The Chinese are coming - with cash and credit cards in hand.

Cities from Paris and London to New York and Tokyo are witnessing shopping sprees by hordes of Chinese buyers, who are spending money like there's no tomorrow on their favorite foreign luxury brands.

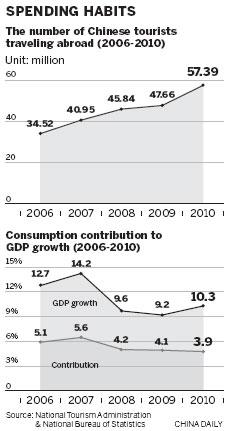

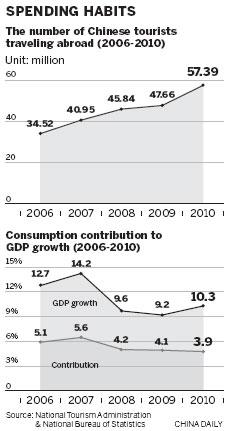

In 2010, more than 57 million Chinese traveled abroad, up 20.4 percent from a year earlier. They spent a staggering $48 billion in overseas destinations, figures from the

National Tourism Administration showed.

Chinese tourists earned themselves the title of the biggest spenders in France and the United Kingdom last year.

The country's international travel market is expected to grow by 17 percent annually over the next decade and to reach some 1.54 trillion yuan ($237.84 billion) in 2020, driven by rising incomes and aspirations, according to a recent report released by the Boston Consulting Group.

However, the other side of the story is relatively sluggish domestic consumption.

The share of private consumption in China's gross domestic product (GDP) was 37.3 percent in 2010, which is much lower than in other major economies such as the United States and Japan, where consumer spending accounted for around 60 to 70 percent of GDP.

Many factors contribute to this unequal scenario, some of which come from structural contradictions.

To begin with, having had enough of poverty in the past, some newly-rich Chinese are eager to show off their wealth through high-value consumption. One trend has been to fly to the country of origin to buy renowned foreign brands.

"Moreover, increasingly convenient transnational payment methods and a stronger yuan have made outbound tourism and associated overseas purchasing easier," according to a report by the National Bureau of Statistics.

The number of countries that accept the China UnionPay debit card increased to 104 by the end of 2010.

The yuan appreciated by 20 percent against the US dollar since China announced that it would no longer be pegged to the US dollar in July 2005.

As the currency becomes more valuable in overseas markets, Chinese travelers and students can buy more foreign goods for the same price.

Another factor fueling high-spending outbound tourism is the growing awareness that China's high tariffs on imported luxury goods make the prices in overseas markets far more attractive.

"Combined with domestic consumption and added-value taxes, overseas tax reimbursement and other tolls, the prices of luxury products sold on the Chinese mainland are at least 30 percent higher than in overseas markets," said Liang Da, an economist with the National Bureau of Statistics.

According to a survey by the World Luxury Association, Chinese consumers spent four times more on luxury goods in overseas markets than in the domestic market last year, due primarily to the large price differentials between luxury goods sold in China and abroad.

In order to spur domestic consumption and increase revenues from sales at home, China needs to further lower tariffs on imports of high-end products, including luxury goods, say observers.

On the whole, the current unequal consumption pattern will continue until the world economic landscape undergoes fundamental changes.

Developed countries are still in a dominant position in brand positioning, marketing and technology innovation, as well as in the environmentally friendly design business. All these factors are attractive to Chinese consumers.

Building China's global brands will be a long-term strategy. Although China has surpassed Japan as the world's second largest economy and is dubbed the world's factory, it is still a developing country with few homegrown globally recognized brands.

Nonetheless, a number of ambitious Chinese entrepreneurs are stepping up efforts to build homegrown brands in the face of a rapid expansion of foreign time-honored brands in China.

By the time Chinese enterprises have developed their own credible brands and the country's domestic consumption policies and environment have reached or approached the levels in developed countries, it is believed by many that most domestic consumers will not feel the same urge to travel far to buy their favorite brands and will look to what lies close at hand.

It is not beyond the realms of imagination to predict that at some stage foreign customers will be swarming to China if there is a price advantage.

Economists at the National Bureau of Statistics contributed to this story.

Source:China Daily

Weekly review

Cities from Paris and London to New York and Tokyo are witnessing shopping sprees by hordes of Chinese buyers, who are spending money like there's no tomorrow on their favorite foreign luxury brands.

In 2010, more than 57 million Chinese traveled abroad, up 20.4 percent from a year earlier. They spent a staggering $48 billion in overseas destinations, figures from the

National Tourism Administration showed.

Chinese tourists earned themselves the title of the biggest spenders in France and the United Kingdom last year.

The country's international travel market is expected to grow by 17 percent annually over the next decade and to reach some 1.54 trillion yuan ($237.84 billion) in 2020, driven by rising incomes and aspirations, according to a recent report released by the Boston Consulting Group.

However, the other side of the story is relatively sluggish domestic consumption.

The share of private consumption in China's gross domestic product (GDP) was 37.3 percent in 2010, which is much lower than in other major economies such as the United States and Japan, where consumer spending accounted for around 60 to 70 percent of GDP.

Many factors contribute to this unequal scenario, some of which come from structural contradictions.

To begin with, having had enough of poverty in the past, some newly-rich Chinese are eager to show off their wealth through high-value consumption. One trend has been to fly to the country of origin to buy renowned foreign brands.

"Moreover, increasingly convenient transnational payment methods and a stronger yuan have made outbound tourism and associated overseas purchasing easier," according to a report by the National Bureau of Statistics.

The number of countries that accept the China UnionPay debit card increased to 104 by the end of 2010.

The yuan appreciated by 20 percent against the US dollar since China announced that it would no longer be pegged to the US dollar in July 2005.

As the currency becomes more valuable in overseas markets, Chinese travelers and students can buy more foreign goods for the same price.

Another factor fueling high-spending outbound tourism is the growing awareness that China's high tariffs on imported luxury goods make the prices in overseas markets far more attractive.

"Combined with domestic consumption and added-value taxes, overseas tax reimbursement and other tolls, the prices of luxury products sold on the Chinese mainland are at least 30 percent higher than in overseas markets," said Liang Da, an economist with the National Bureau of Statistics.

According to a survey by the World Luxury Association, Chinese consumers spent four times more on luxury goods in overseas markets than in the domestic market last year, due primarily to the large price differentials between luxury goods sold in China and abroad.

In order to spur domestic consumption and increase revenues from sales at home, China needs to further lower tariffs on imports of high-end products, including luxury goods, say observers.

On the whole, the current unequal consumption pattern will continue until the world economic landscape undergoes fundamental changes.

Developed countries are still in a dominant position in brand positioning, marketing and technology innovation, as well as in the environmentally friendly design business. All these factors are attractive to Chinese consumers.

Building China's global brands will be a long-term strategy. Although China has surpassed Japan as the world's second largest economy and is dubbed the world's factory, it is still a developing country with few homegrown globally recognized brands.

Nonetheless, a number of ambitious Chinese entrepreneurs are stepping up efforts to build homegrown brands in the face of a rapid expansion of foreign time-honored brands in China.

By the time Chinese enterprises have developed their own credible brands and the country's domestic consumption policies and environment have reached or approached the levels in developed countries, it is believed by many that most domestic consumers will not feel the same urge to travel far to buy their favorite brands and will look to what lies close at hand.

It is not beyond the realms of imagination to predict that at some stage foreign customers will be swarming to China if there is a price advantage.

Economists at the National Bureau of Statistics contributed to this story.

Source:China Daily

Weekly review