China: demand powers zircon

DAVID Harley is back from Shenzhen and the recent Global Zircon Conference with a bounce in his step.

He says even some of the analysts were startled by the shortage of this substance, used in ceramics such as bathroom and kitchen tiles and lavatory bowls. The Chinese, it seemed to those who attended the conference, cannot get their hands on nearly enough of it.

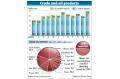

Harley says that the penny has well and truly dropped. About 85 per cent of the zircon used is imported into China.

Nor is he worried about any move by Beijing to rein in the real estate market. If the private sector got into trouble, he believes the government would step in to build low-cost housing to keep a lid on social unrest. Whatever the outcome, just think of all those kitchen and bathroom tiles that need to be glazed using zircon.

Start of sidebar. Skip to end of sidebar.

Related Coverage

Escaping the super tax The Australian, 1 day ago

Hot demand for mineral sands The Australian, 28 Mar 2010

Big players climb aboard shale gas train The Australian, 14 Mar 2010

Beach Petroleum eyes shale gas project Adelaide Now, 16 Nov 2009

Planet's pole position on the grid The Australian, 3 Nov 2009

End of sidebar. Return to start of sidebar.

Harley argues his company, Gunson Resources (GUN), has one of only two significant greenfields zircon projects in the world that have a realistic chance of being in production by 2012. The final feasibility study for the Coburn deposit in Western Australia was finished early this year with the construction cost set at $169 million.

The other project is the Grand Cote mineral sands deposit in Senegal. Mineral Deposits (MDL) is expected to receive any day the definitive feasibility study on a development that will cost $US400m.

Grand Cote will have an expected yearly output of at least 75,000 tonnes of zircon, 550,000 tonnes of ilmenite, 6000 tonnes of rutile and 9000 tonnes of leucoxene.

Iluka Resources (ILU) produced a fascinating briefing paper after the Shenzhen talkfest that's now on the company's website.

It backs up Harley's case that China has got some acute supply problems, and that alternatives to Australia and South Africa (such as Madagascar, Pakistan and Mozambique) don't yet have the scale of production needed.

Interestingly, last month Goldman Sachs named the three commodities where China has to import more than 60 per cent of its needs -- the platinum group of metals, iron ore and zircon.

In another zircon development, Red Metal (RDM) says its Saudi Arabian-owned partner has started drilling in the South Australian section of the Eucla Basin. The partners are targeting another deposit like the large Jacinth and Ambrosia projects being brought into production by Iluka. RDM is a very busy company at present: it has its potash project in Colorado and earlier this month the junior brought in Canadian uranium giant Cameco to explore its Lakes uranium project in South Australia.

Finally, Image Resources (IMA) has been making strong progress at its Gingin and Atlas heavy minerals projects in the West.

Punting on thermal

WHILE much of the resources sector agonises about the so-called super tax, Kuth Energy (KEN) has its own government problem.

It has some very promising geothermal projects in Tasmania but the company says it is still waiting for the commonwealth and state governments here to nail down renewable energy support policies. The postponement, to describe it kindly, of the emissions trading scheme has left Kuth wondering what the future will be for renewable energy companies.

So while it waits -- and it could be a very long wait -- Kuth has decided to put its Vanuatu geothermal project near the top of the to-do list. Not only is there strong government support in Port Vila, but the company says there's strong interest in the project from international development banks and donor agencies keen on Pacific climate change plans.

And unlike Australia with its cheap base-load coal power stations, Port Vila gets its electricity from diesel generators at a very high 50c a kilowatt hour.

While indecision and backsliding dominate the ETS and renewables policies here, Vanuatu has geothermal legislation in place and has drafted regulations to allow Kuth to qualify for carbon credits.

Hard assets

IF you believe Wall Street's sudden, last half-hour rally on Friday, you'll believe anything. How many times have we seen that sudden surge out of the blue at the end of the week as some unseen hand makes it seem that the market has found some equilibrium?

Sorry, but Pure Speculation doesn't buy it. The Germans agreeing to shoulder their share of the plan to monetise another $US1 trillion of debt may have reassured some traders, but it sends shivers up this columnist's spine. Debt mountains and money printing never end well. So we'll stick with hard assets, thanks all the same.

Debt implosions, double-dip recessions and the bugs of inflation/deflation will come and go, but the fact is that minerals and energy are becoming harder to find and often more expensive to produce. Long term, companies with something tangible in the ground will be the winners, as no doubt the Chinese know only too well.

Among the items you might have missed during the week, there was news from King Island Scheelite (KIS) that it has a high-grade tungsten ore reserve at its Dolphin project on the Bass Strait island. The company is in a joint venture there with Hunan Nonferrous Corp. Platinum has had a very volatile week, but Patersons Securities is underwriting a $1.

62m rights issue for Rimfire Pacific Mining (RIM). The company will use the money for work at its NSW projects. At its Fifield project, RIM has identified more than eight targets for platinum, gold and base metals -- with the focus on the platinum. Platinum prices recovered from the $US800/oz level in 2008 to $US1650/oz this month, but over the past week the metal has shed about 17 per cent of its value to close on Friday at $US1500/oz.

And backing up Pure Speculation's belief that the fertiliser feedstocks are coming back into focus, Phosphate Australia (POZ) thinks the time is right to start the formal process to finance its Highlands Plains project in the Northern Territory. POZ said preliminary talks with foreign customers and potential development partners had shown support for the project. As we reported recently, China is going to be a growing importer of phosphate.

Certainly Dart Mining (DTM) sounded very bullish in a presentation posted on Friday. It believes it may have found a new mining district around Corryong in Victoria (it's east of Albury) with its Unicorn project showing potential for a large molybdenum-copper-silver body. It is early days, of course, but a hole returning 0.19 per cent molybdenum and 0.15 per cent copper has sent hearts racing at DTM.

Zinc and lead have taken some savage hits in recent weeks, with both metals predicted to be in surplus for the next 18 months, but companies cannot sit on their hands. They have to think of the demand situation several years ahead. Meridian Minerals (MII) continues to get some impressive results from its Lennard Shelf project in Western Australia. The latest holes came in at high grades, including 5m at 30.5 per cent lead and zinc and 23m at 11.3 per cent. MD Jeremy Read says he's encouraged that such high grades are being found in the infill drilling stage.

And interest continues to grow regarding oil shale projects, even though the economics of these are not always easy. Boss Energy (BOE) has brought in a Chinese state-owned coal and oil shale company to test the junior's Latrobe oil shale resource in Tasmania, with sample shale to be shipped to China.

The company says its resource at Latrobe stands at 72 million tonnes of oil shale, equivalent to 59 million barrels of oil and that the shale, unlike others in Australia, is also suitable for bitumen manufacturing

If you need any more details of the above news and/or products, please visit Chinatungsten Online, or contact us directly.

Disclaimer: The article is only reflecting the opinions of the author. We have no responsibility to prove the originality and authenticity of the content, words and/or pictures. You readers should just take it as reference and check the details by yourselves. And the content is not a suggestion for investment decision. The investor takes his or her own risks if he or she operates accordingly. If you have any dissent about the contents above, please contact the relevant author, or the webmaster. We will try our best to assist the dealing of the related issues. Thanks for your visit and cooperation.