in that week would be excellent.

President Xia Haijun said that the sales amount of the first quarter this year of the Group had been up to 8.39 billion yuan. The sales area of March was up to 557,000 square meters, with the revenue of 3.67 billion yuan, increasing 98% compared with that of the same period in last year. Due to the good sales situation, the Group planned to keep the construction area of about 18 million square meters this year. The as-built area would be about 8 million square meters, among which, the area of 5.39 million square meters was sold last year, and the housing would be handed over this year.

In addition, Xie Huihua, CFO of Evergrande Real Estate Group, said that the gross profit rate was expected to increase this year. The reason was that the selling price per square meter in 2009 increased quarter over quarter, with an increase of 40% in the fourth quarter compared with that of the third quarter.

Focusing on the markets of second- and third-tier cities to further establish the leading position in the industry

As to land reserve, Evergrande adopted the look-ahead strategy to focus on the provincial capital reserved land of China with high economic growth and great appreciation potential of real estate price. By the end of the year 2009, the Group had owned 57 real estate projects in 25 major cities of the country, with the high-quality and low-cost land reserve of about 54.976 billion square meters, which could meet the needs for large-scale development in the next 5 years.

Within the year, the Group had constantly been paying close attention to the high-growth cities of China and the regions within cities with beautiful environment, reasonable planning, developed traffic, and great potential of land appreciation, and had reserved in large scale high-quality and low-cost lands. Throughout the year, the Group had newly purchased 13 pieces of lands in 9 cities of China, including Chongqing, Xi an, Taiyuan, Hefei, and Changsha, with the increased land reserve for the construction area of 13.08 million square meters. In addition, the Group also entered into Nanchang, Shijiazhuang, Haikou and other cities to effectively seize the rapid growth of emerging markets and the development opportunity of constructing Hainan as an international tourist island, while continuing to consolidate the strategic layout in the whole country.Related News

- Sharing the Remarkable Achievement the Launching of Evergrande s Global Road Show

- Chen Quanguo, Governor of Hebei Province, Met with Xu Jiayin, indicating Evergrande Accelerated its Steps to North China

- Secretary of Hubei Provincial Party Committee and Governor Visit Evergrande Community at E Zhou

- Guangzhou Evergrande Automobile Team successfully won the halfway champion

Photos

More>>trade

- Evergrande s Midyear Working Conference was Successfully Held

- Grand foundation stone laying ceremony of Evergrande Oasis in Lanzhou

- Chairman Xu requiring the club to be most in three aspects

- Guangzhou Evergrande Team Tied Chengdu Sheffield United Team at 2:2

- Jinan Party and Government Leaders Visiting Evergrande and High Praising Its

market

- Guangzhou Evergrande Team Overwhelming Anhui Jiufang Team at 4:0

- Interim results released by Evergrande in Hong Kong showing sharp increase in

- Global Road Show of Evergrande Officially Started

- Evergrande Donated 3 Million Yuan to Support Asian Para Games

- Guangzhou Evergrande Team Tied with Shanghai Dongya Team at 1:1 and Topped the

finance

- Chairman Hui Attended 2010 Guangzhou Real Estate Expo

- Evergrande Became the Most Valuable Brand in China Real Estate Industry with a

- Evergrande GAC Team Defeated Yanbian Team at 2:1 and Moved a Step Near CSL

- Winning Derby Match, Guangzhou Evergrande Team Gained Promotion to CSL Three

- The monthly work conference of the Group system was successfully held