Chinese miners active globally to feed economic growth

In its recently released report on the state of the global mining industry Mine Back to the Boom PriceWaterhouseCoopers (PwC) reported that, in 2009, the Chinese had been in the forefront of mining mergers and acquisitions (M&A) across the world. Chinese investment in 2009 made up $17-billion, or 22%, of all global mining M&A activity and 30% of the top ten deals by value, it highlighted.

This is hardly surprising, given that, as the World Bank reported in its China Quarterly Update March 2010, the Chinese economy grew at a rate of 8,7% last year.

Massive investment-led stimulus was the key, but . . . household consumption growth has held up very well, it stated.

The domestic growth momentum continued in the first months of 2010. Exports declined in 2009 as a whole . . . . [but] rebounded strongly through 2009 . . . and exceeded the precrisis level in early 2010 . . . . Government-led investment is bound to decelerate. But exports are likely to continue to recover amidst a pick-up in the global economy . . . . Consumption growth should remain solid. Inflation is on course to be significant in 2010, after being negative in 2009. But . . . China s inflation is unlikely to reach high rates in 2010.

The global institution forecasts that the Chinese economy will grow 9,5% this year.

Already, in purchasing power parity (PPP) terms, China s gross domestic product (GDP) is the second-biggest in the world, at $8,789-trillion. (The US is still number one, at $14,260-trillion).

However, with a population estimated to reach 1 330 141 295 next month, the result is that China ranks only 126th out of 225 countries and territories in the world in terms of per capita GDP, in PPP terms. In comparison, South Africa ranks 105th, while, of the other members of the now-famous Bric group (Brazil, Russia, India and China), only India is placed lower than China in per capita terms, ranking 162nd (Russia is 74th and Brazil 103rd).

In dollar terms, China s per capita PPP GDP for 2009 is estimated at $6 600, while for 2008 it was $6 100 and for 2007, $5 700. This is below the 2009 world average of $10 500. The figure for South Africa is $10 100, for Russia $15 100, Brazil $10 200, and India $3 100, while the average for the European Union is $32 600.

China had an official urban unemployment rate estimated at 4,3% last September, but the actual urban unemployment rate could be 9%. More importantly, it is known that there is sizable unemployment and under- employment in rural areas. (These figures are from the US Central Intelligence Agency s World Factbook 2010).

China is thus both very rich and very poor and while it has made enormous progress, it needs to make even greater progress in the future. A sustained high rate of economic growth is thus absolutely essential to China, morally, socially and politically. It is widely perceived that the very legitimacy of the current Chinese political system and not merely of the current government depends on Beijing s success in delivering continuing rapid growth.

Economic growth requires natural resources to feed the population, create and feed the industries and provide the energy for domestic, industrial, agricultural, services and State use. Little wonder, then, that modern China has a voracious appetite for just about every kind of resource.

CHINA'S MINING INDUSTRY

China is, geographically, the world s fourth-largest country and, within its total area of 9 596 961 m2, contains 158 recognised minerals with proven reserves. Of these, 91 are nonmetal minerals, 54 are metals, ten are energy minerals and three are water and gas minerals. The country s proven mineral resources are the third-largest in the world (after the US and Russia) and account for some 12% of the global total.

Notably, the country possesses high-quality and internationally competitive rare earth (or lanthanide) minerals. It also has high-quality and competitive resources of barite, bentonite, fluorite, graphite, gypsum, magnesite, mirabilite (which contains the decahydrate form of sodium sulphate, called Glauber s salt), molybdenum, niobium, talcum, tin and tungsten.

Unfortunately for China, its reserves of key resources, including bauxite, copper, iron-ore, lead, manganese, phosphorous, sulphur and zinc, are limited and mostly of low grade. Its other resources include antimony, coal, mercury, natural gas, petroleum, uranium and vanadium. But, again, the natural gas and petroleum reserves are limited and generally of low grade.

Overall, while China s resources are rich in terms of total volume, they are lacking in per capita volume and most of the country s mineral deposits are only of medium to small size. However, it is believed that there are a number of unexploited large and even super-large mineral resources lying in the remote far western regions of the country. Nevertheless, China is still the world s biggest producer of aluminium, antimony, cement, coal, fluorspar, lead, magnesium, mercury, rare earths, steel, tin, tungsten and zinc.

Among resources currently being exploited, coal production is concentrated in the north-western and northern regions of the country, copper along the middle and lower reaches of the Yangtze river, iron-ore in the north-eastern, northern and south-western regions, petroleum in the north-east, north and north-west, phosphorus in the south-western and south-central regions, while the production of antimony, manganese and tin is concentrated in the provinces of Guizhou, Hunan, Jiangxi and Yunnan.

The exploitation of these resources is overwhelmingly in the hands of a domestic mining industry comprising some 80 000 State-owned mining companies and roughly 200 000 collectively owned mines, but China is opening the industry to foreign investment.

CHINA'S MINING MAJORS

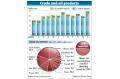

Unable to supply the necessary quantity and quality of mineral and metal inputs to support its economic growth from its own resources, China turned to foreign sources of supply. For example, in 2003, the country became and remains today the world s biggest importer of iron-ore. And, despite being the world number one coal producer, the country still has to import scores of millions of tons of the energy mineral net imports of coal came to 103-million tons last year.

Indeed, in its 2010 Mine Back to the Boom report on global mining, PwC has highlighted that China is on the verge of overtaking North America and becoming the global mining industry s biggest customer.

Not surprising, Chinese mining companies have been moving out of their homeland, looking to find, buy and develop mining projects in other countries, either on their own or in joint ventures (JVs). They have prioritised the developing world, and in particular Africa and Central Asia although Australia is also an area of great interest.

Chinese investments in foreign mining assets totalled $50-billion over the past ten years. As a result, a number of Chinese companies have already emerged as global mining majors, and more will follow them. It should be noted that few of these groups are dedicated mining companies; most are vertically integrated industrial complexes that do everything from exploration and mining through to metals and/or chemicals production and/or electricity generation and/or equipment manufacturing.

PwC has now ranked China Shenhua Energy as the world s fourth-largest mining company in terms of market capitalisation, after BHP Billiton, Vale and Rio Tinto, and ahead of Anglo American (fifth) and Xstrata (sixth). Moreover, there are now five Chinese companies in PwC s list of the world s top 40 miners in terms of market capital-isation. Apart from China Shenhua, they are China Coal Energy, Jiangxi Copper, Shanxi Xishan Coal & Electricity Power and Zijin Mining Group. Of these, only China Shenhua and China Coal Energy were in PwC s top 40 in 2008.

However, as this list is based on market capitalisation, it is unavoidably misleading. Many major Chinese mining companies are wholly State-owned (some by the central government in Beijing and some by provincial governments) and are not listed on any stock exchange and so have no market capitalisation at all.

Thus, China s largest diversified mining company is not China Shenhua but the Aluminium Corporation of China (Chinalco), which owns 9% of Rio Tinto. Other major and entirely State-owned Chinese mining companies include China Minmetals Corporation, Sinosteel and Jinchuan Group.

Chinalco mines bauxite, copper and titanium, producing alumina, aluminium, copper concentrate, copper cathodes, fabricated copper products, sponge titanium and titanium alloys. Chinalco s groupwide strategy is to expand its businesses vertically, including the exploration, mining and processing of metals and minerals, and become a global major diversified resources company.

China Minmetals is the country s largest supplier of raw materials to the metal- lurgical industry and has iron-ore reserves of 600-million tons and coking coal reserves of 250-million tons. It sells some 20-million tons of steel products annually, and manufactures equipment for the metallurgical industry, including blast furnaces. In 2008, China Minmetals achieved total revenues of $27,7-billion and was ranked 331st in the Fortune magazine Global 500 list.

Sinosteel is active in the development and processing of metals resources, in metallurgical resources trade and logistics, the manufacture of mining equipment, and in engineering and technical services and science and technology. It has 86 subsidiary companies, 60 in China and 26 in other countries, and the group ranked 372nd in the Fortune 500 list for 2009. It mines iron-ore, chrome, manganese, nickel, cobalt and zinc.

China Shenhua is listed on both the Hong Kong (primary) and Shanghai (secondary listing) stock exchanges and is a coal-mining, transport and electricity-generating group. Last year, it produced 210,3-million tons of coal and has saleable coal reserves (calculated according to the Joint Ore Reserves Committee) of 6,927-billion tons. The group also operates five railways in China and (as of December 31) 55 coal-fired and three gas-fired power stations and 21 wind power units, with a total generating capacity of 23 520 MW.

China Coal Energy is also listed on the Hong Kong Stock Exchange and is, in terms of reserves, the second-largest listed coal company in China and the fifth-largest in the world. Its production amounted to 100,37-million tons in 2008. The group also produces coke and provides consultancy and design services for collieries, and manufactures coal-mining equipment

Jiangxi Copper is based in the province of the same name and mines, mills, smelts and processes copper. It is the country s biggest producer of copper, sulphur, gold and silver and also produces lead, molybdenum, palladium, platinum, selenium and zinc, besides other commodities. It is listed primarily on the Hong Kong and secondarily on the Shanghai stock exchanges.

Shanxi Xishan mines and sells coal, generates electricity and provides mine design and development services. During 2009, the group produced some 18,55-million tons of raw coal and generated about 4,473-billion kilowatt hours of electricity. It is listed on the Shenzhen Stock Exchange.

The Jinchuan group has its home base in the city of Jinchang, in the province of Gansu, in north-west China, and is an integrated nonferrous metallurgical and chemical engineering business. Jinchuan is China s largest producer of nickel and cobalt, with a production capacity of 130 000 t/y of nickel amounting to more than 90% of the country s total output of this metal and 6 000 t/y of cobalt, but it also produces copper (a capacity of 200 000 t/y) and precious metals, including platinum-group metals (PGMs).

With an output of 8 t/y, the company accounts for more than 90% of China s PGMs production. It also produces 1 200 000 t/y of chemical products.

Zijin Mining produces (mines, processes and refines) gold, copper, zinc, silver and molybdenum and is listed on the Shanghai Stock Exchange. During 2009, it produced more than 75 t (2 423 286 oz) of gold.

CHINESE MINERS AND SOUTH AFRICA

South Africa is one of the countries which has benefited from Chinese investment in mining, although this is sometimes indirect.

The most recent case involves South African junior PGMs company Wesizwe, which recently announced a $877-million (R6,6-billion) deal with Jinchuan Group and the China-Africa Development Fund, in which the Chinese partners would take 51% of Wesizwe s increased equity and would fund the development of the 350 000-oz/y Frischgewaagd-Ledig PGMs project, with Jinchuan buying all the PGM concentrate produced under a long-term offtake contract.

Moreover, it is reported that Hong Kong-listed medium-sized gold miner Grand TG Gold, a key member of the Virgile Asian Mining Consortium, is bidding to buy the Orkney and Grootvlei gold mines, currently in the hands of liquidators.

Grand TG Gold owns 72% of Taizhou Gold Mines, in China, and currently produces 0,4 t/y of gold.

Back in 2006, Sinosteel acquired 50% of the Tweefontein chrome mine and the Tubatse ferrochrome smelter for a reported $230-million, creating a JV with Samancor, known as Tubatse Chrome. The JV is situated at Steelpoort, in the province of Mpumalanga, and has a ferrochrome production capacity of 280 000 t/y to 300 000 t/y. It sells charge chrome to the highest bidder on the international market.

In addition, Sinosteel owns 60% of Asa Metals, the other 40% being held by Limpopo Economic Development Enterprise. In turn, Asa Metals owns 100% of the Dilokong chrome mine, which lies 125 km south of Polokwane, on the eastern rim of the Bushveld Complex, which has a production capacity of 400 000 t/y of chrome ore, and two smelters with a total capacity of 120 000 t/y of ferrochrome. There is an expansion project for the ferrochrome plant which involves the construction of two additional furnaces, which will take production to 240 000 t/y.

China Minmetals subsidiary National Minerals has bought the exploration rights for the Naboom chrome project from Mission Point and Versatex for $6,5-million. The Naboom project is sited at the northern tip of the eastern limb of the Bushveld Complex.

In addition, a major Chinese steelmaker, Jiuquan Iron & Steel (Jisco), is involved in South African mining as a result of a $30-million purchase of 26,1% of Inter-national Ferro Metals (IFM). IFM owns the Buffelsfontein chromite mine and smelter, located on the western limb of the Bushveld Complex, in the Brits area.

Buffelsfontein has both openpit and underground operations with two blast furnaces, and has an annual ferrochrome production capacity of 267 000 t. The mine has a life of another 16 years, and expansion which will see the construction of three new blast furnaces is planned. Jisco will receive 50% of the ferrochrome production and will also have the marketing rights.

at home

If you need any more details of the above news and/or products, please visit Chinatungsten Online, or contact us directly.

Disclaimer: The article is only reflecting the opinions of the author. We have no responsibility to prove the originality and authenticity of the content, words and/or pictures. You readers should just take it as reference and check the details by yourselves. And the content is not a suggestion for investment decision. The investor takes his or her own risks if he or she operates accordingly. If you have any dissent about the contents above, please contact the relevant author, or the webmaster. We will try our best to assist the dealing of the related issues. Thanks for your visit and cooperation.